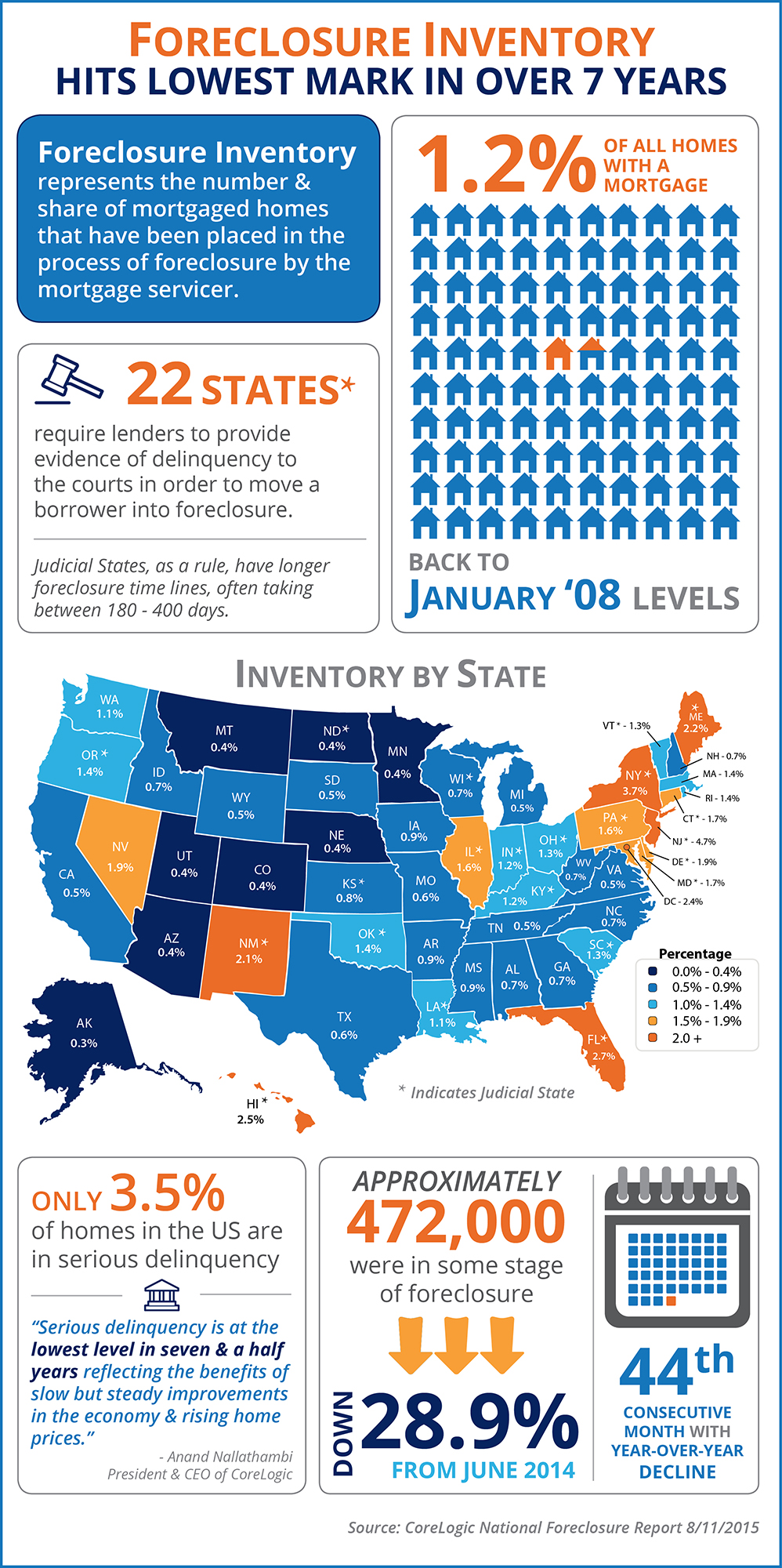

Some Highlights: The number of homes in the US in some stage of foreclosure is down 28.9% to 472,000. Only 3.5% of homes in the US are currently in serious delinquency. Foreclosure Inventory levels hit the lowest level since January 2008 at 1.2% of all homes with a...

