Watch the latest episode of our Woodinville Real Estate Market Update for a recap on our local housing market. We will dive into current inventory levels and housing prices for homes in Woodinville Washington. Would you like to know more about our local real estate market? Contact us here. We are happy to help!

Sold 10% Above List Price with 5 Offers! Beautiful 3 Bedroom 1.5 Bath Rambler with Fantastic Yard in Edmonds

Sold for $621,090

Click Here for Details

Beautifully, remodeled rambler on a quiet cul-de-sac in Edmonds. The spacious floorplan boasts 1,504 s.f. and features 3 bedrooms, 1.5 bathrooms on a 6,970 s.f. lot. Updates include: Brand new roof, tankless water heater, double pane windows, new carpet, fresh paint, white millwork, new doors, remodeled kitchen and baths.

Beautiful, well manicured front yard welcomes you to the home. Formal living room with cozy wood burning fireplace and gleaming wood floors. Dining room with slider to back deck – great for BBQing or entertaining! Remodeled kitchen with granite counters and backsplash, ample white cabinets and full compliment of stainless steel appliances included. Large family room with slider to back deck. Laundry room/half bathroom with soaking sink – washer and dryer included.

Three generous bedrooms with fresh paint and new carpet. Fully remodeled bathroom with double vanity, marble counters, beautiful custom tile work in shower and tile floor.

Lush, private, fully fenced rear yard with large entertainment sized deck, mature trees, storage shed, play structure and sandbox included. Attached 1 car garage and a carport too.

Great Edmonds Schools – Westgate Elementary, College Place Middle School & Edmonds Woodway High.

“Tony Meier and team were amazing to work with.”

Tony Meier and team were amazing to work with. From the first interaction to closing, the team was always on top of everything. We were especially impressed with the professional photos, video and marketing materials created to showcase our home.

Tony and Mary Harlich

Sold in Monroe – April 2019

April 2019 – Eastside, King & Snohomish County Real Estate Market Update – Housing Trends and Current Pricing

Watch the latest episode of our Eastside, King & Snohomish County Real Estate Market Update for a recap on our local housing market. We will dive into current inventory levels and housing prices for homes in the Eastside, King & Snohomish County Washington.

Would you like to know more about our local real estate market? Contact us here. We are happy to help!

What to Consider When Choosing Your Home To Retire In

As more and more baby boomers enter retirement age, the question of whether they should sell their homes and move has become a hot topic. In today’s housing market climate, with low available inventory in the starter and trade-up home categories, it makes sense to evaluate your home’s ability to adapt to your needs in retirement.

According to the National Association of Exclusive Buyers Agents (NAEBA), there are 7 factors that you should consider when choosing your retirement home.

1. Affordability

“It may be easy enough to purchase your home today but think long-term about your monthly costs. Account for property taxes, insurance, HOA fees, utilities – all the things that will be due whether or not you have a mortgage on the property.”

Would moving to a complex with homeowner association fees actually be cheaper than having to hire all the contractors you would need to maintain your home, lawn, etc.? Would your taxes go down significantly if you relocated? What is your monthly income going to be like in retirement?

2. Equity

“If you have equity in your current home, you may be able to apply it to the purchase of your next home. Maintaining a healthy amount of home equity gives you a source of emergency funds to tap, via a home equity loan or reverse mortgage.”

The equity you have in your current home may be enough to purchase your retirement home with little to no mortgage. Homeowners in the US gained an average of over $9,700 in equity last year.

3. Maintenance

“As we age, our tolerance for cleaning gutters, raking leaves and shoveling snow can go right out the window. A condominium with low-maintenance needs can be a literal lifesaver, if your health or physical abilities decline.”

As we mentioned earlier, would a condo with an HOA fee be worth the added peace of mind of not having to do the maintenance work yourself?

4. Security

“Elderly homeowners can be targets for scams or break-ins. Living in a home with security features, such as a manned gate house, resident-only access and a security system can bring peace of mind.”

As scary as that thought may be, any additional security is helpful. An extra set of eyes looking out for you always adds to peace of mind.

5. Pets

“Renting won’t do if the dog can’t come too! The companionship of pets can provide emotional and physical benefits.”

Consider all of your options when it comes to bringing your ‘furever’ friend with you to a new home. Will there be necessary additional deposits if you are renting or in a condo? Is the backyard fenced in? How far are you from your favorite veterinarian?

