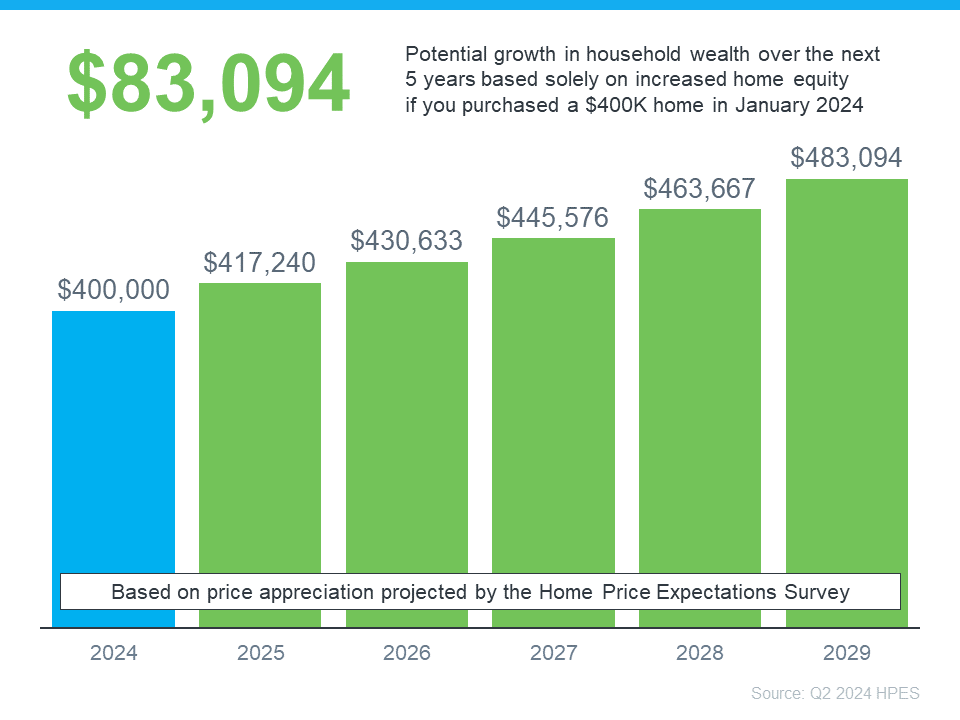

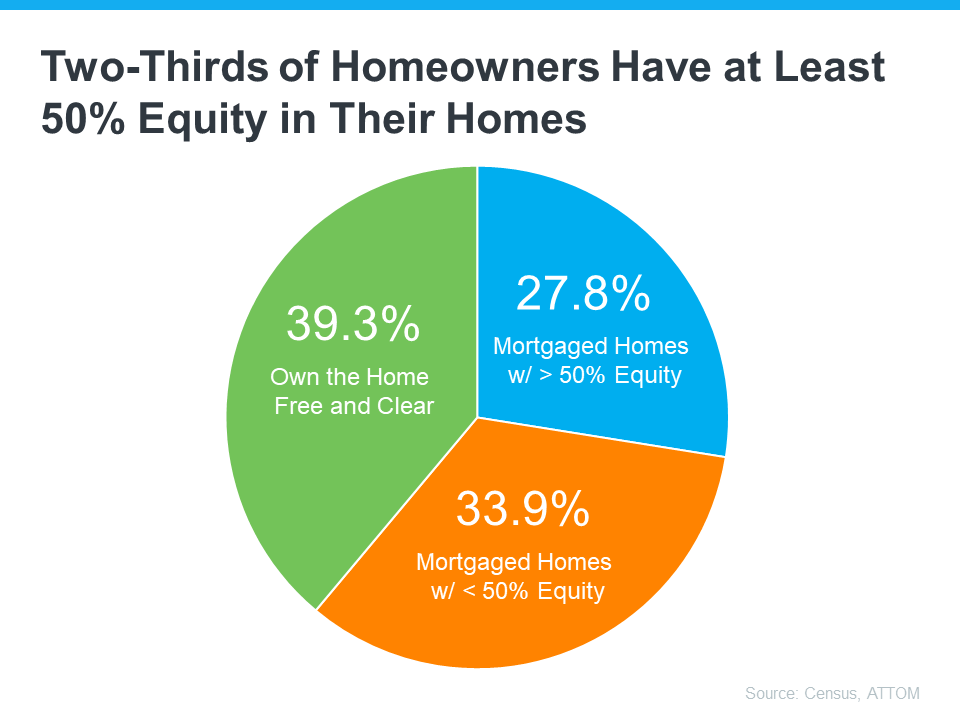

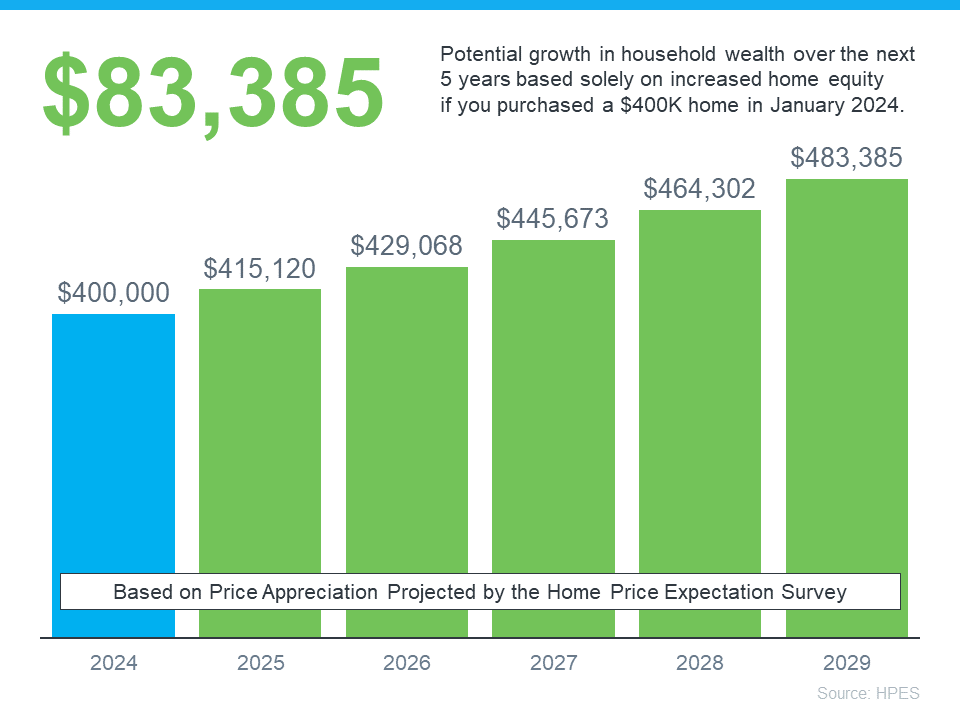

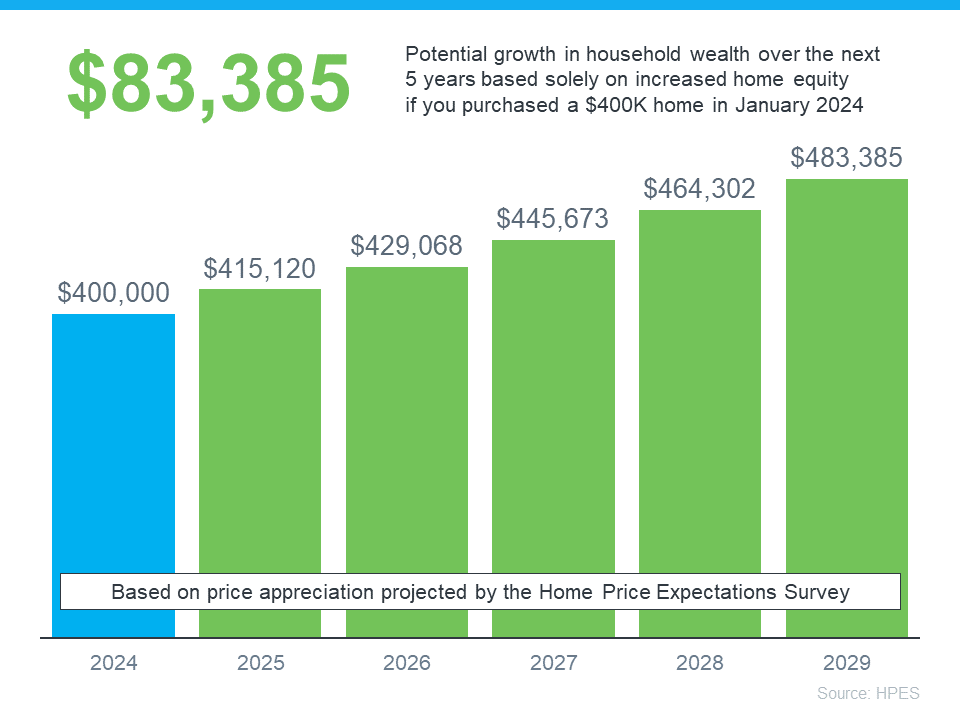

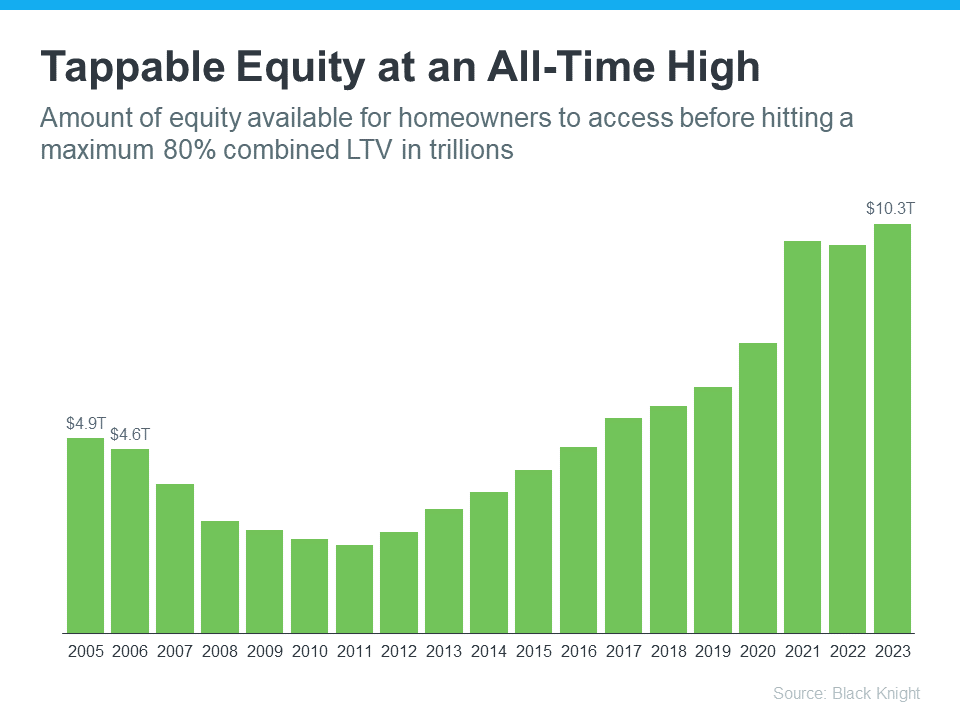

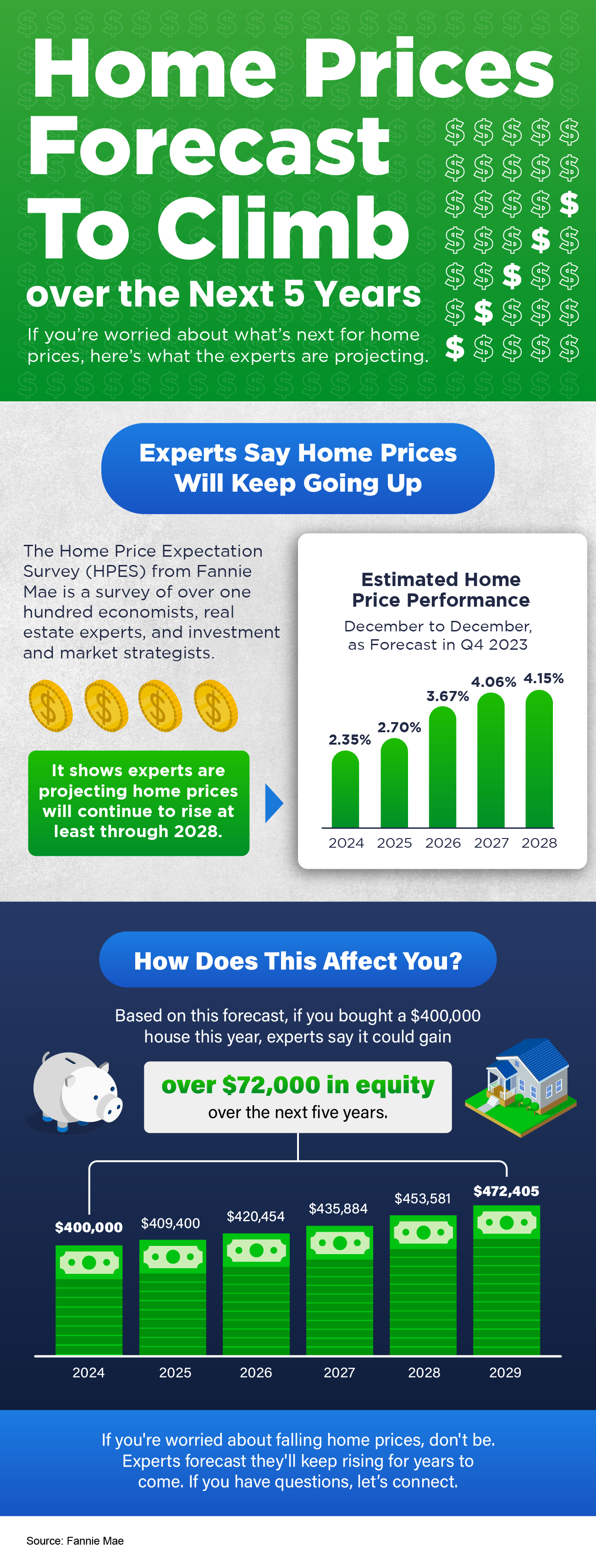

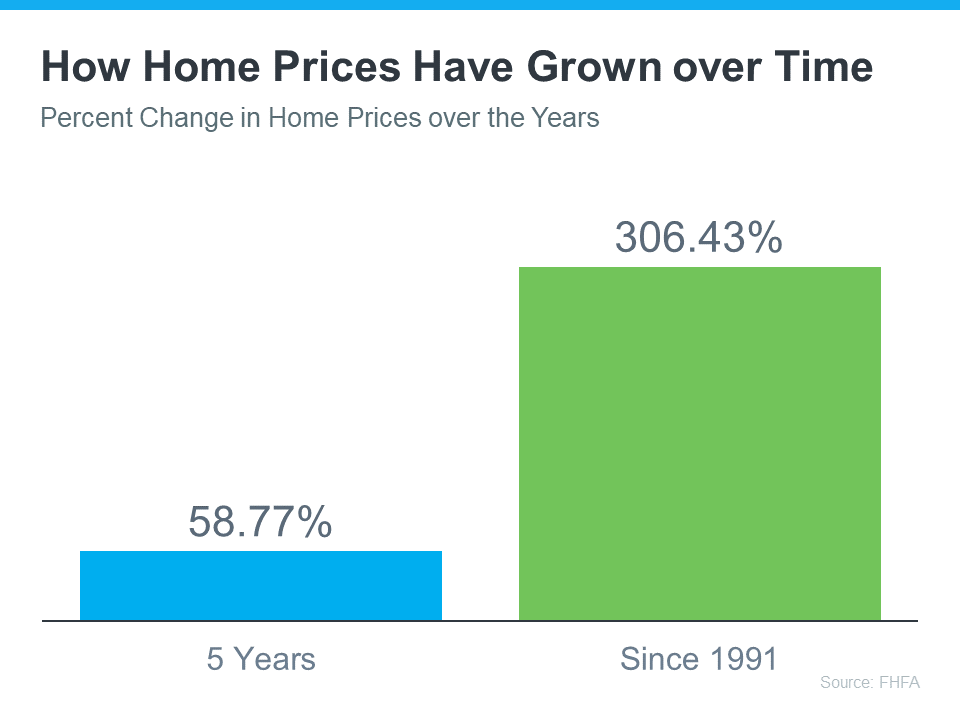

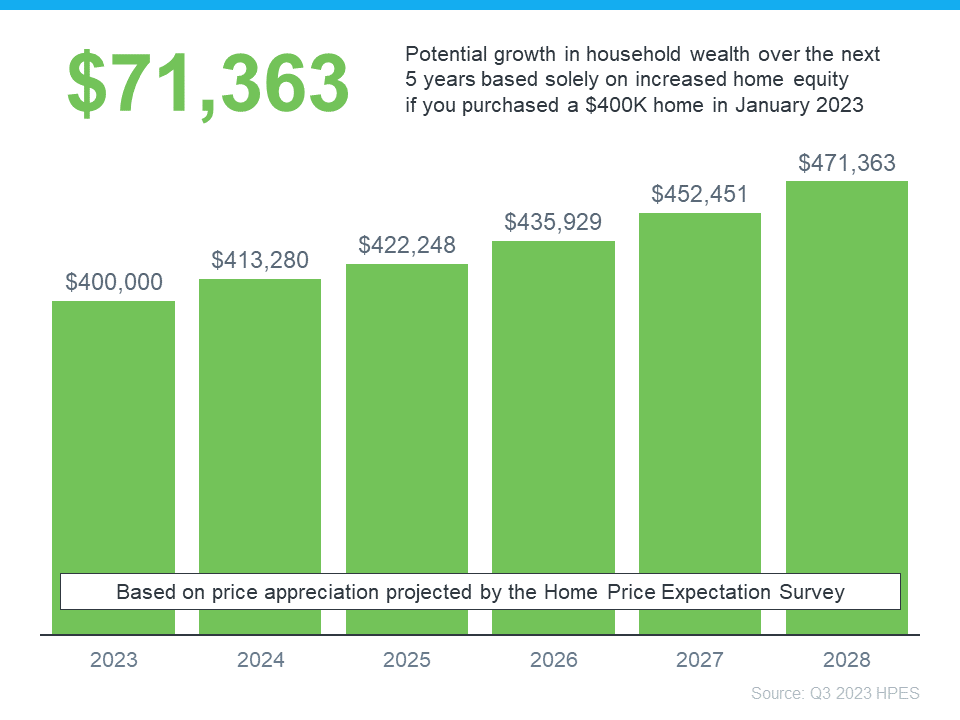

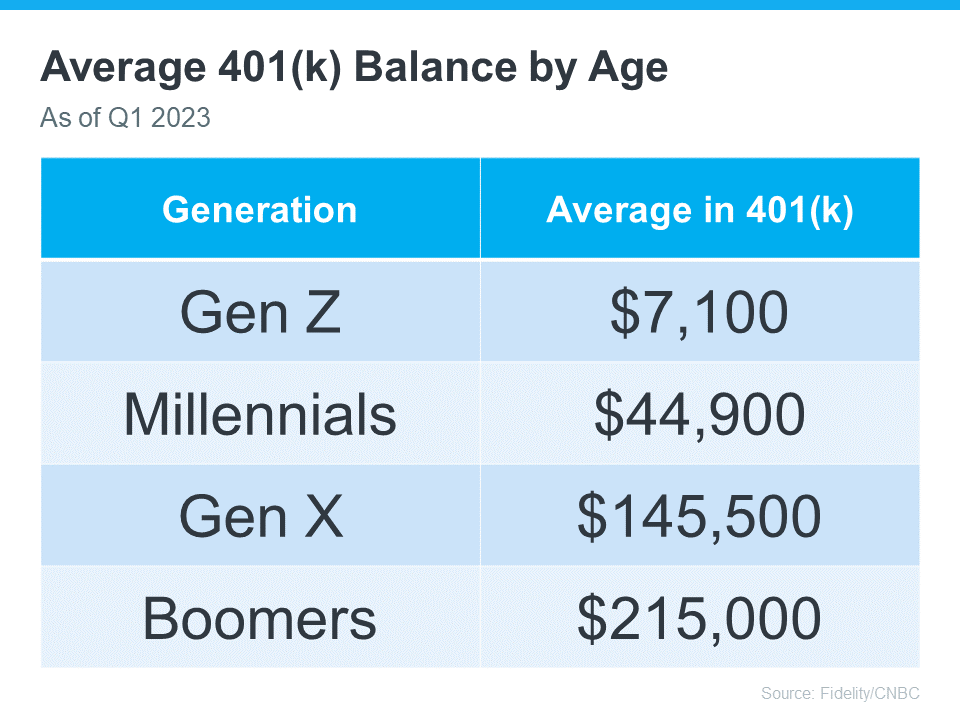

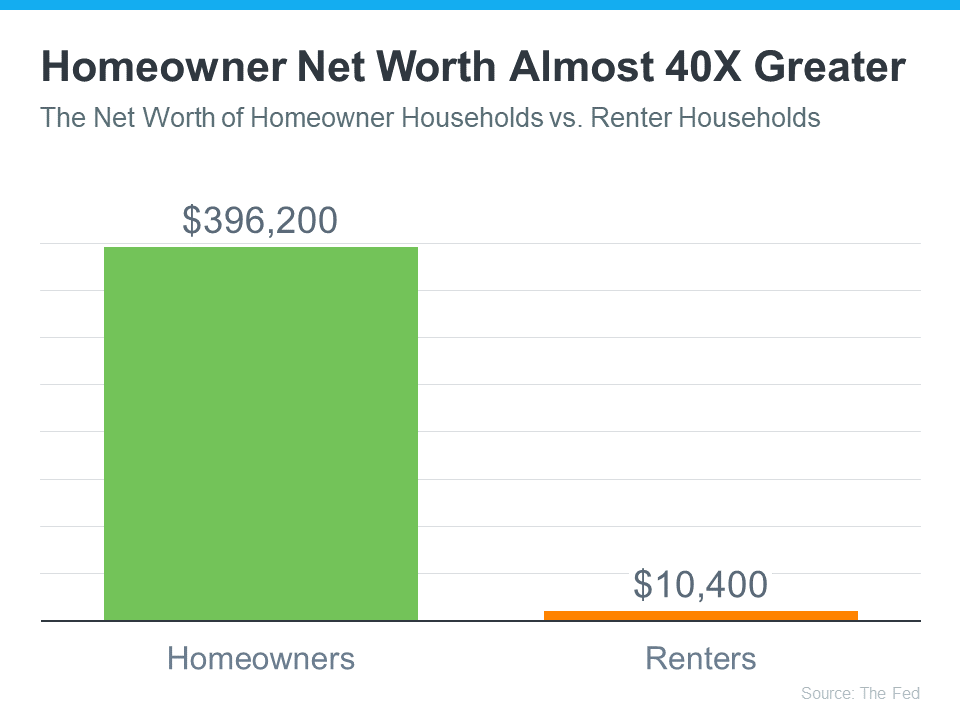

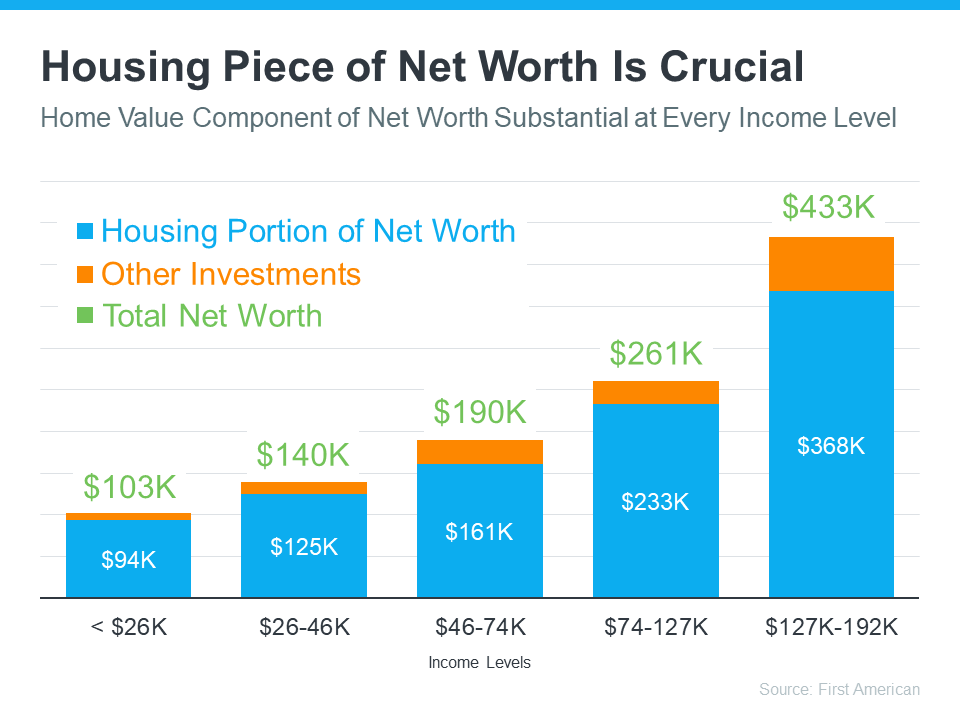

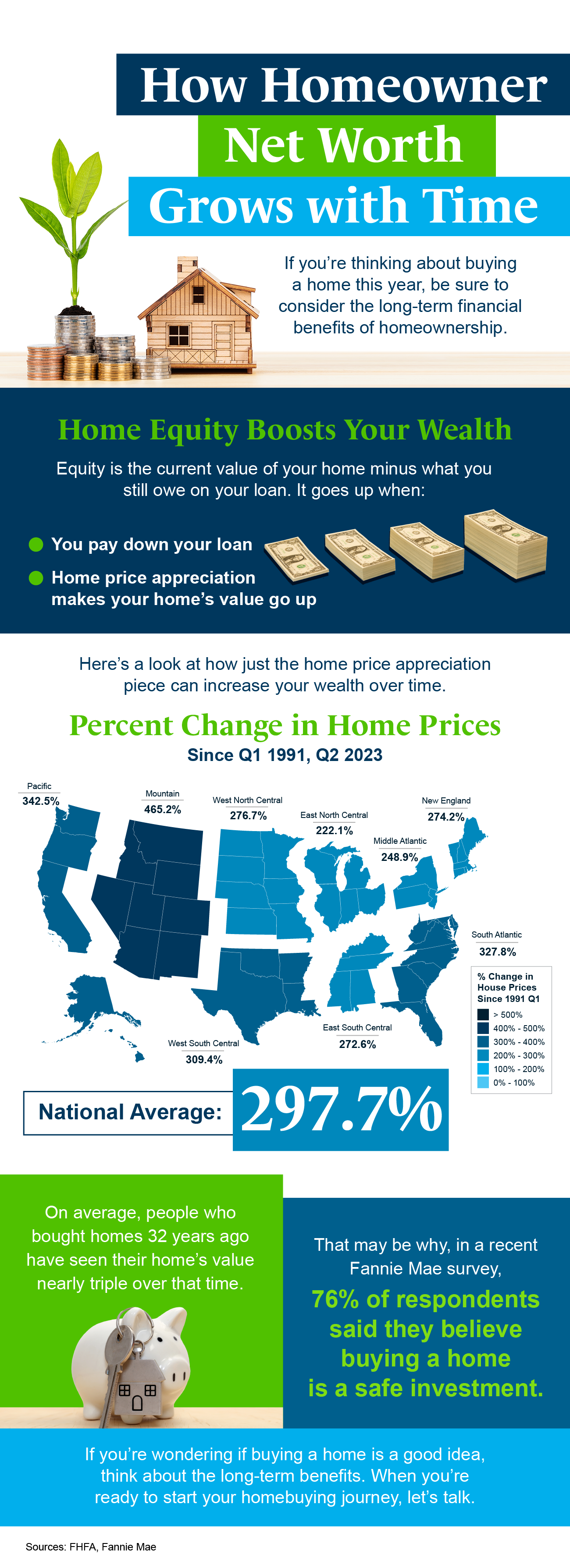