National Information

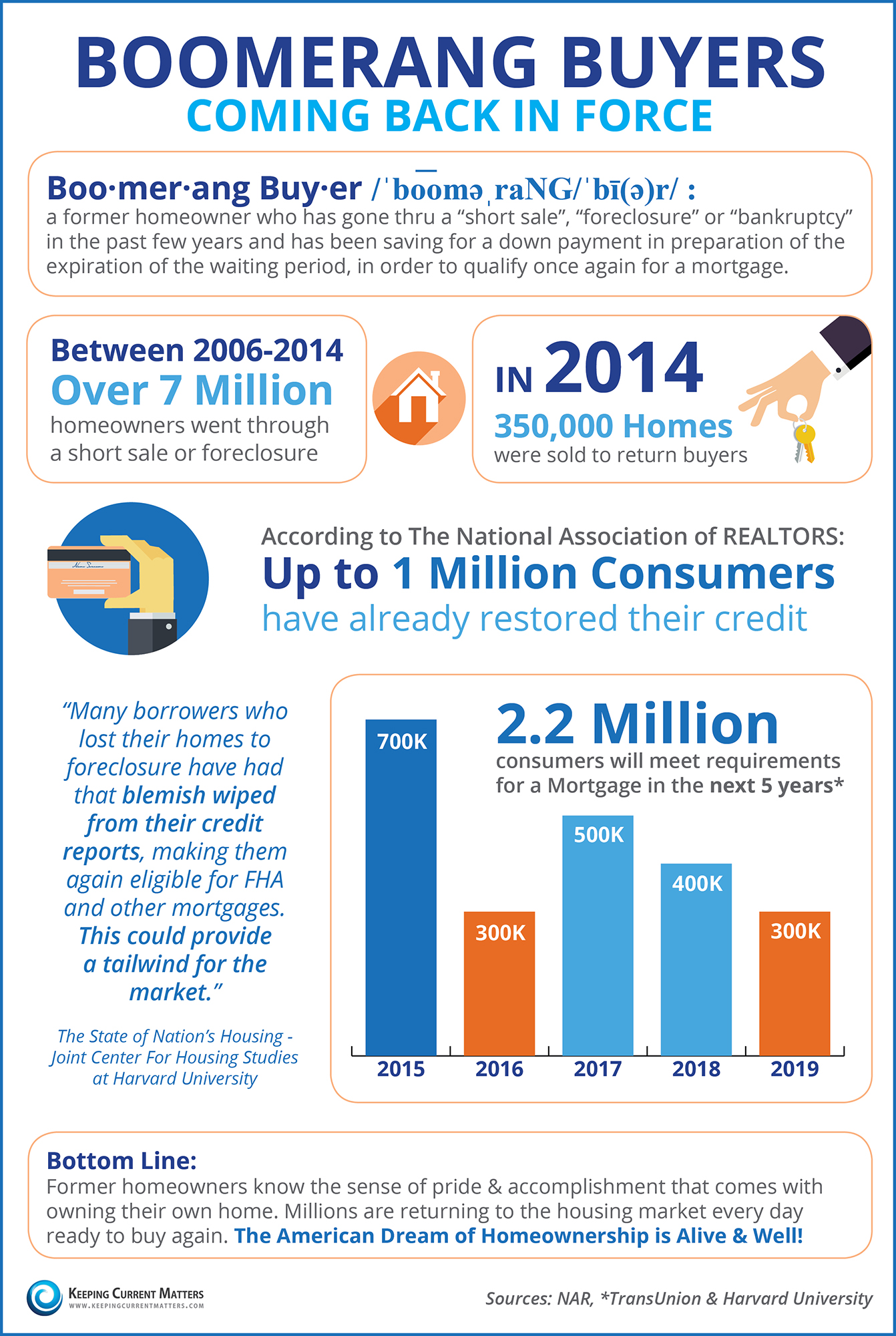

Some Highlights: What is a Boomerang Buyer? A former homeowner who has gone thru a “short sale”, “foreclosure” or “bankruptcy” in the past few years and has been saving for a down payment in preparation of the expiration of the waiting period, in order to qualify once again for a mortgage. According to NAR: Up to 1 Million consumers have already restored their credit and qualify to...