6. Mobility

“No one wants to picture themselves in a wheelchair or a walker, but the home layout must be able to accommodate limited mobility.”

Sixty is the new 40, right? People are living longer and are more active in retirement, but that doesn’t mean that down the road you won’t need your home to be more accessible. Installing handrails and making sure your hallways and doorways are wide enough may be a good reason to look for a home that was built to accommodate these needs.

7. Convenience

“Is the new home close to the golf course, or to shopping and dining? Do you have amenities within easy walking distance? This can add to home value!”

How close are you to your children and grandchildren? Would relocating to a new area make visits with family easier or more frequent? Beyond being close to your favorite stores and restaurants, there are a lot of factors to consider.

Bottom Line

When it comes to your forever home, evaluating your current house for its ability to adapt with you as you age can be the first step to guaranteeing your comfort in retirement. If after considering all these factors you find yourself curious about your options, let’s get together to evaluate your ability to sell your house in today’s market and get you into your dream retirement home!

Looking to Upgrade Your Current Home? Now’s the Time to Move-Up!

In every area of the country, homes that are priced at the top 25% of the price range for that area are considered to be Premium Homes. In today’s real estate market there are deals to be had at the higher end! This is great news for homeowners who want to upgrade from their current house and move-up to a premium home.

Much of the demand for housing over the past couple years has come from first-time buyers looking for their starter home, which means that many of the more expensive homes that have been listed for sale have not seen as much interest.

This mismatch in demand and inventory has created a Buyer’s Market in the luxury and premium home markets according to the ILHM’s latest Luxury Report. For the purpose of the report, a luxury home is defined as one that costs $1 million or more.

“A Buyer’s Market indicates that buyers have greater control over the price point. This market type is demonstrated by a substantial number of homes on the market and few sales, suggesting demand for residential properties is slow for that market and/or price point.”

The authors of the report were quick to point out that the current conditions at the higher end of the market are no cause for concern,

“While luxury homes may take longer to sell than in previous years, the slower pace, increased inventory levels and larger differences between list and sold prices, represent a normalization of the market, not a downturn.”

Luxury can mean different things to different people. It could mean a secluded home with a ton of property for privacy to one person, or a penthouse in the center of it all for someone else. Knowing what characteristics you are looking for in a premium home and what luxury means to you will help your agent find your dream home.

Bottom Line

If you are debating upgrading your current house to a premium or luxury home, now is the time!

NWMLS March 2019 Real Estate Market Report – Housing Market Rebounds From February Freeze

KIRKLAND, Washington (April 5, 2019) – Both pending sales and new listing activity around Western Washington surged during March as buyers, sellers, and brokers emerged from February’s record snowfall.

Brokers added 10,516 new listings of single family homes and condos to the Northwest Multiple Listing Service inventory last month, the highest monthly volume since August 2018. Compared to the same month a year ago, new listings across the 23 counties in the report were down slightly (79 fewer units).

MLS members also reported 10,261 pending sales during the same timeframe, the highest number of mutually accepted offers since July, and nearly matching the year-ago total of 10,311.

“After the housing adjustment in 2018, this year’s spring market is back to frenzied in the more affordable and mid-price ranges,” remarked J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. Noting March is the start of the prime-time selling season, he expects this year “will be no exception.” He also commented on improved affordability from last fall’s price adjustments in the close-in job centers of Seattle and the Eastside. “This improved affordability, along with lower interest rates and very strong job growth, all point us in the right direction for red-hot acceleration again this year,” Scott stated.

Year-over-year prices area-wide were up 3.5 percent, rising from $401,761 to $415,950, with most counties reporting gains. King County was an exception. Prices there were flat (down 0.4 percent), slipping from the year-ago median of $625,000 to last month’s figure of $622,500, but rising from February’s price of $604,000.

Compared to February, prices rose 2.2 percent system-wide. The four-county Puget Sound region had larger month-to-month increases, led by Kitsap County, up 5.9 percent from February. Prices in Snohomish County jumped nearly 5.5 percent, while King County’s median prices rose more than 3 percent when comparing February to March.

Commenting on the uptick in new listings and new sales, broker Dean Rebhuhn pointed to lower mortgage interest rates and a growing selection of properties as drivers of activity. “Well-priced properties are selling. Buyers who are getting fully underwritten loan commitments are winning the prize – the home,” stated Rebhuhn, the owner of Village Homes and Properties in Woodinville.