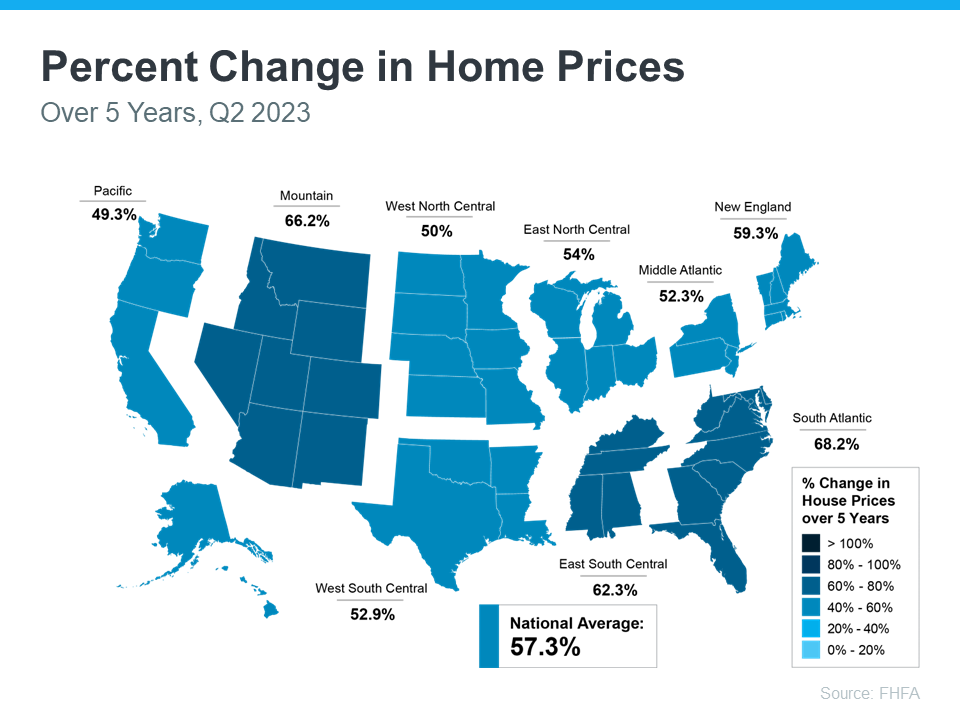

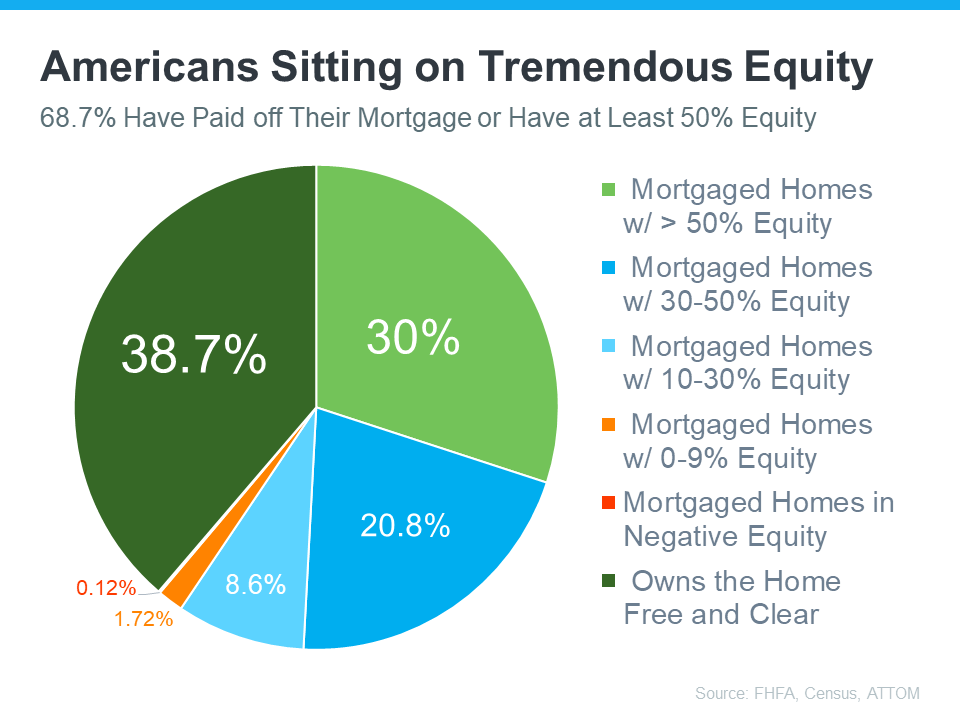

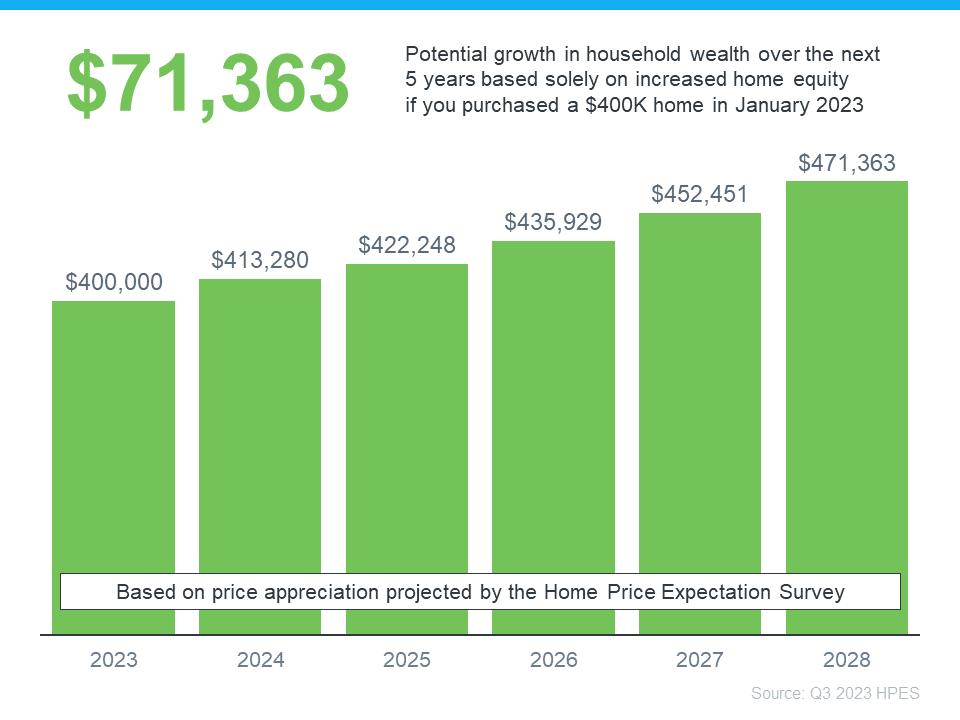

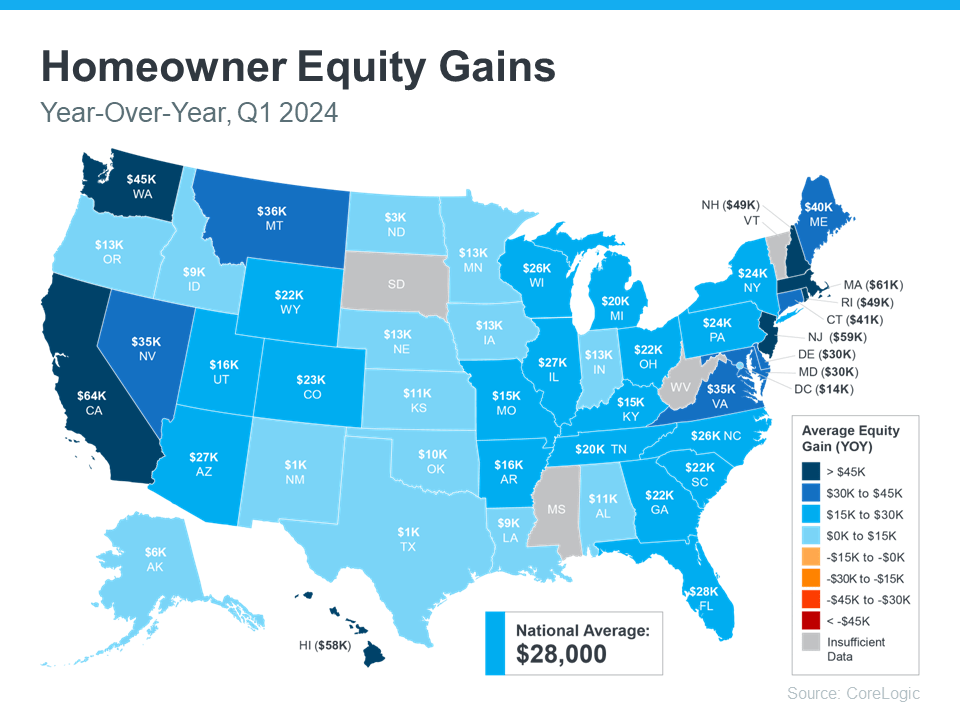

Equity is the difference between what your house is worth and what you still owe on your mortgage. The typical homeowner gained $28,000 over the past year and has a grand total of $305,000 in equity. And there are a lot of great ways you can use that equity. Want to know how much equity you have? Let’s connect so you can get a Professional Equity Assessment Report (PEAR).