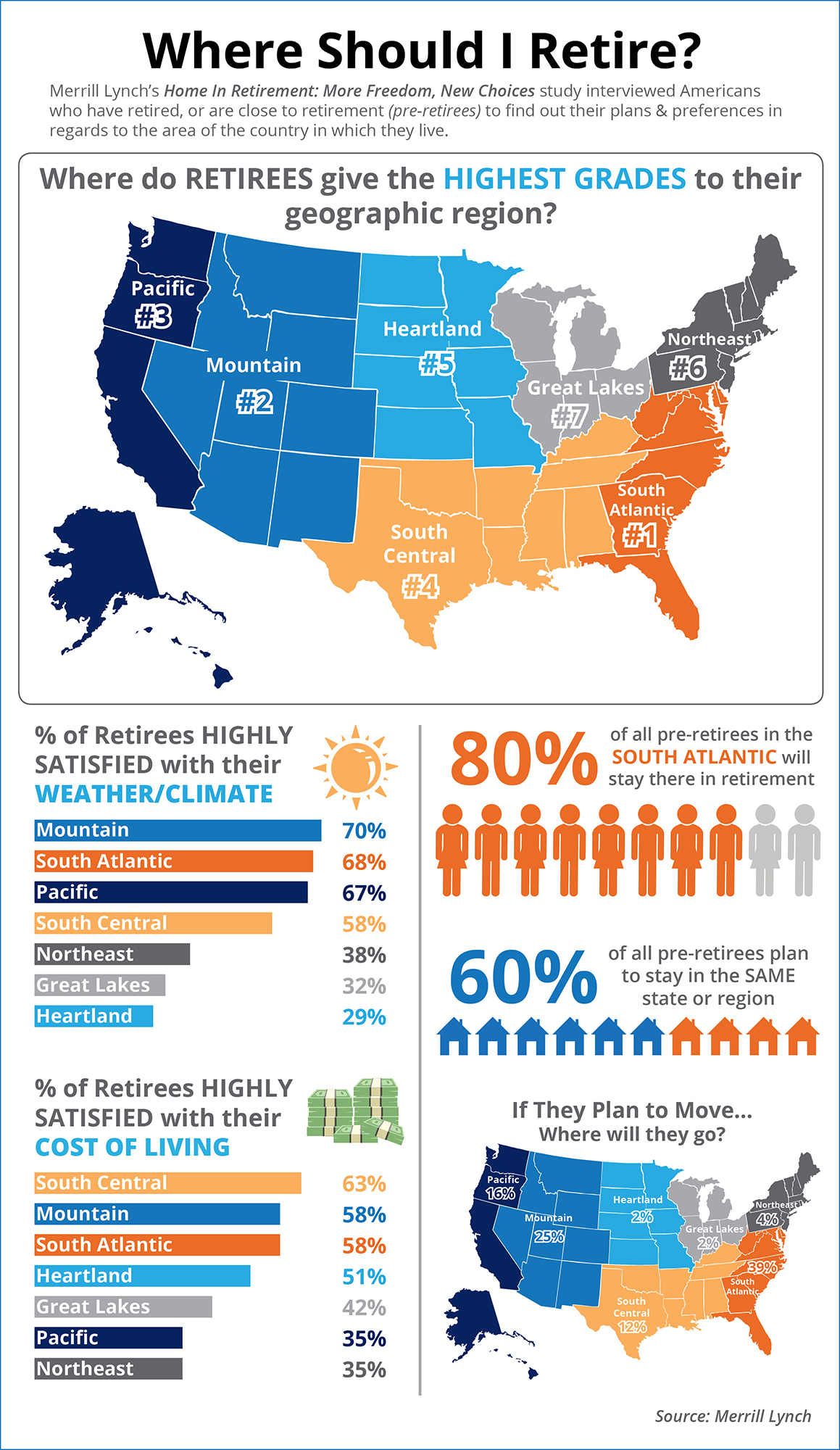

Some Highlights From The Report: •80% of all pre-retirees in the South Atlantic region plan to stay there in retirement •4 out of 10 pre-retirees plan to relocate in retirement •Retirees in the South Central Region are most satisfied with their Cost of...

After the housing market bust we experienced across the country in 2008, many experts have been quick to warn that a new bubble may be forming in some areas. One particular example of this is a recent article pointing toward the California Bay Area’s price gains over the last 18 months. The quickest and easiest way to show how far we’ve come and how far we still need to go in regards to the...

For the last several years, home sellers had to compete with huge inventories of distressed properties (foreclosures and short sales). The great news is that the supply of these properties is falling like a rock in the vast majority of housing markets (only 11% of homes sold in January). Many homeowners are now thinking of selling as the impact of this substantially discounted competition has...

According to the latest CoreLogic National Foreclosure Report, “approximately 552,000 homes in the US were in some state of foreclosure as of December 2014”. This figure is down 34.3% from the 840,000 homes in December of 2013. December marked the 38th consecutive month in which there were year-over-year declines. Anand Nallathambl, the President and CEO of CoreLogic, is hopeful for the...