At month end, there were 12,017 active listings of single family homes and condos in the Northwest MLS database. That represents an increase of more than 36 percent from a year ago when there were only 8,825 active listings. Inventory more than doubled in King County compared to a year ago, rising from 2,060 active listings to 4,263 at the end of March. Nine counties reported less inventory than 12 months ago.

Even with improving inventory, there is less than two months of supply overall and in seven counties, including Pierce (1.2 months), Snohomish (1.3 months), Kitsap (1.4 months) and King (nearly 1.9 months).

“March signaled the beginning of the annual rise in King County residential listing inventory, and this year’s active listings are building on a higher base of listings than previous years,” observed John Deely, principal managing broker at Coldwell Banker Bain in Seattle. He also noted pending sales (10,261 during March) kept pace with new listings (10,516) to slow the buildup of inventory.

“Many buyers found the increased inventory meant more choices and less competition in many market areas,” said Deely, a member of the Northwest MLS board of directors. “In core Seattle markets, new listings that are competitively priced are seeing multiple and contingency-stripped offers,” he added.

OB Jacobi, president of Windermere Real Estate, described March as an “eventful month for real estate,” as the snow finally melted and interest rates dropped, “nudging buyers off the fence and back into the market. The result was a spike in pending sales between February and March (up more than 49 percent), and a pop in price growth in several counties, suggesting we are entering an active spring market.”

Another MLS director, Meredith Hansen, attributed the downturn in last month’s closed sales to inclement weather. Tight inventory makes spring an excellent time for sellers to put their homes on the market, she suggested. “Buyers have more selection, good interest rates, and a less frenzied market to make solid decisions. Overall, I’d say it’s a win-win for both sides,” remarked Hansen, the owner/designated broker at Keller Williams Greater Seattle.

Brokers from Kitsap and South Sound markets are reporting strong activity, with pending sales outgaining new listings, and heavy traffic at open houses.

“In Kitsap County, the buyers have arrived to the market faster than sellers,” reported Frank Wilson, Kitsap regional manager and branch managing broker at John L. Scott’s Poulsbo office. “Low interest rates are giving buyers a break in house payments, which allows them to buy a little more house. Buyers have received the message about the spring market, but sellers are still waiting in the wings,” he commented.

Broker Dick Beeson said the South Sound market is somewhat of an anomaly, as prices continue to rise despite growing inventory. “Multiple offers are less frequent in this market, and, unlike 6-to-12 months ago, sellers are now agreeing to do repairs and pay buyer’s closing costs,” according to Beeson, principal managing broker at RE/MAX Northwest Realtors in Gig Harbor. “Some type of negotiation is once again prevalent in almost every sale,” he added.

Beeson said in certain higher price ranges buyers and sellers have “almost equal footing.” He suggested it could become a buyer’s market in South Sound “when the Seattle/King County market flattens out even more and can provide homes at affordable prices so those who don’t work in high tech can afford them.”

“Areas outside of King County and along the I-5 corridor outperform as people continue to look for value outside the main urban centers,” observed James Young, director of the Washington Center for Real Estate Research at the University of Washington. He expects the spring price growth will be “solid” as long as demand remains.

“The market is highly interest rate sensitive, and this is reflected in current price trends in the region,” Young stated. “Given interest rates are now 70 basis points lower than their peak in November last year (and back down near historic lows), house prices could rise by 8.4 percent and people could keep the same mortgage repayments. This means someone who could have purchased a $450,000 house six months ago can now purchase a house costing $487,800 and keep the same monthly repayment, an 8.2 percent increase,” he explained.

Northwest MLS members report 6,750 completed transactions during March, a drop of about 8.3 percent from a year ago, and likely a result of February’s heavy snows that resulted in hazardous roads and kept many people housebound for several days.

“Although closed sales were down in March, we believe February’s snowy weather slowed the closing of pending transactions,” suggested Mike Grady, president and COO of Coldwell Banker Bain. “Most notably in determining the strength of our market is the ratio of new listings and pending sales, which were close, resulting in less than two months of inventory in many areas. We expect the market to continue these trends as we head into what is always the busiest time of the year.”