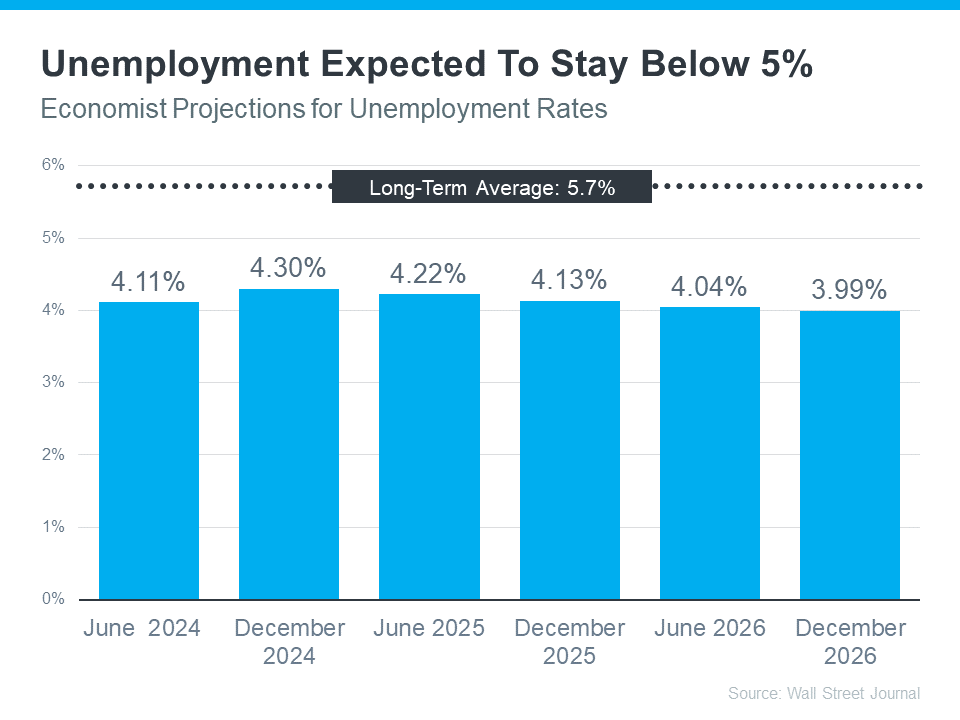

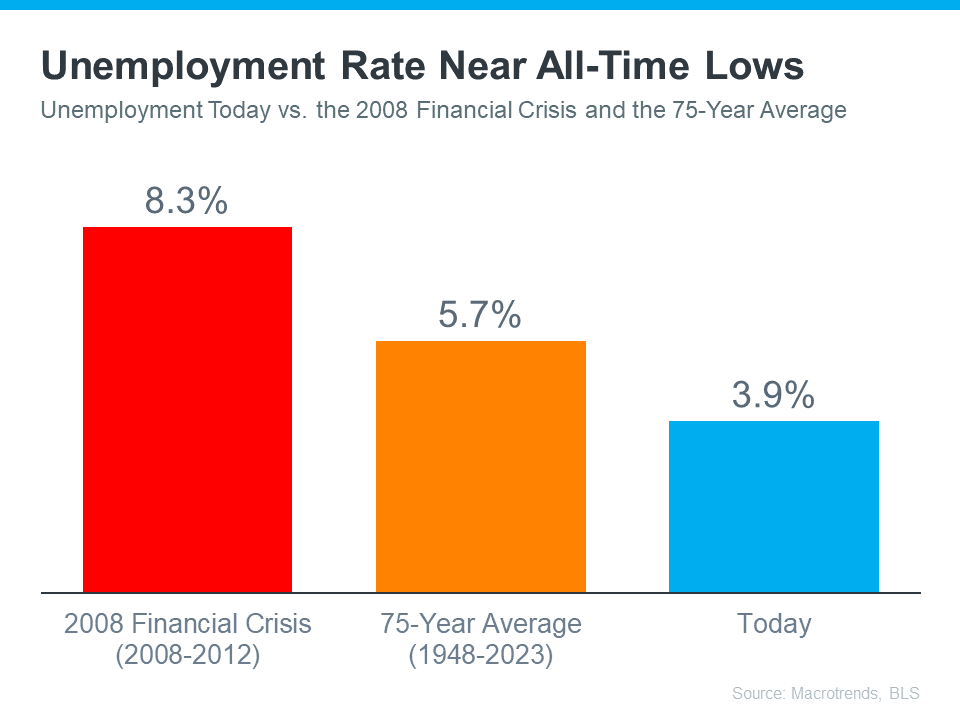

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding

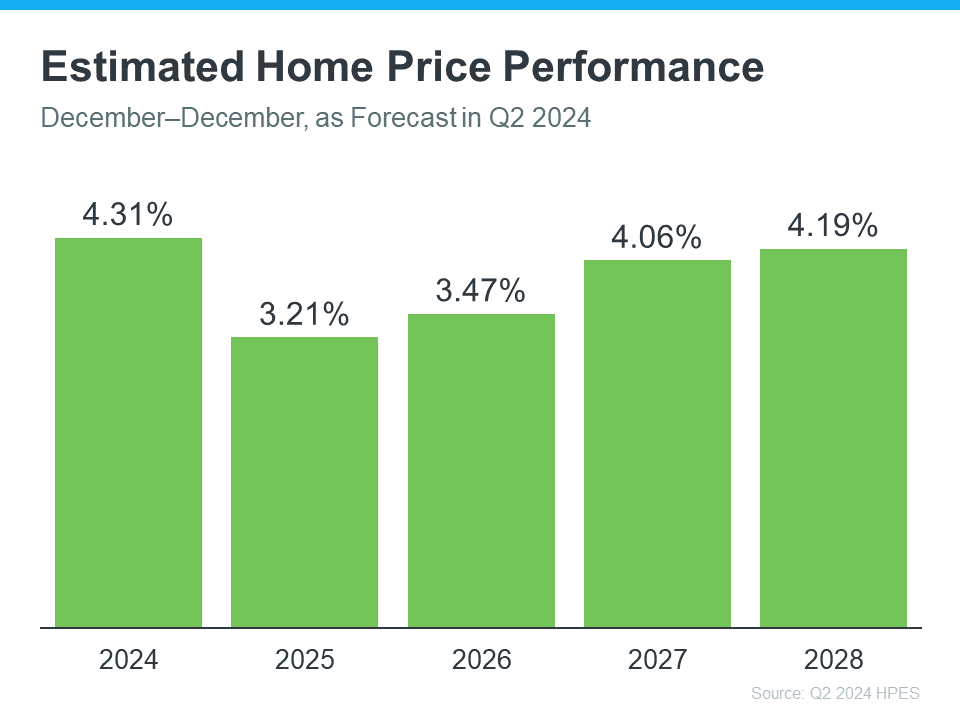

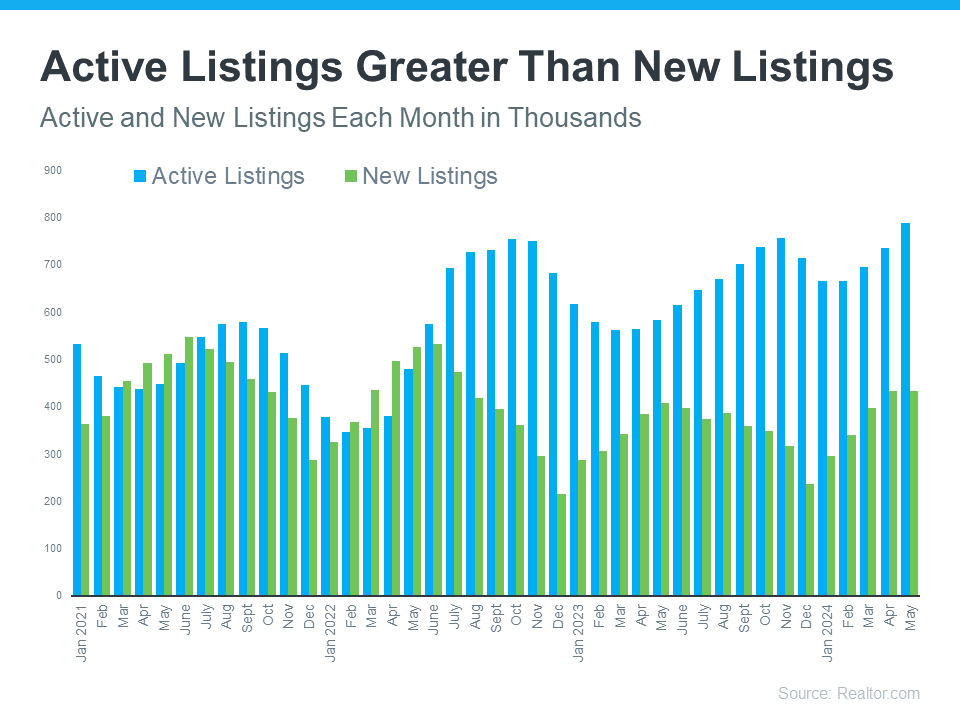

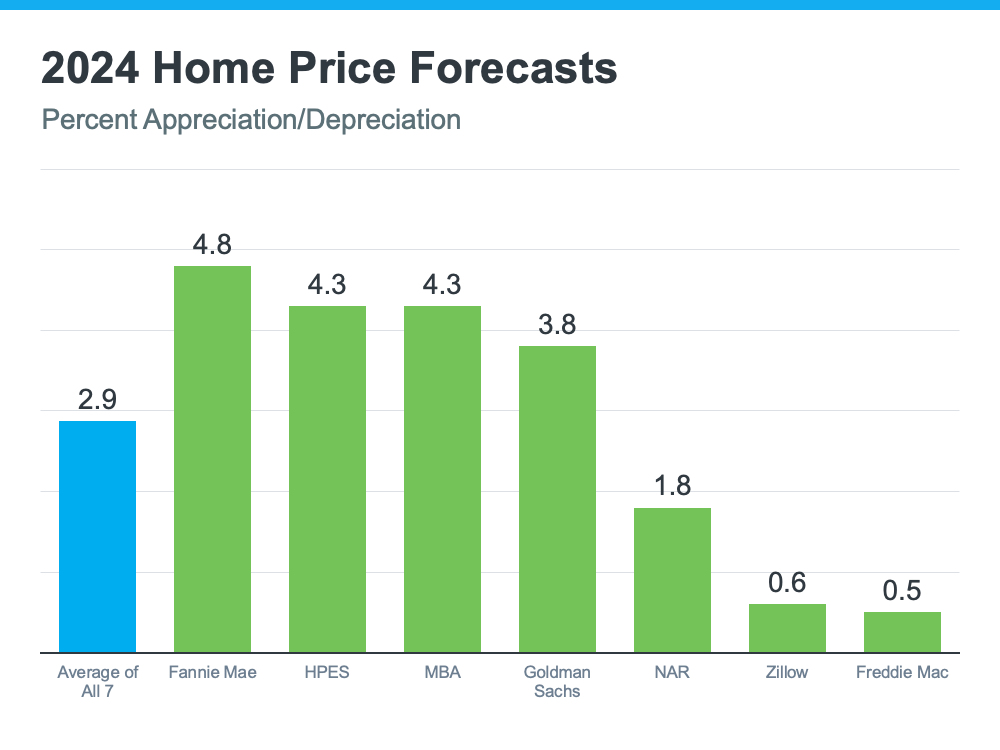