If You Want to Flip, Do It Now DAILY REAL ESTATE NEWS | MONDAY, FEBRUARY 03, 2014 In 2013, home flips snagged sellers a tidy profit. But the trend may not continue. RealtyTrac's Home Flipping Report for the fourth quarter of 2013 showed single-family home flips were up 16 percent from 2012 and up 114 percent from 2011. The average gross profit for a home flip—defined as a home being...

Better times are ahead for the real estate market in the new year, according to several forecasts and recent surveys. Fiserv, a financial information services firm, predicts that 95 percent of the 384 metro areas it tracks will see prices rise in 2012. Many surveys and economists are forecasting a very modest increase for the housing market in the new year, but after several years of dropping prices...

March saw another increase in pending home sales, with contract activity rising unevenly in six of the past nine months, according to the National Association of REALTORS®. The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 5.1 percent to 94.1 in March from a downwardly revised 89.5 in February. The index is 11.4 percent below 106.2 in March 2010; however,...

Sales of existing-home sales rose in March, continuing an uneven recovery that began after sales bottomed last July, according to the NATIONAL ASSOCIATION OF REALTORS®. Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 3.7 percent to a seasonally adjusted annual rate of 5.10 million in March from an upwardly revised 4.92...

Forbes names Seattle as the market most likely to rebound. Here is the article: Real Estate Markets Most Likely To ReboundDorothy Pomerantz 10.29.08, 4:00 PM ET If you're a homeowner seeing property values plummet, look to the commercial real estate market for solace. It might tell you which areas will recover fastest--and which will likely remain weak. The Urban Land Institute recently asked 700 real...

Existing-home sales increased last month as buyers responded to improved housing affordability conditions, according to the National Association of Realtors®. Existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 5.5 percent to a seasonally adjusted annual rate of 5.18 million units in September from a level of 4.91 million in August. Home sales are 1.4 percent...

The U.S. Treasury announced plans today to purchase up to $250 billion in preferred stock from the nation's top banks. The move is part of a plan that President Bush says will help prevent recession and preserve the free market. "Government owning a stake in any private U.S. company is objectionable to most Americans – me included," Treasury Secretary Henry Paulson said in a statement....

The Federal Reserve, in an emergency meeting on Tuesday, slashed the key rate to 3.5 percent, citing a weakening economic outlook. The move marks the Fed's biggest rate cut — three quarters of a point — in more than 20 years. As fears of a recession looms, the Fed said the rate-cut was to help restore confidence in the U.S. economy. “While strains in short-term funding markets have eased somewhat,...

Replace the flooring. Install laminate floor over old linoleum, vinyl or chipped tile. It costs just $1 to $5 a square foot and looks like wood, stone or tile.Replace the lighting. A new ceiling fixture costs less than $100 and will brighten up the place. Adding some under-the-cabinet lights will illuminate work surfaces.Give the cabinets a new life. A coat of paint and new knobs is the cheapest way to go....

Home sales are projected to move in a relatively narrow range with a gradual upturn becoming more pronounced by the end of the year, according to the latest forecast by NAR. Lawrence Yun, NAR senior economist, said the market is relatively soft. “Overall housing levels are historically strong, but sales remain sluggish compared to the recent boom,” he said. “Home sales will probably fluctuate in a...

Fed Chair: Home Slump Lasting Longer than ExpectedFederal Reserve Chairman Ben Bernanke told a bankers’ conference in South Africa Tuesday that the U.S. housing slump will last longer than he had previously expected, but it hadn’t spilled over into other parts of the economy.Speaking via satellite, he also expressed concern about rising inflation, but made it clear that it was unlikely that the Fed...

Forbes magazine has calculated what it considers the most overpriced U.S. housing markets by estimating a “price-to-earnings” (P/E) ratio for each of the 40 largest metro areas. Just like the P/E of a stock, this value attempts to measure the price a home owner would pay for $1 of return. It was figured by dividing each market’s median home price by annual rents minus taxes and insurance. The average...

Fewer than 20 percent of all U.S. households are affluent, yet that group controls nearly half of all aggregate income, according to a new report from Packaged Facts, a division of MarketResearch.com. A major component of their wealth? Residential real estate, thanks to “the run-up in values in major metropolitan areas, where the affluent tend to live,” according to the company. Nearly 21 million...