Scott also expects momentum to continue. “Looking ahead, more new listings are on the way, and the more affordable and mid-price ranges will see strong price appreciation this year – just not at last year’s extreme levels,” he commented.

Deely said one change from past markets is the trend of buyers who are unwilling to participate in properties with an offer review date. “This has the notable effect of fewer competing offers and an increase in properties going past their offer review date without a sale.”

Condo activity remains mostly unremarkable, although inventory is improving. Brokers added 1,487 new listings to the selection last month and reported 1,387 pending sales. Inventory at month end stood at 1,610 active listings, up more than 85 percent from a year ago. That still leaves months of supply below two months in many areas, including King (1.95 months of supply), Snohomish (1.1 months), Pierce (0.83 months), and Kitsap (1.67 months).

MLS members reported 932 closed sales of condominiums during March with a median price of $367,150, about the same as the year-ago price of $365,000. In King County, the median sales price for condos was $434,000, a drop of almost 7 percent from twelve months ago.

3 Graphs that Show What You Need to Know About Today’s Real Estate Market

The Housing Market has been a hot-topic in the news lately. Depending on which media outlet you watch, it can start to be a bit confusing to understand what’s really going on with interest rates and home prices!

The best way to show what’s really going on in today’s real estate market is to go straight to the data! We put together the following three graphs along with a quote from Chief Economists that have their finger on the pulse of what each graph illustrates.