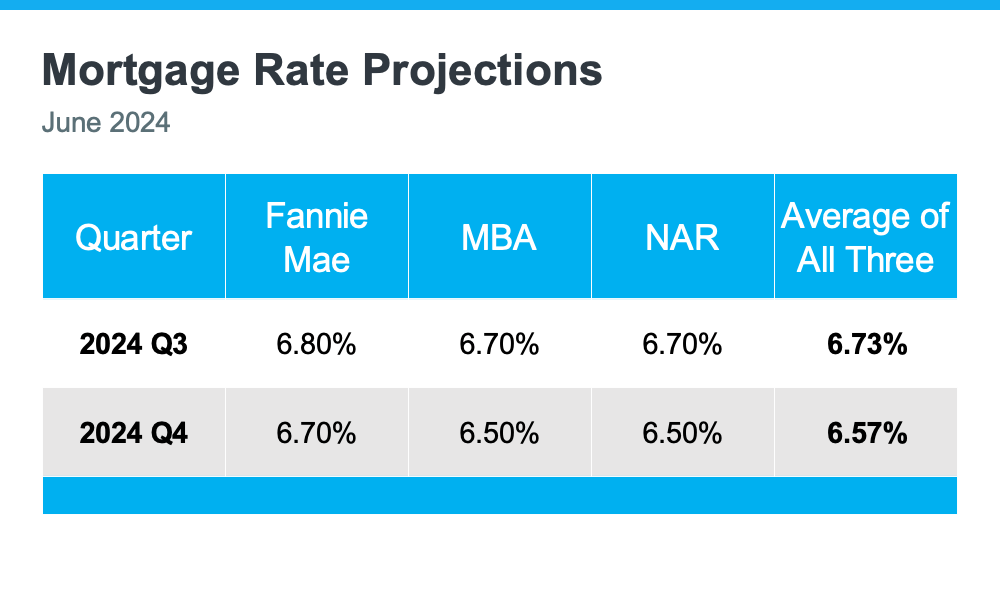

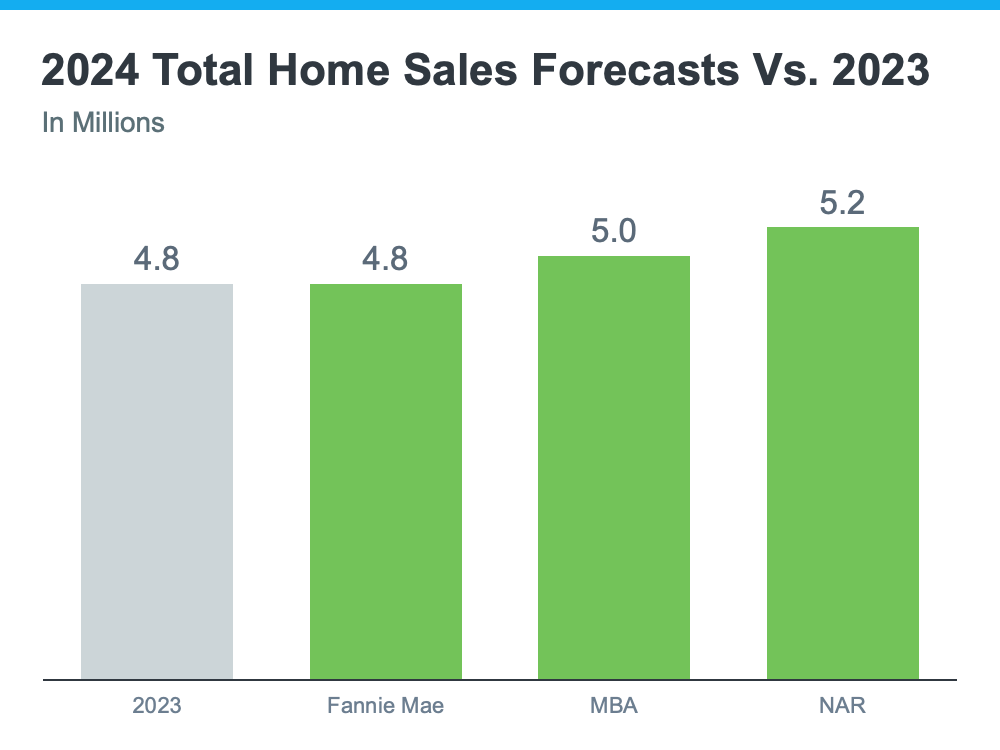

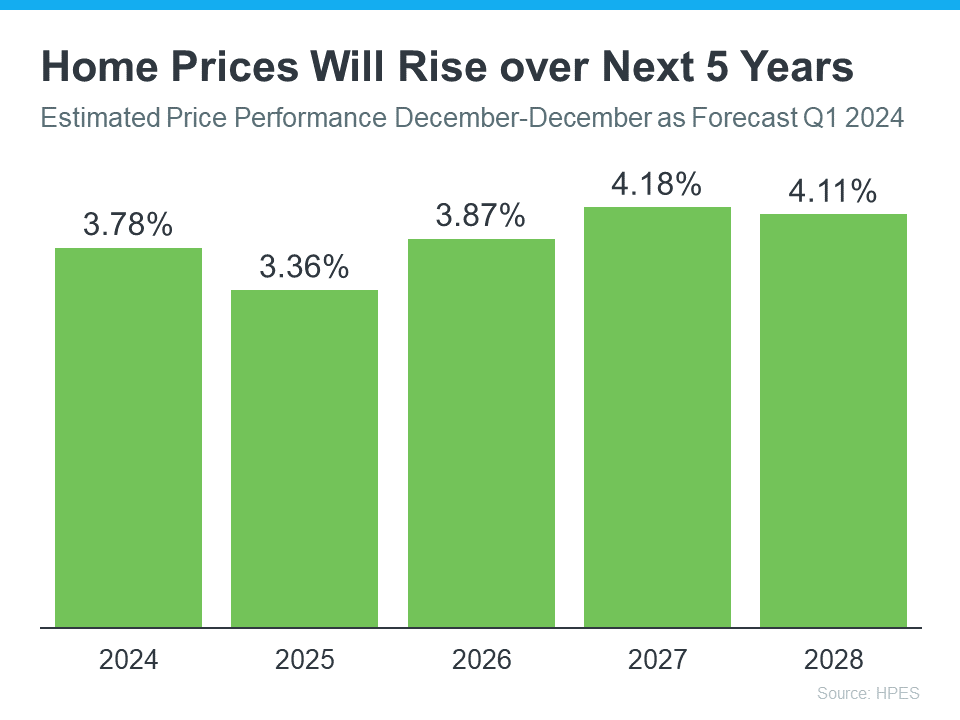

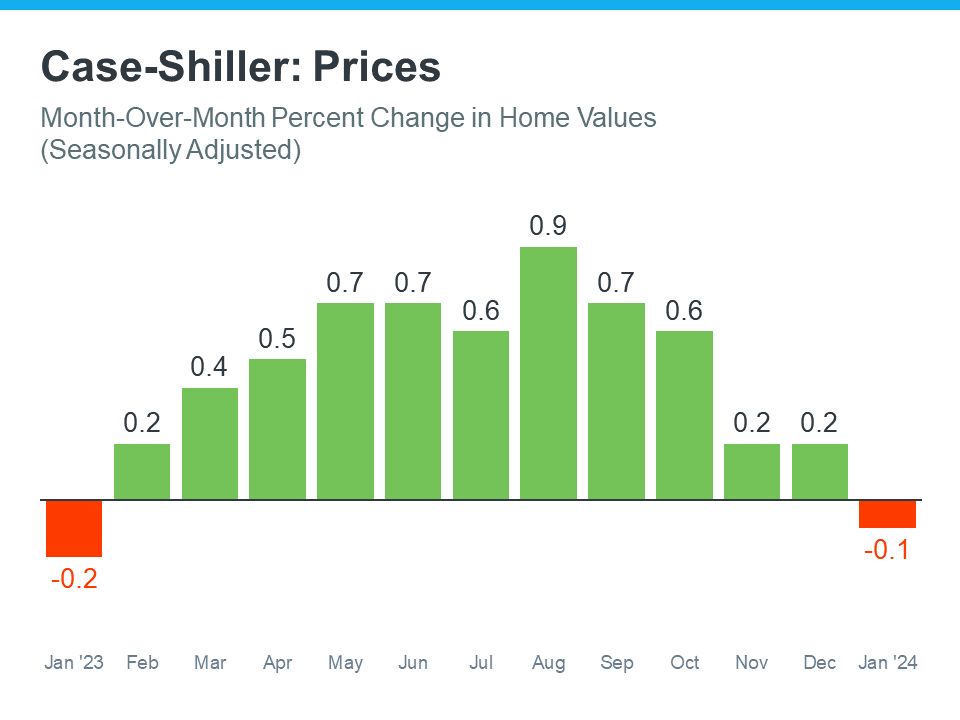

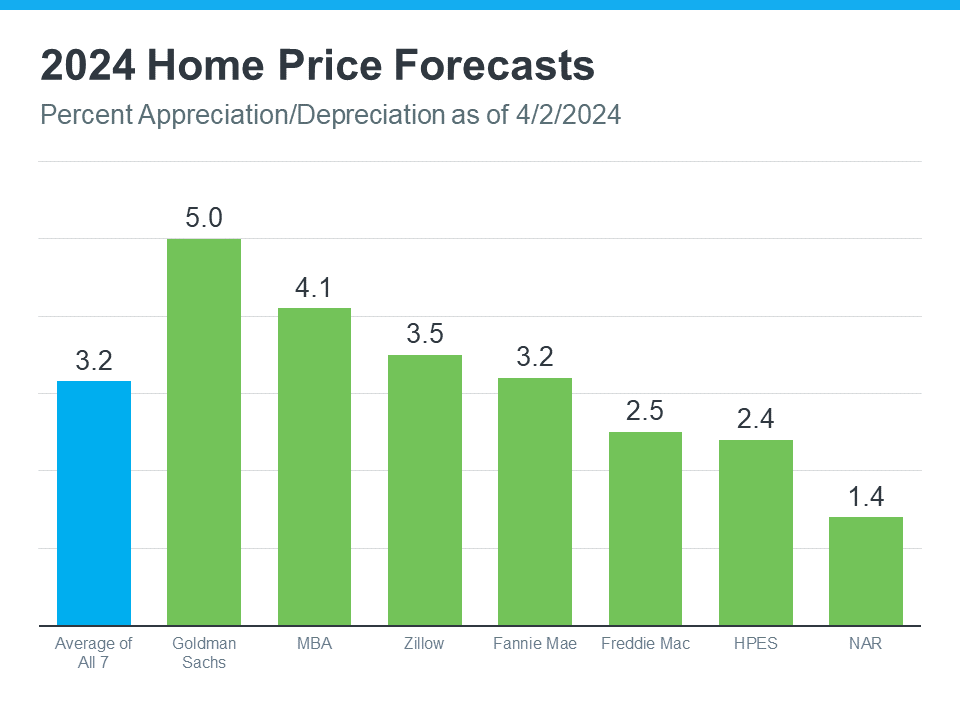

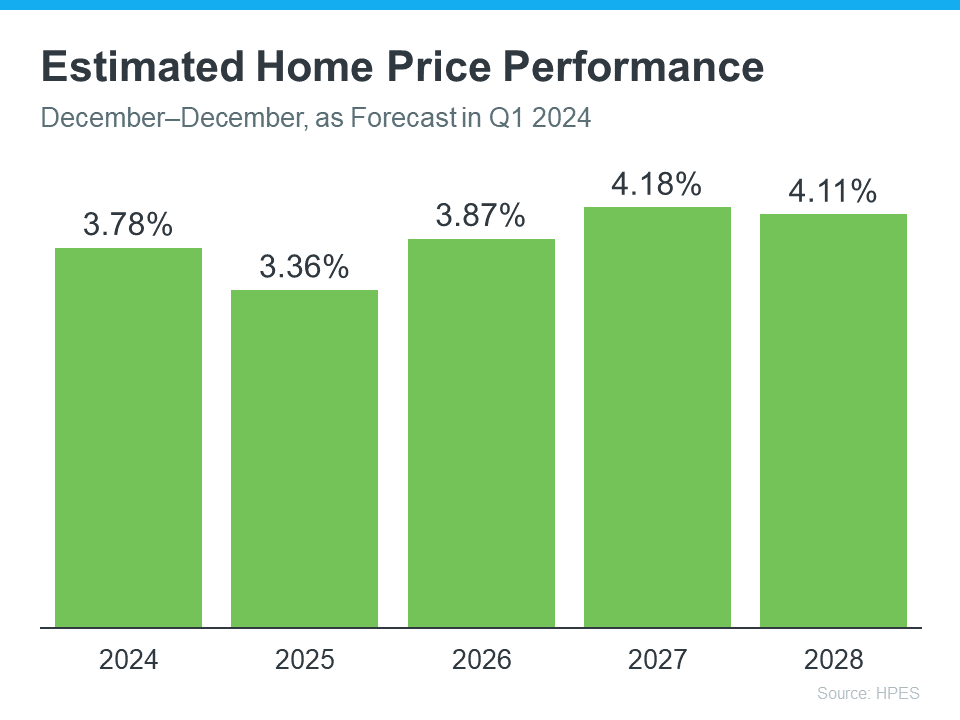

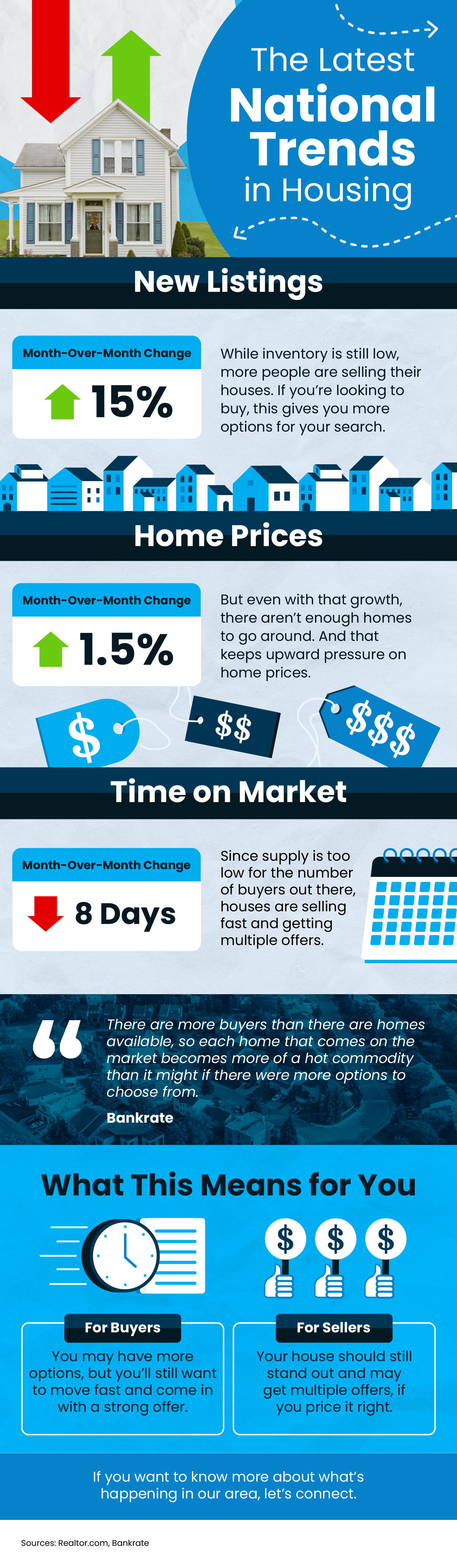

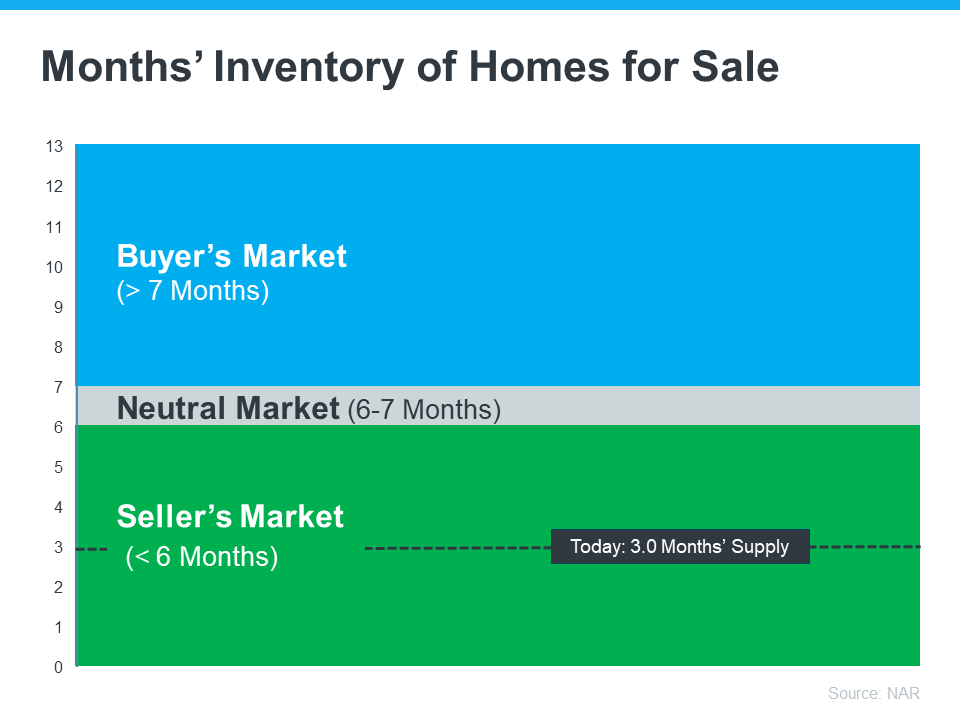

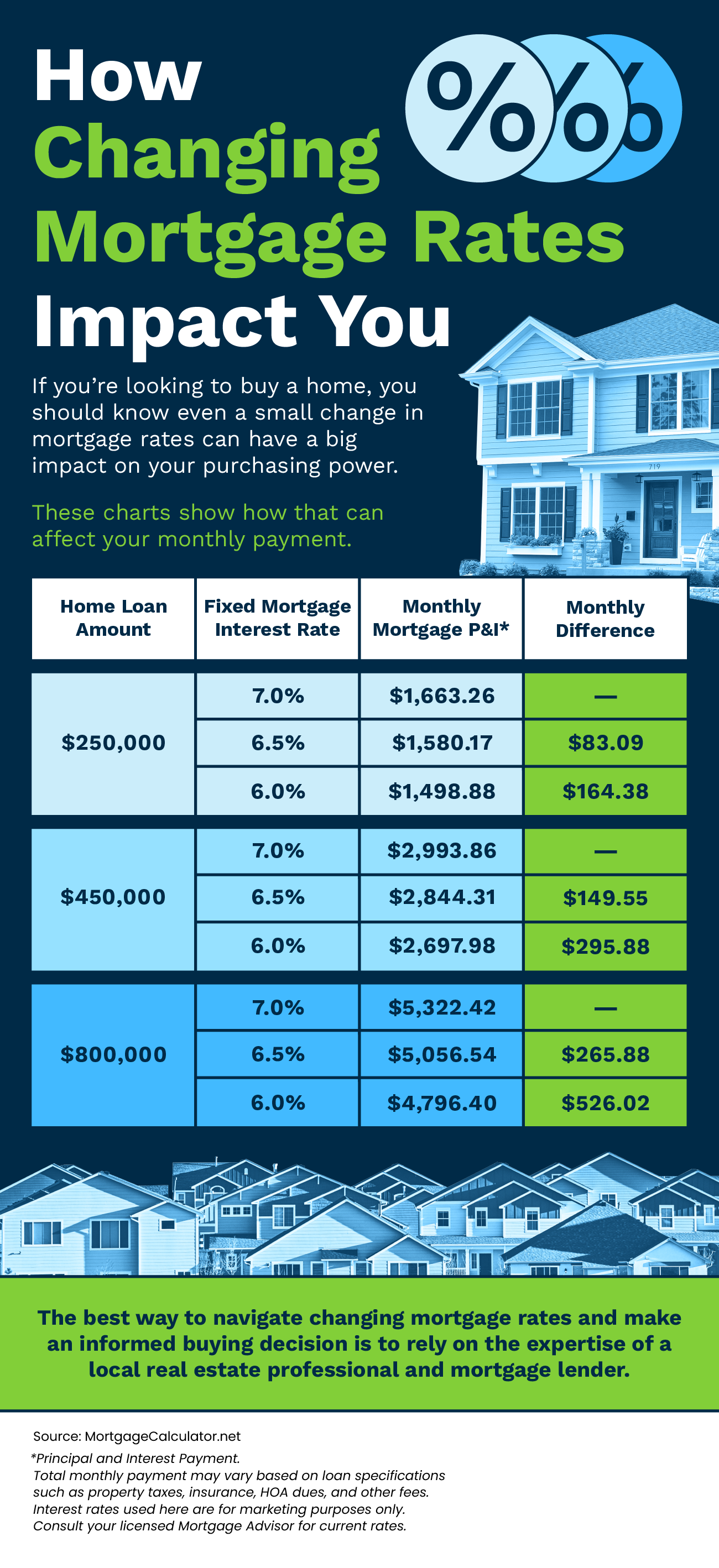

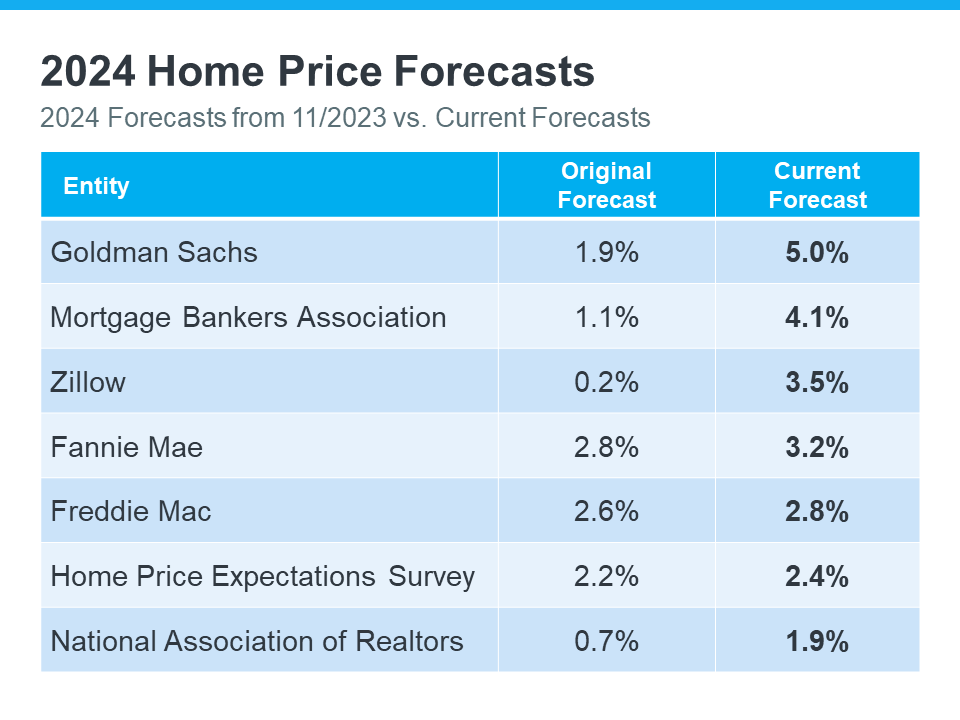

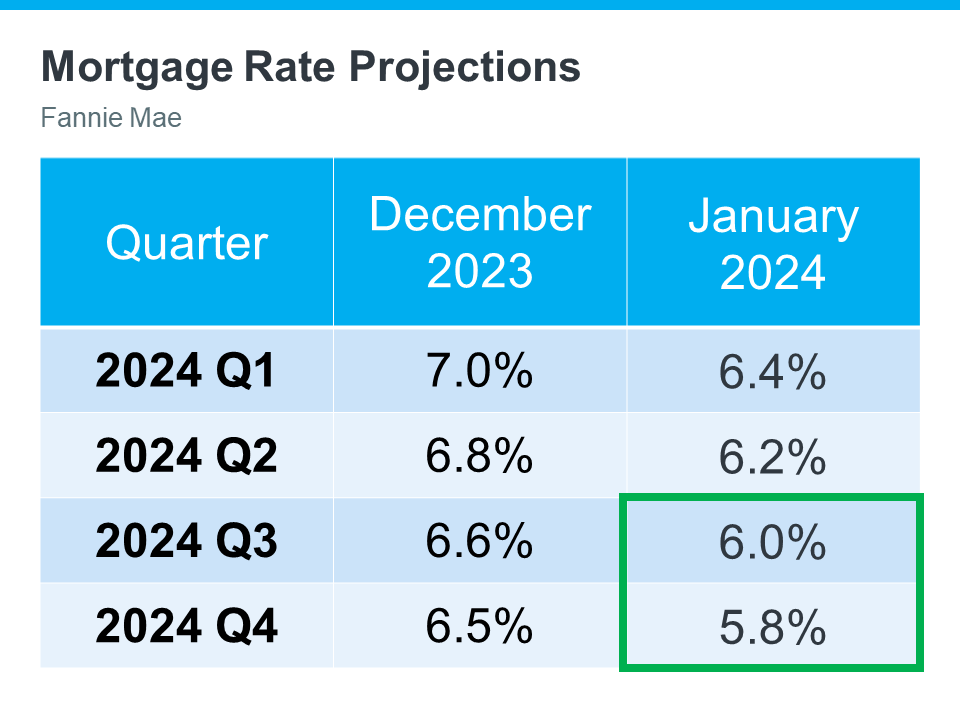

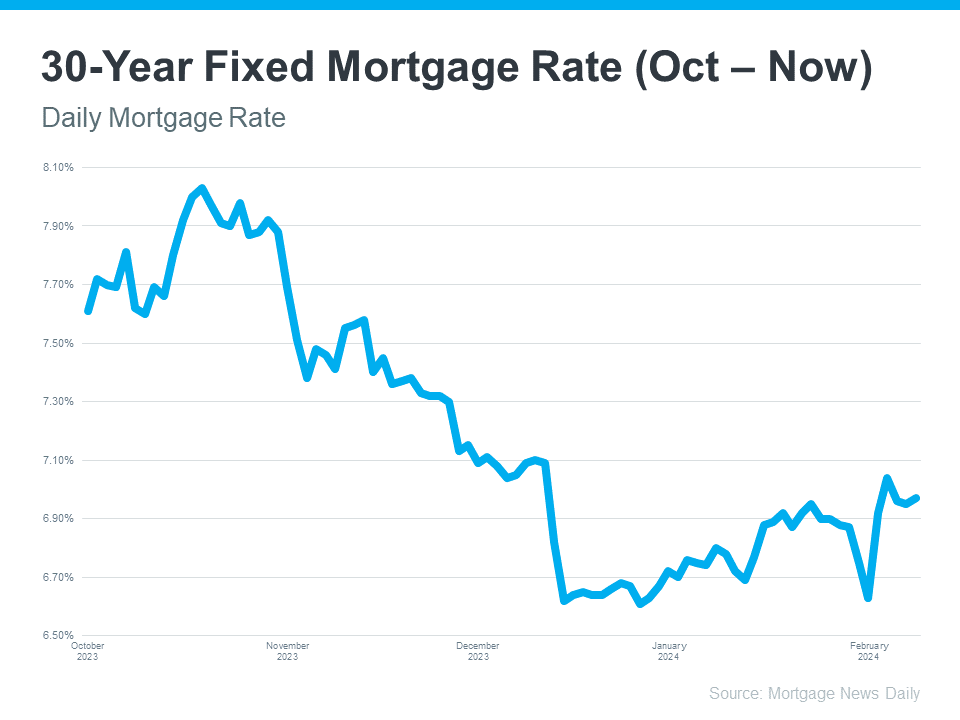

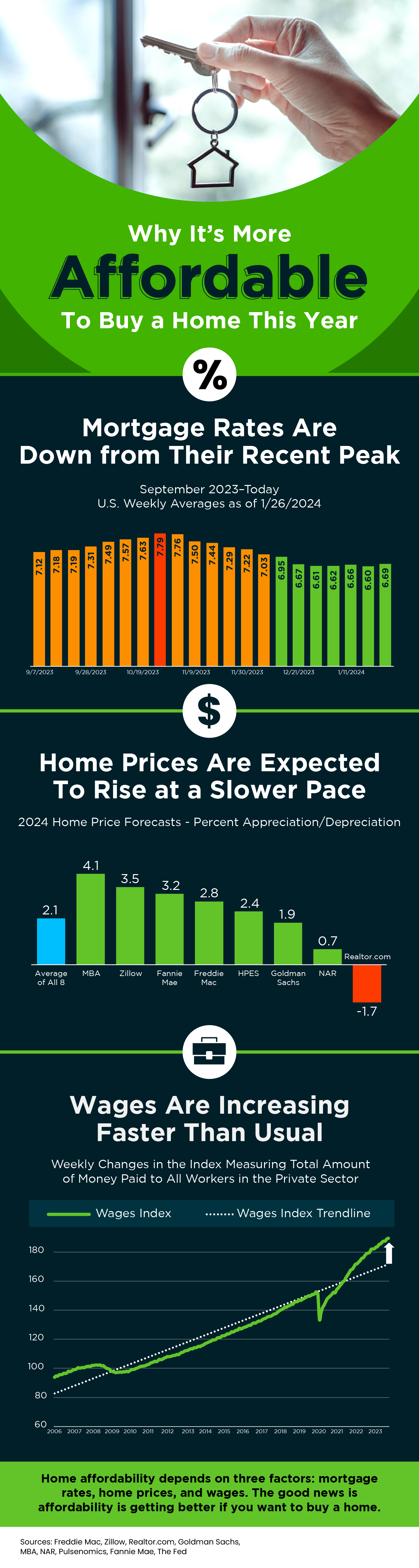

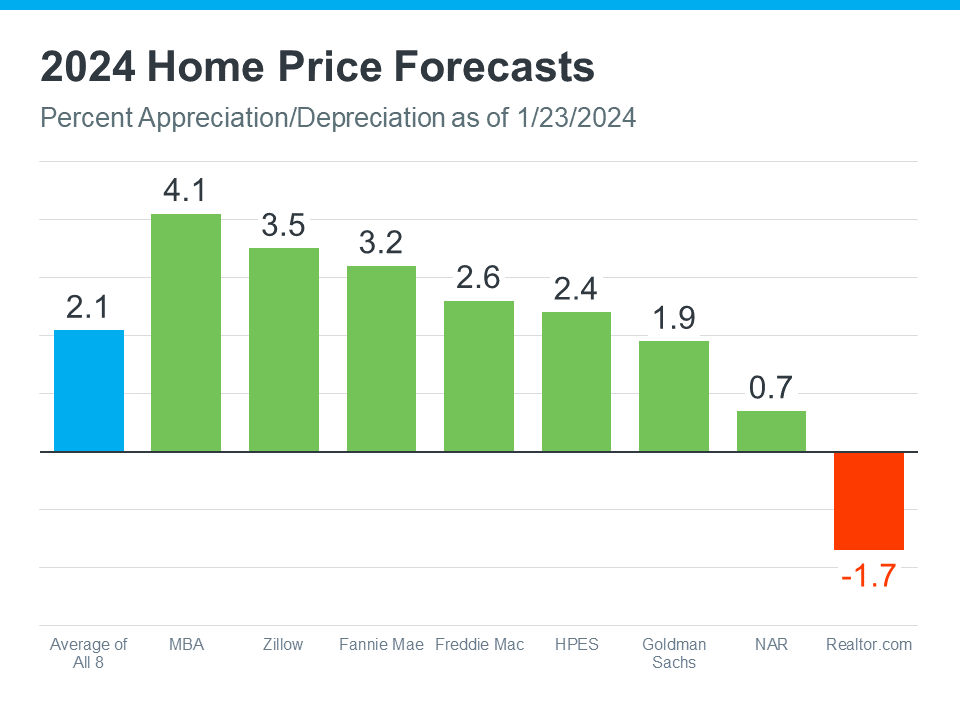