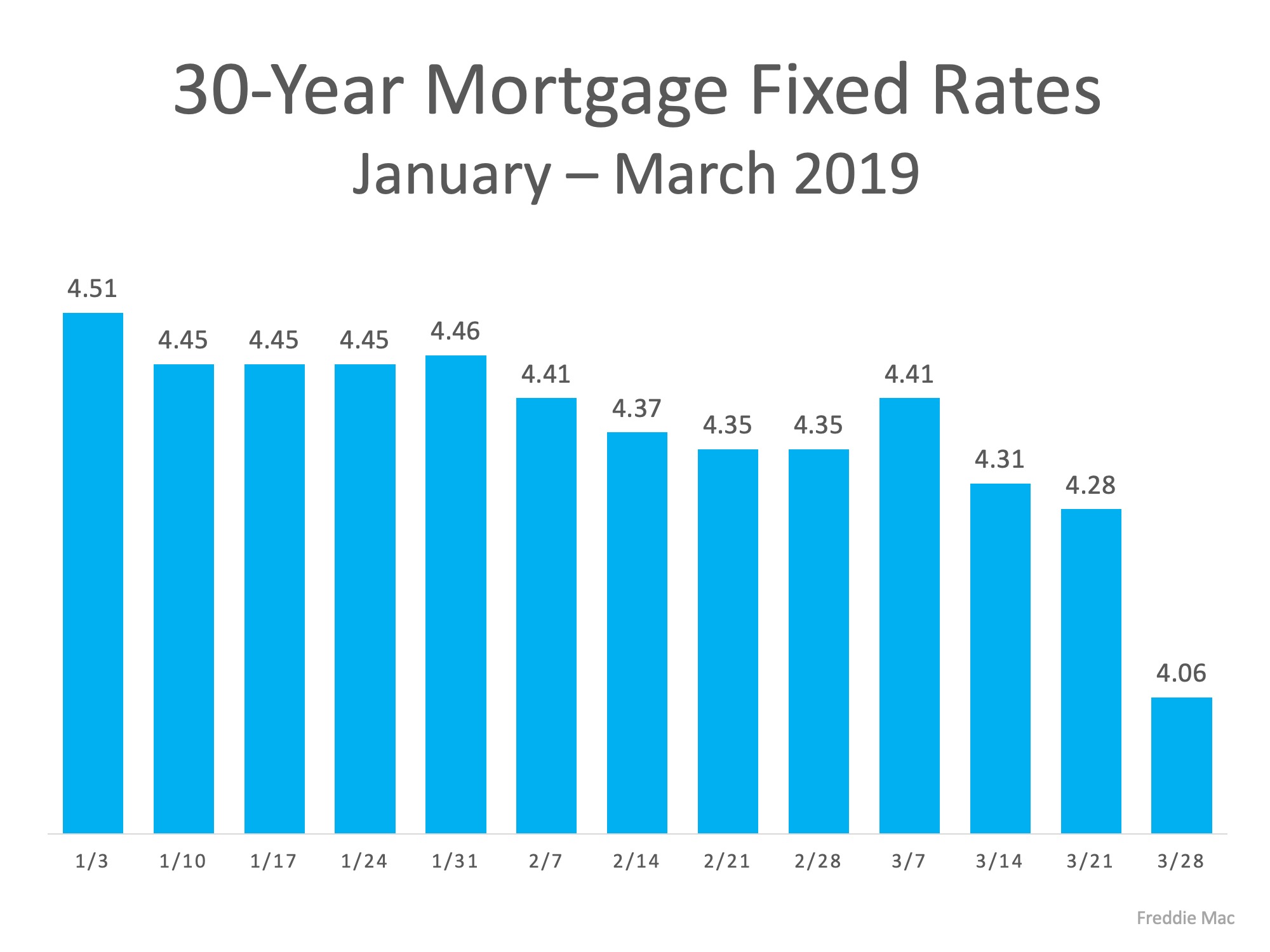

Interest Rates:

“The real estate market is thawing in response to the sustained decline in mortgage rates and rebound in consumer confidence – two of the most important drivers of home sales. Rising sales demand coupled with more inventory than previous spring seasons suggests that the housing market is in the early stages of regaining momentum.” – Sam Khater, Chief Economistat Freddie Mac