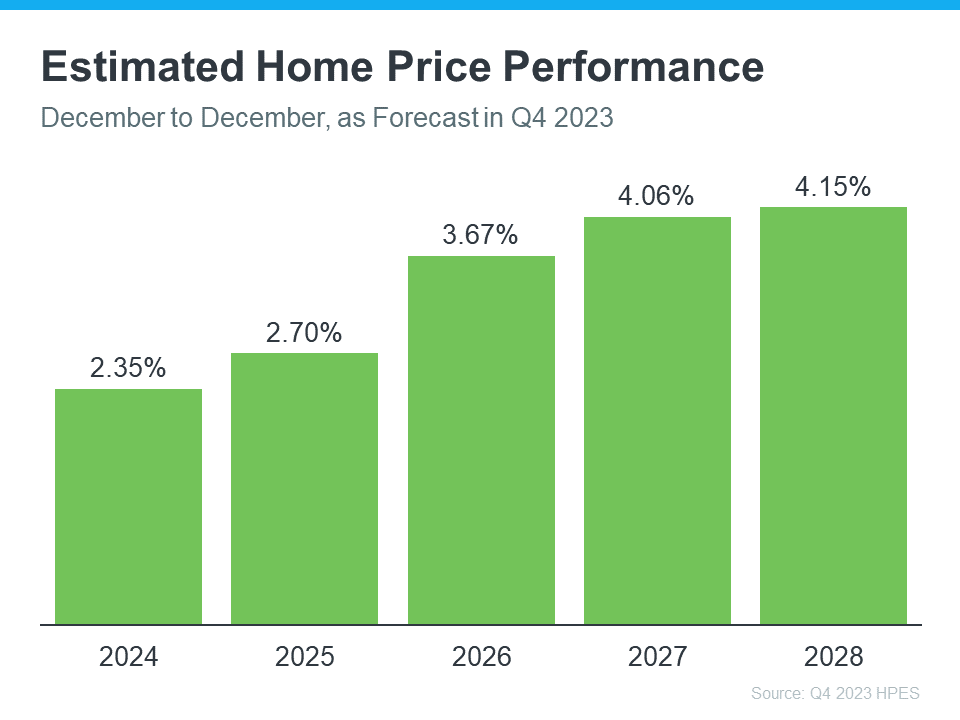

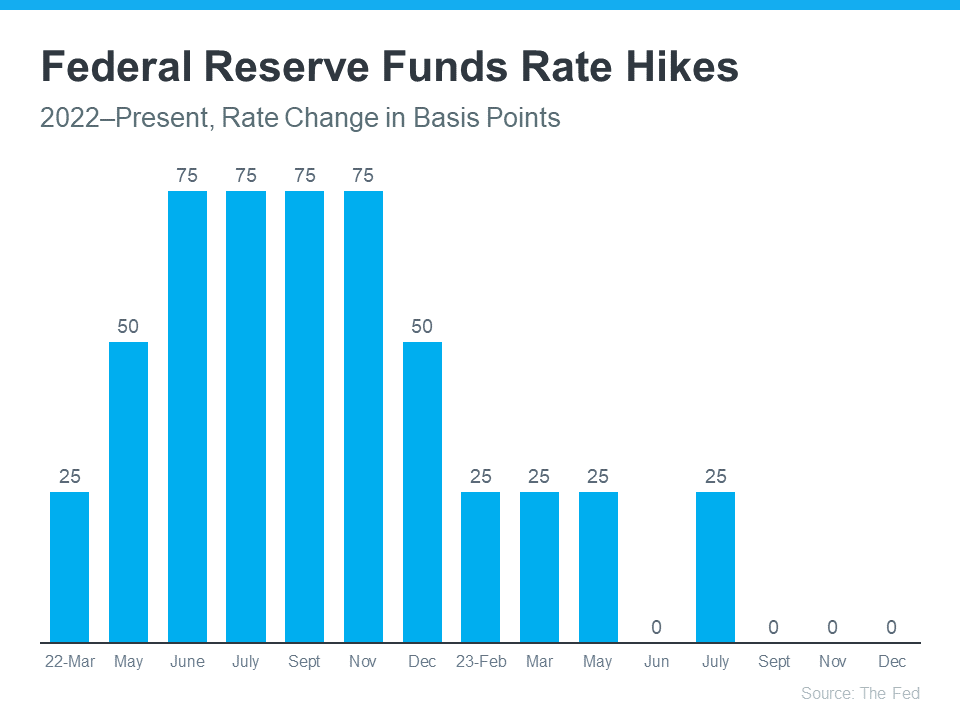

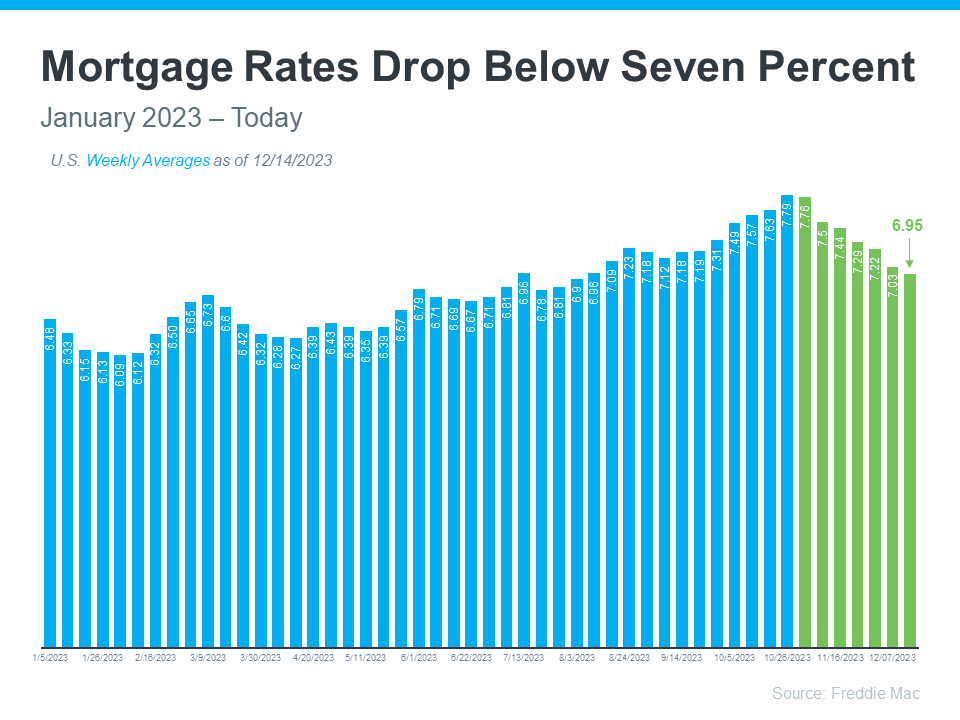

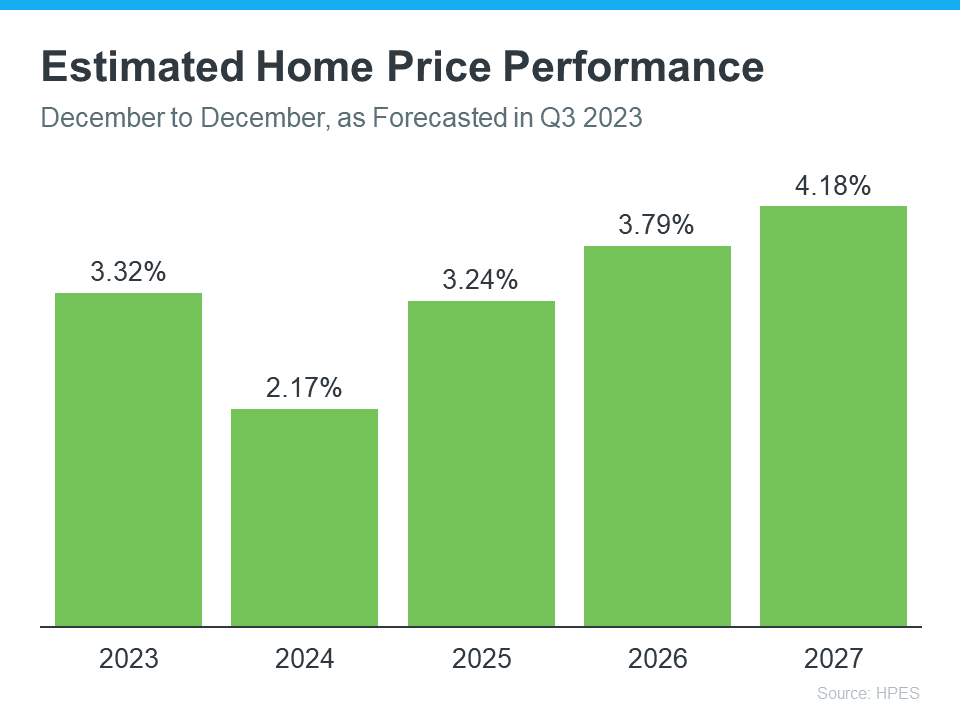

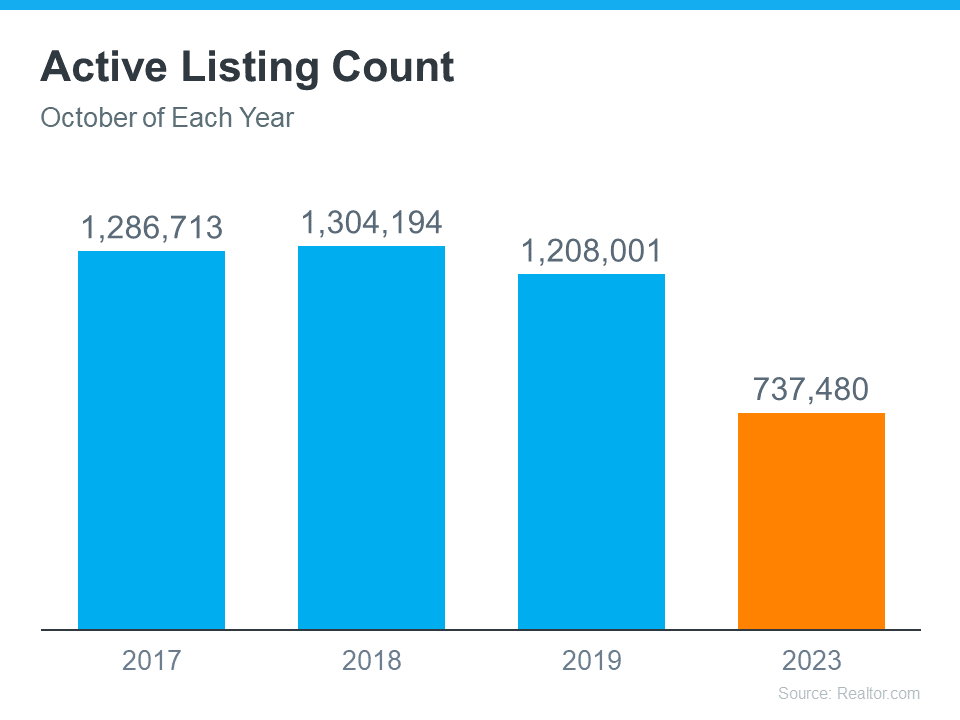

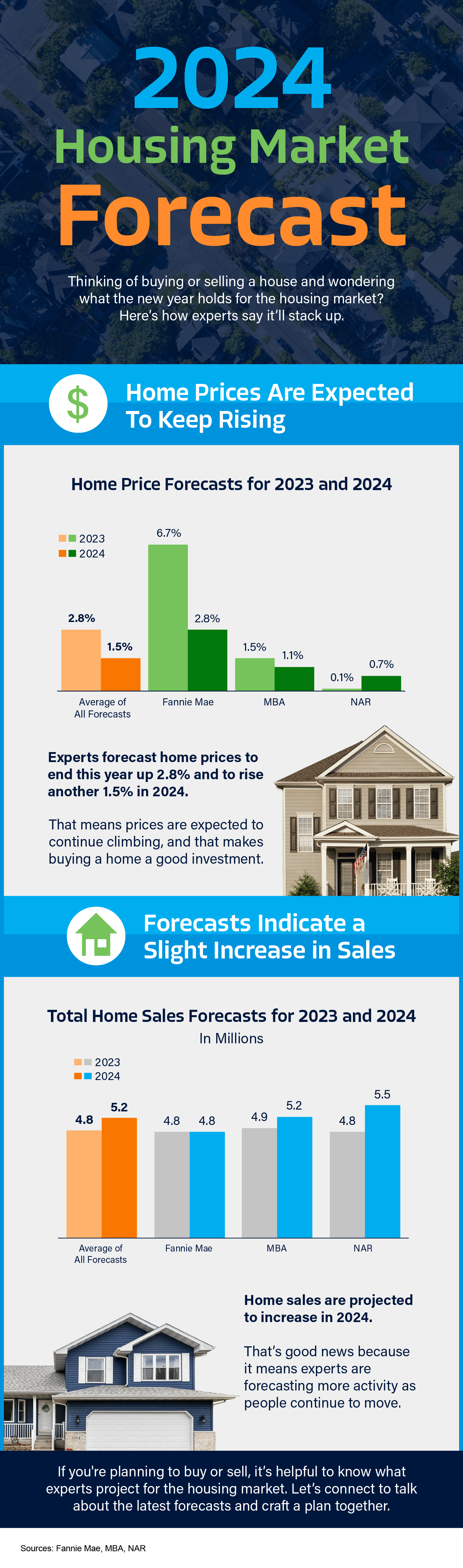

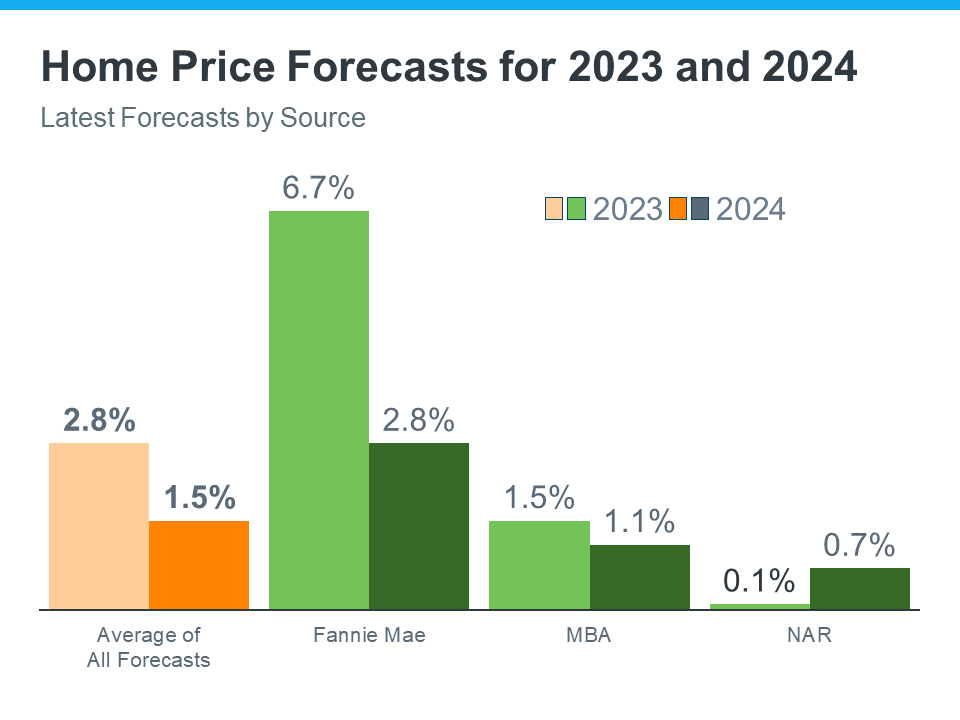