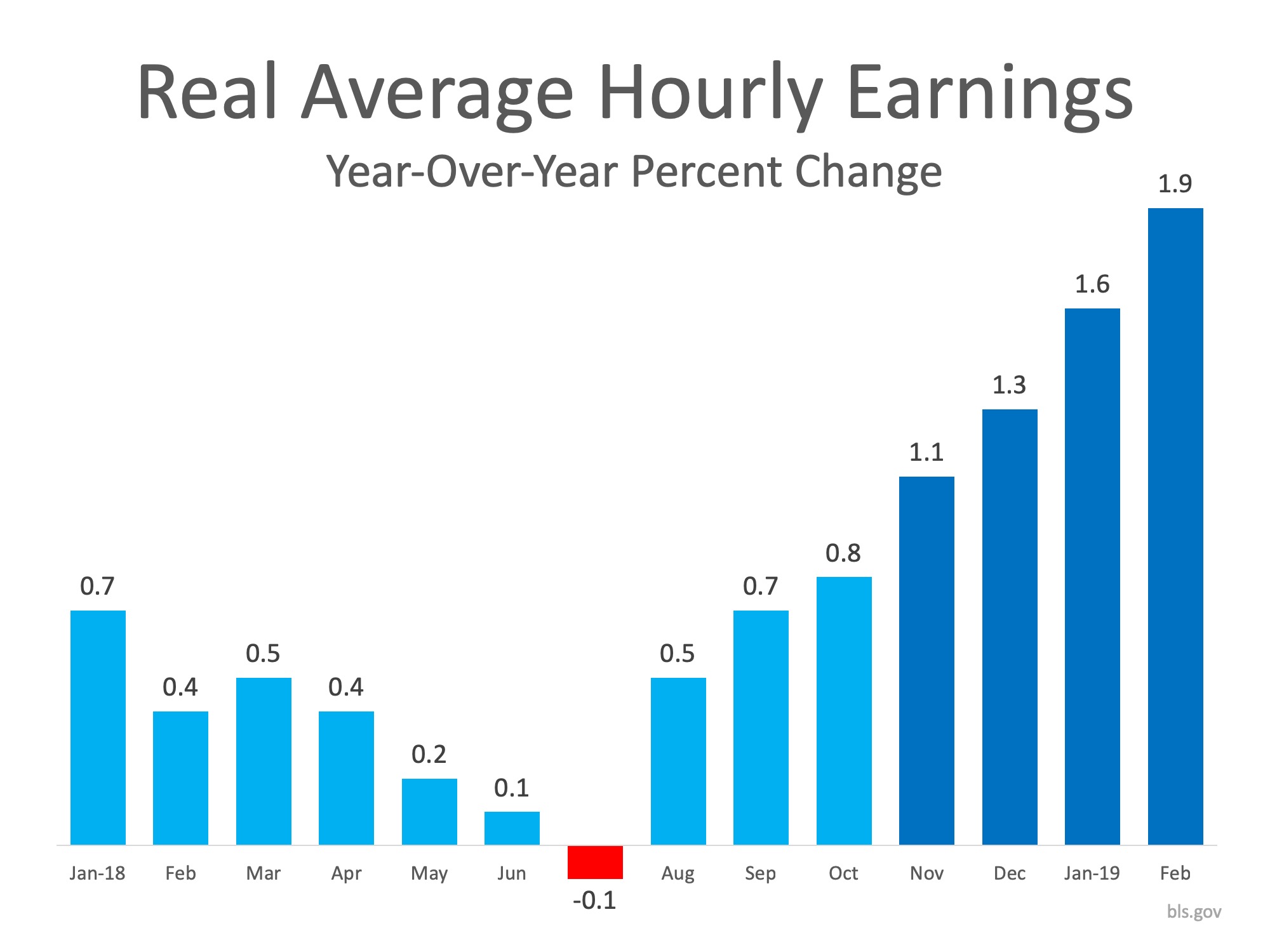

Income:

“A powerful combination of lower mortgage rates, more inventory, rising income and higher consumer confidence is driving the sales rebound.” – Lawrence Yun, Chief Economist at NAR