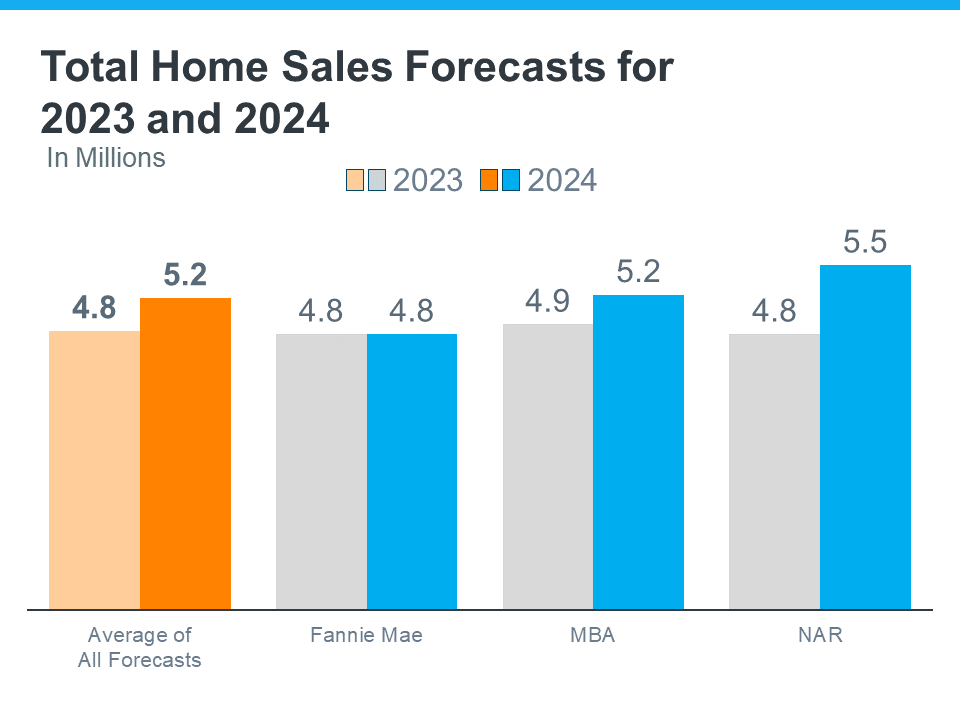

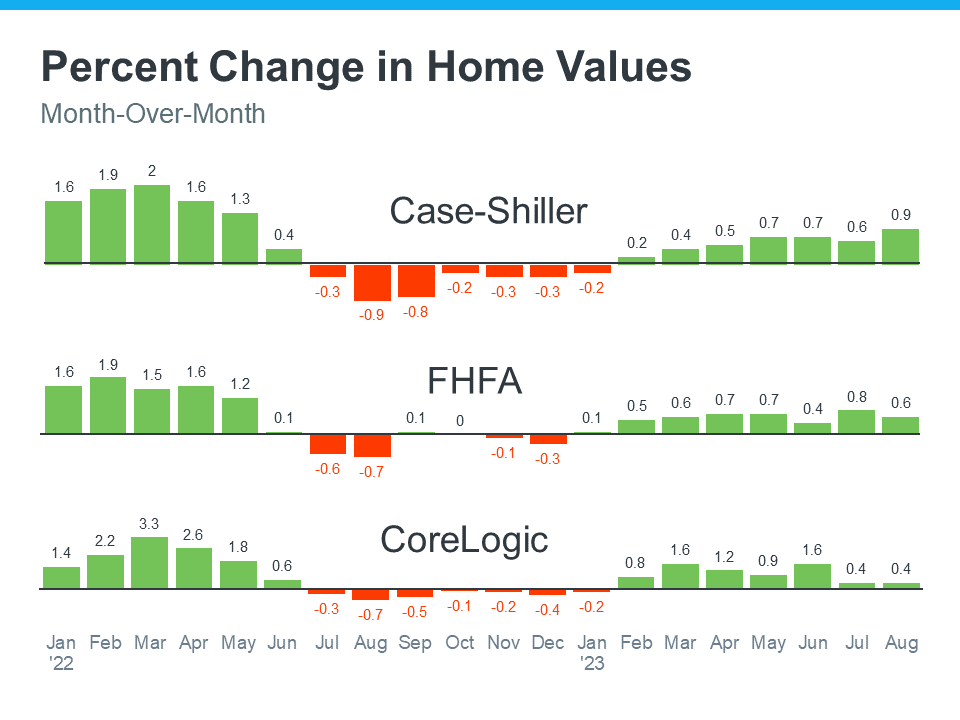

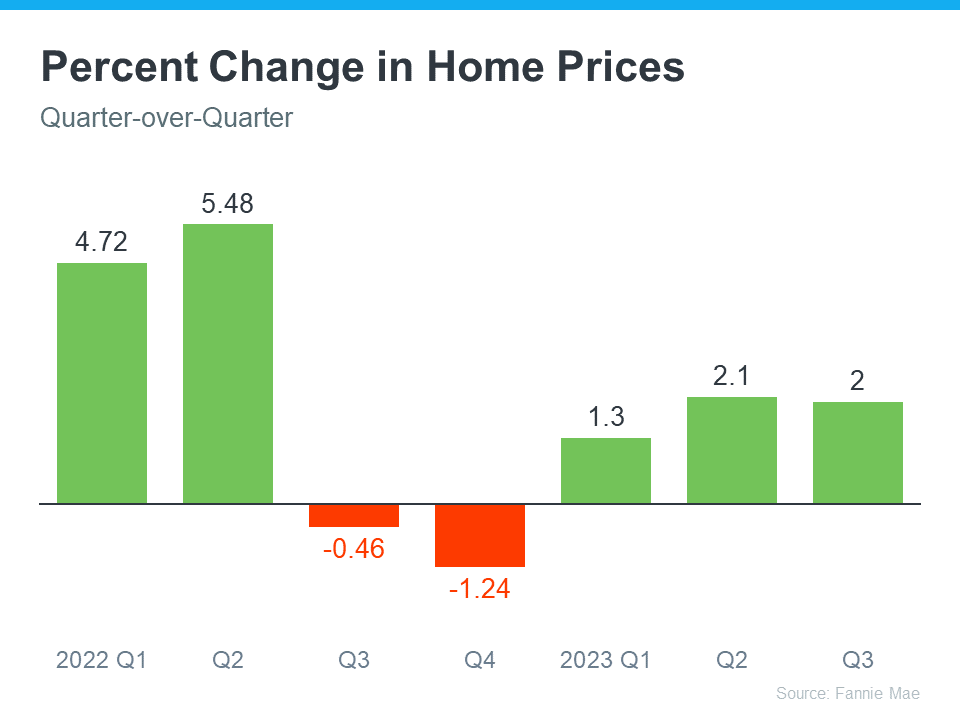

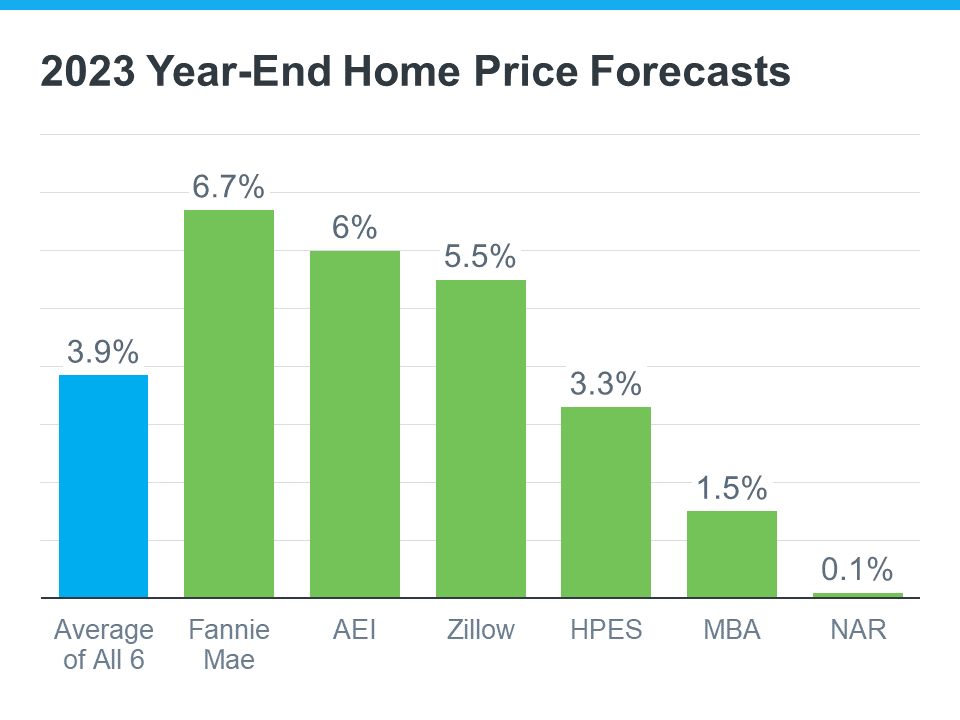

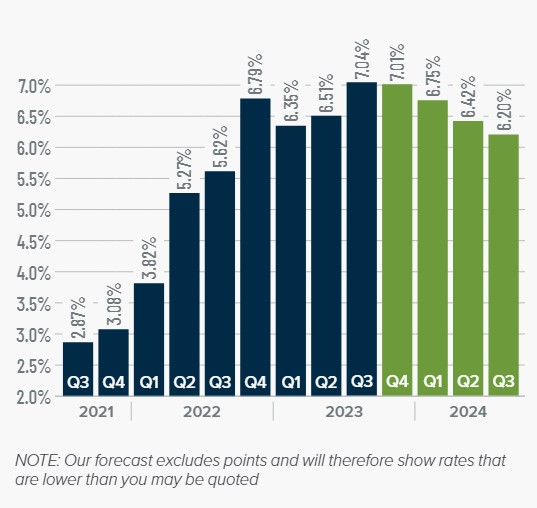

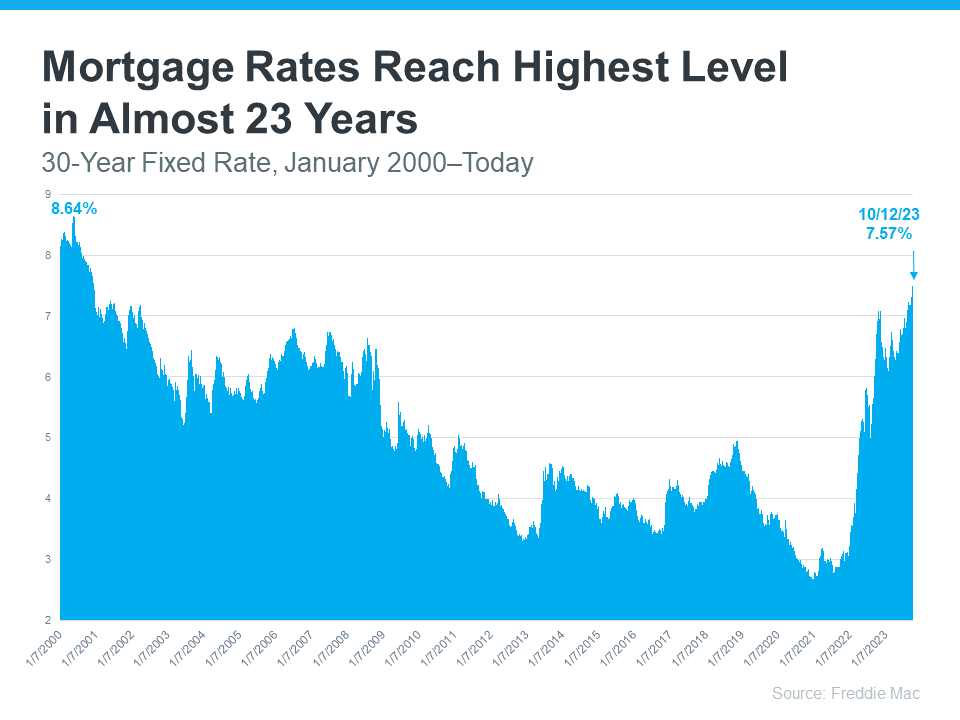

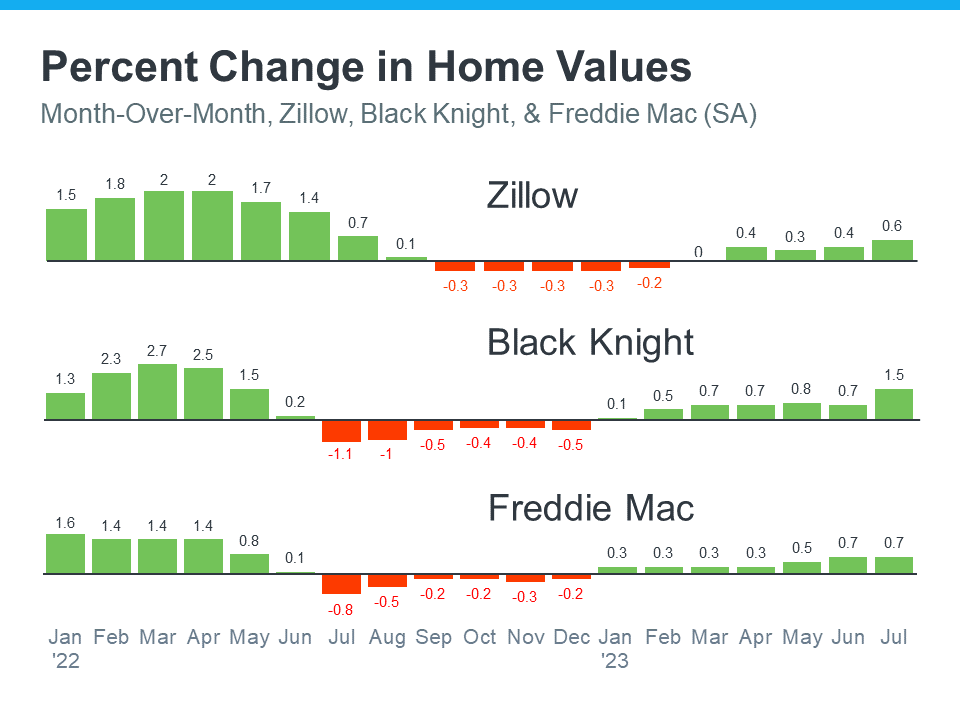