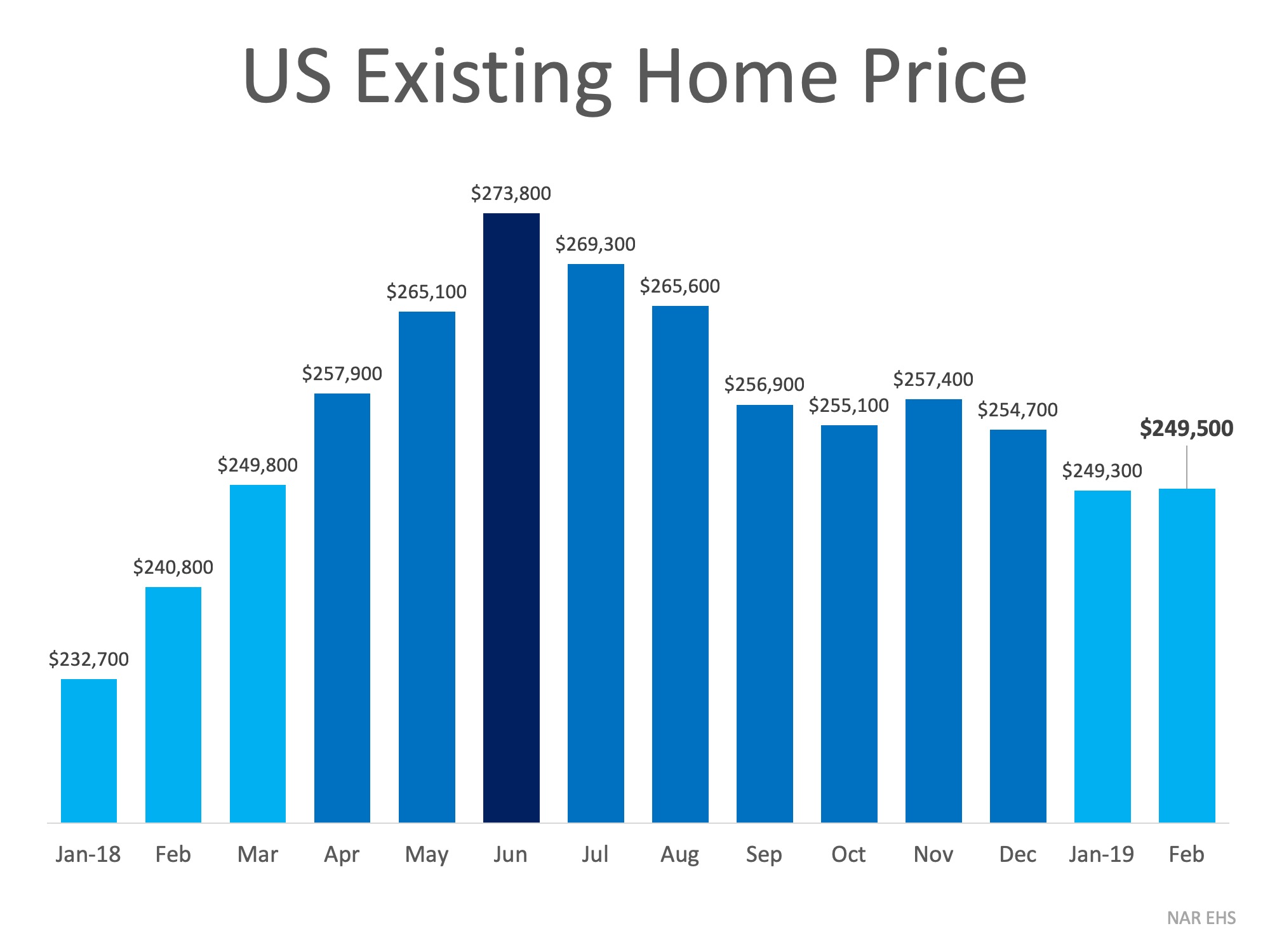

Home Prices:

“Price growth has been too strong for several years, fueled in part by abnormally low interest rates. A mild deceleration in home sales and Home Price Index growth is actually healthy, because it will calm excessive price growth — which has pushed many markets, particularly in the West, into overvalued territory.” – Ralph DeFranco, Global Chief Economist at Arch Capital Services Inc.

Bottom Line

These three graphs indicate good news for the spring housing market! Interest rates are low, income is rising, and home prices have experienced mild deceleration over the last 9 months. If you are considering buying a home or selling your house, let’s get together to chat about our market!

Homebuyers Shouldn’t Worry About 2008 All Over Again

Last week, realtor.com released a survey of active home shoppers (those who plan to purchase their next home in 1 year or less). The survey asked their opinion on an impending recession and its possible impact on the housing market.

Two major takeaways from the survey:

- 42% believe a recession will occur this year or next (another 16% said 2021)

- 59% believe the housing market would fare the same or worse than it did in 2008

Why all the talk about a recession recently?

Over the last year, four separate surveys have been taken asking when we can expect the next recession to occur:

- The Pulsenomics Survey of Market Analysts

- The Wall Street Journal Survey of Economists

- The Duke University Survey of American CFOs

- The National Association of Business Economics

70% of all respondents to the four surveys believe that a recession will occur in 2019 or 2020 with an additional 18% saying 2021.

However, we must realize that a recession does not mean we will experience another housing crash. According to the dictionary definition, a recession is:

“A period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.”

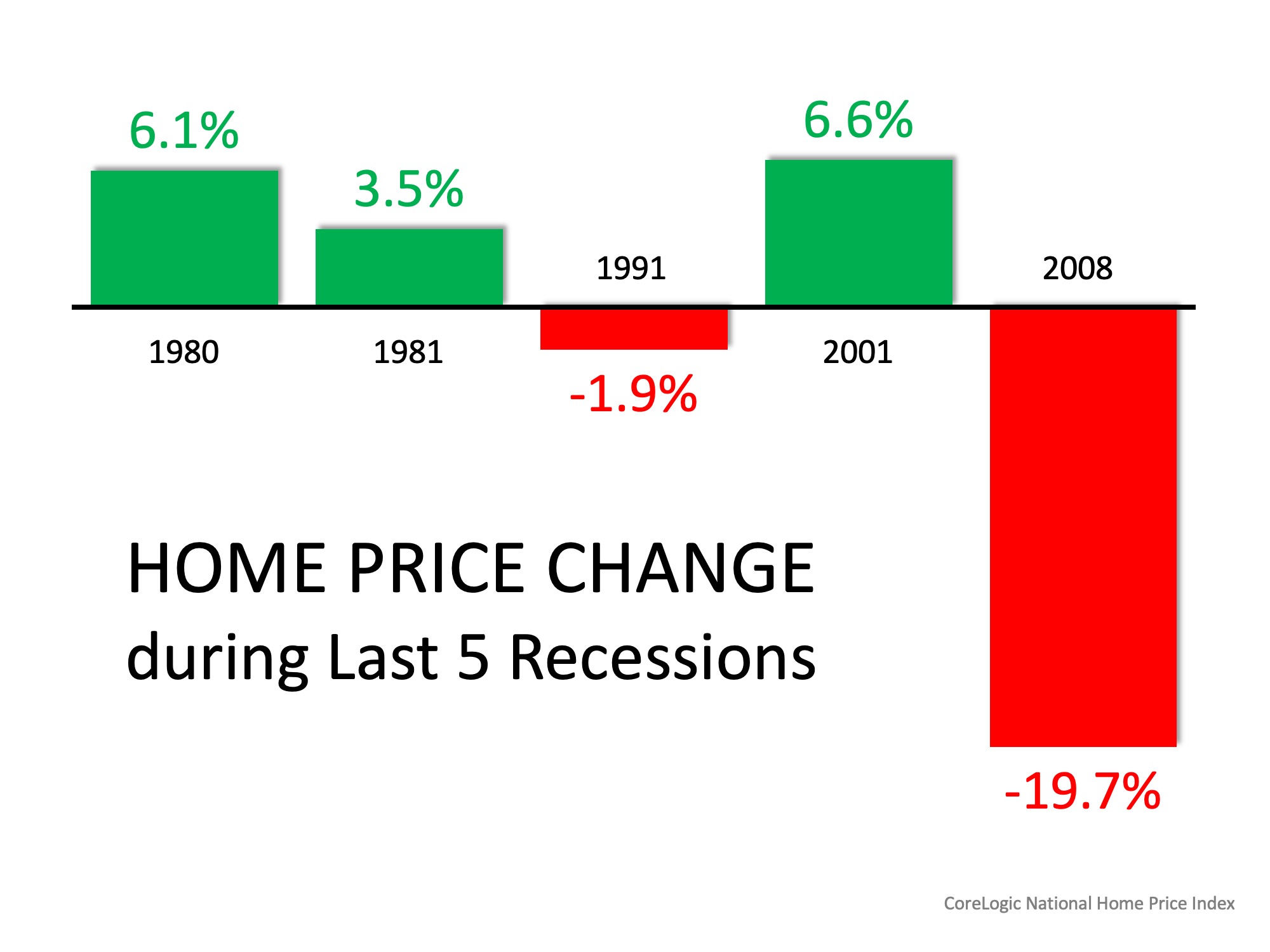

During the last recession, a dramatic fall in home values helped cause it.

However, according to research done by CoreLogic, home values weren’t negatively impacted as they were in 2008 during the previous four recessions:

During the four recessions prior to 2008, home values depreciated only once (at a level that was less than 2%). The other three times home values appreciated, twice well above the historic norm of 3.6%.

Bottom Line

If there is an economic slowdown in our near future, there is no need for fear to set in. Most experts agree with Ralph McLaughlin, CoreLogic’s Deputy Chief Economist, who recently explained that there’s no reason to panic right now, even if we may be headed for a recession.

“We’re seeing a cooling of the housing market, but nothing that indicates a crash.”

5 Reasons To Sell Your House This Spring!

Here are five compelling reasons listing your home for sale this spring makes sense.

1. Demand Is Strong

The latest Buyer Traffic Index from the National Association of Realtors (NAR) shows that buyer demand remains strong throughout the vast majority of the country. These buyers are ready, willing, and able to purchase… and are in the market right now! More often than not, multiple buyers are competing with each other for the same home.

Take advantage of the buyer activity currently in the market.

2. There Is Less Competition Now

Housing inventory is still under the 6-month supply needed for a normal housing market. This means that, in most of the country, there are not enough homes for sale to satisfy the number of buyers.

Historically, the average number of years a homeowner stayed in his or her home was six, but that number has hovered between nine and ten years since 2011. Many homeowners have a pent-up desire to move, as they were unable to sell over the last few years due to a negative equity situation. As home values continue to appreciate, more and more homeowners are granted the freedom to move.

Many homeowners were reluctant to list their home over the last couple of years for fear that they would not find a home to move in to. That is all changing now as more homes come to market at the higher end. The choices buyers have will continue to increase. Don’t wait until additional inventory comes to market before you to decide to sell.

3. The Process Will Be Quicker

Today’s competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. Buyers know exactly what they can afford before home shopping. This makes the entire selling process much faster and simpler. According to Ellie Mae’s latest Origination Insights Report, the time to close a loan has dropped to 47 days.

4. There Will Never Be a Better Time to Move Up

If your next move will be into a premium or luxury home, now is the time to move up! The inventory of homes for sale at these higher price ranges has created a buyer’s market. This means that if you are planning on selling a starter or trade-up home, it will sell quickly, AND you’ll be able to find a premium home to call your own!

According to CoreLogic, prices are projected to appreciate by 4.6% over the next year. If you are moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage payment) if you wait.

5. It’s Time to Move on With Your Life

Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should?

Only you know the answers to these questions. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to move on and start living the life you desire.