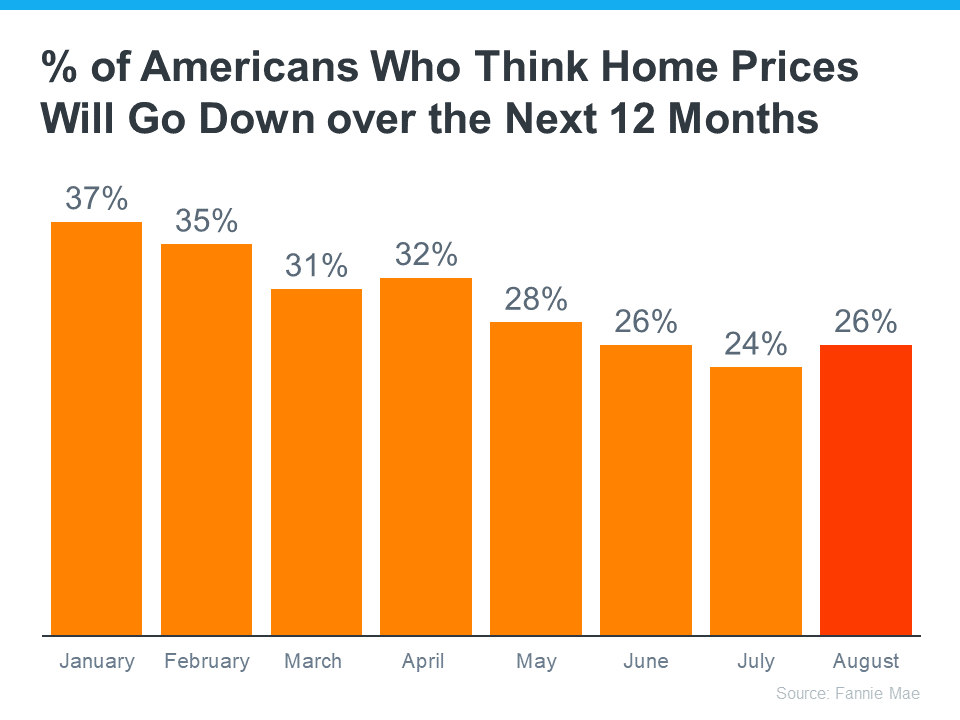

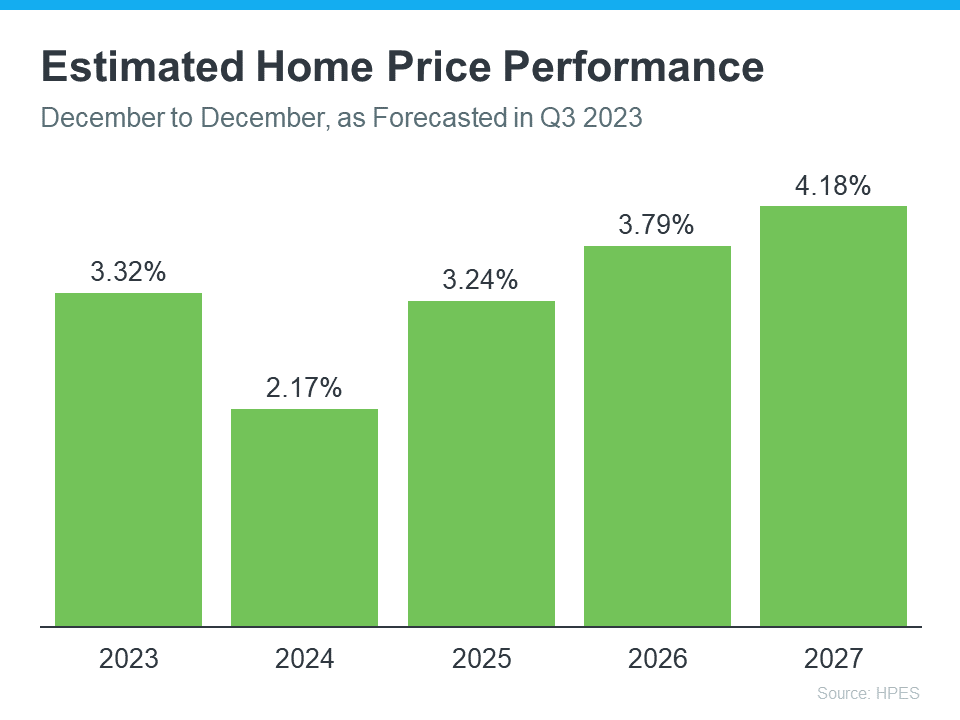

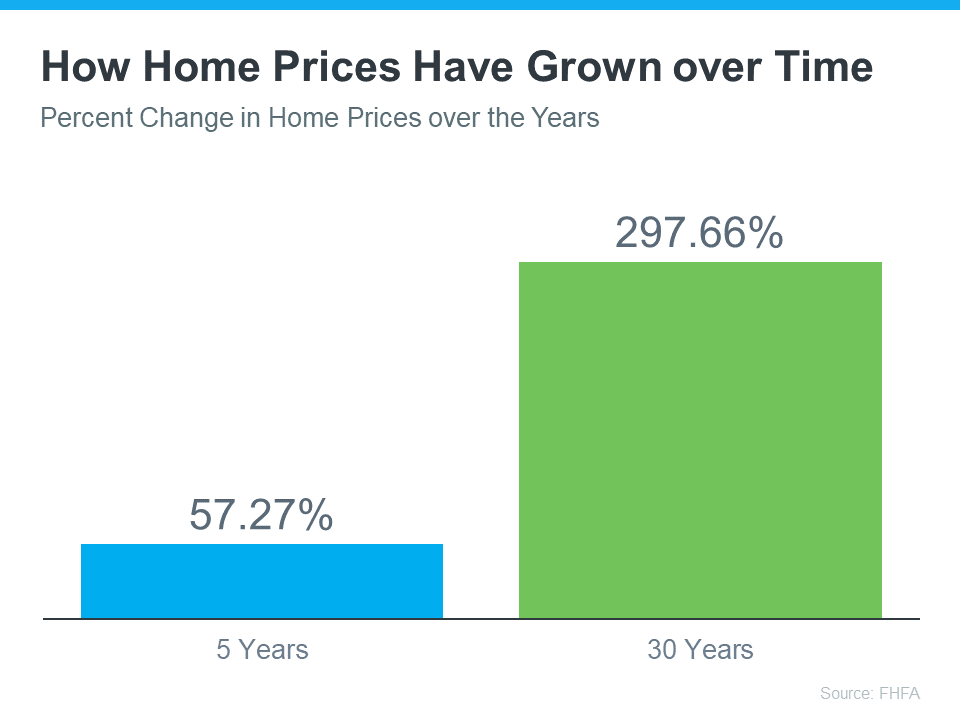

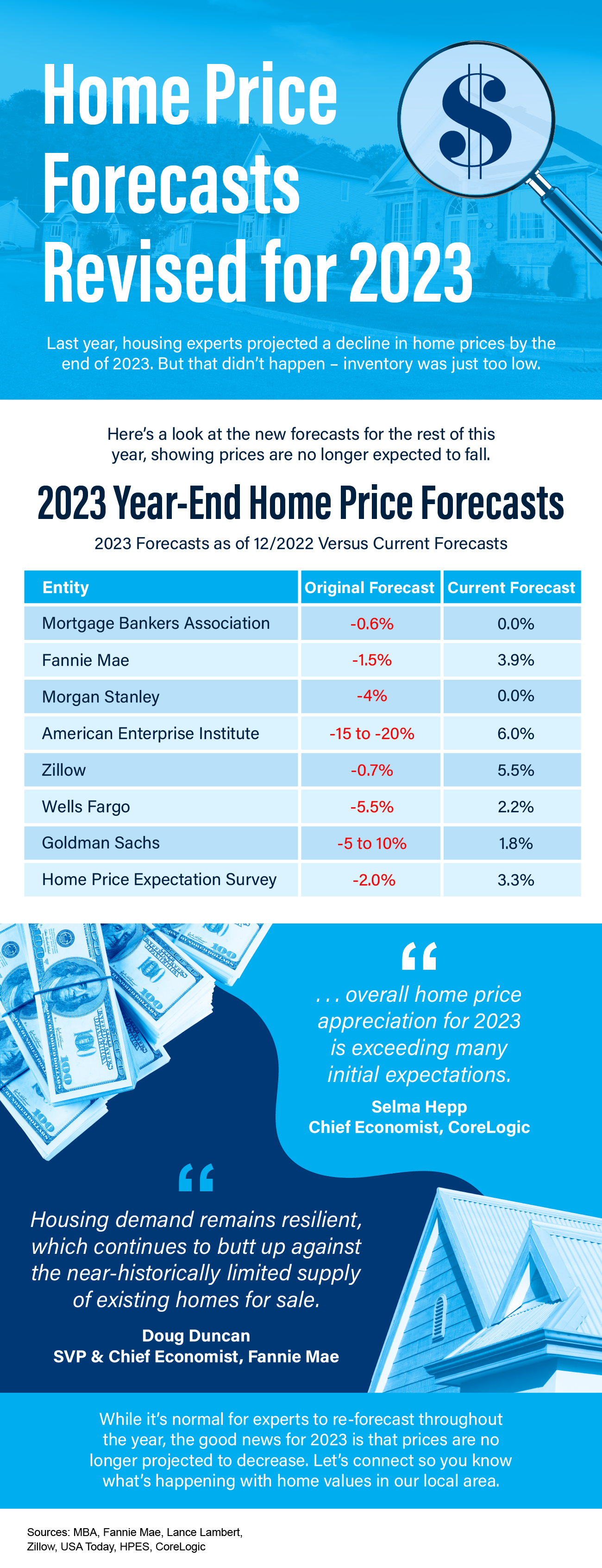

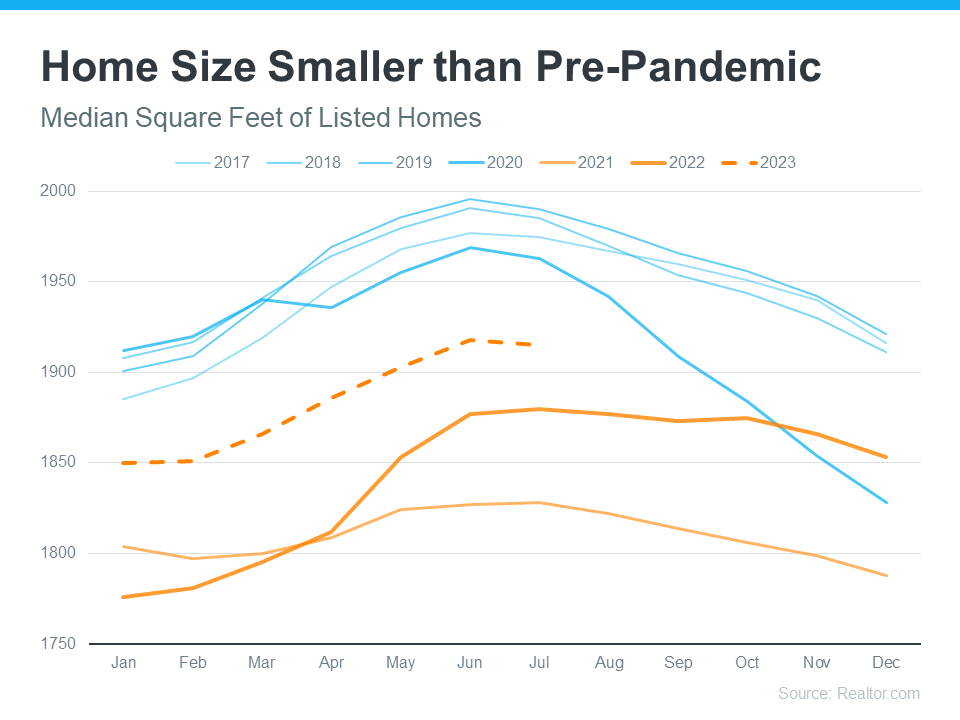

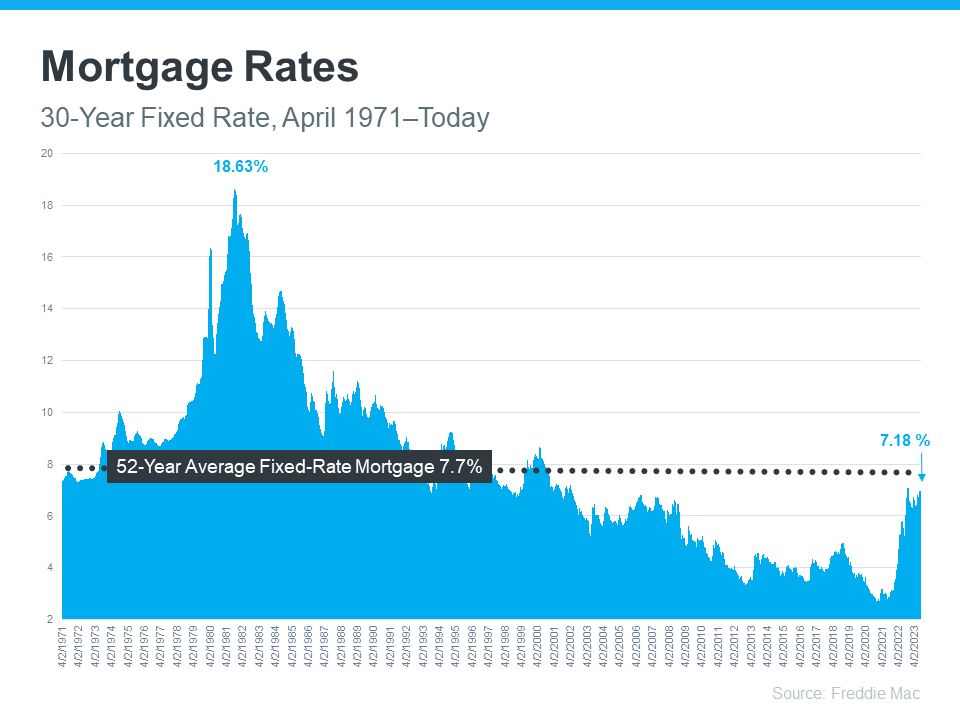

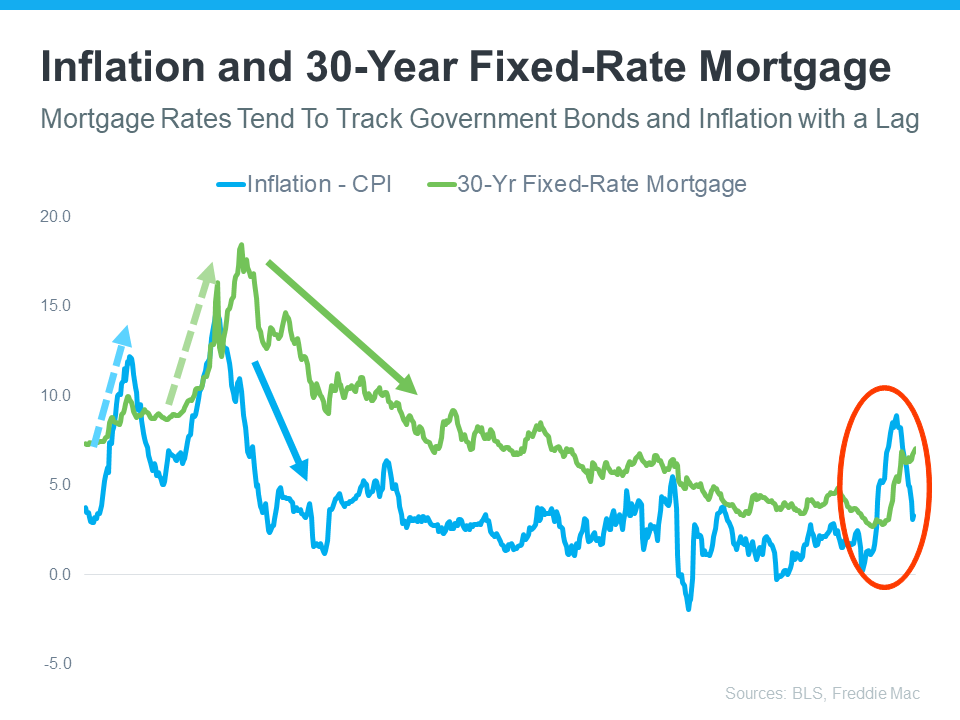

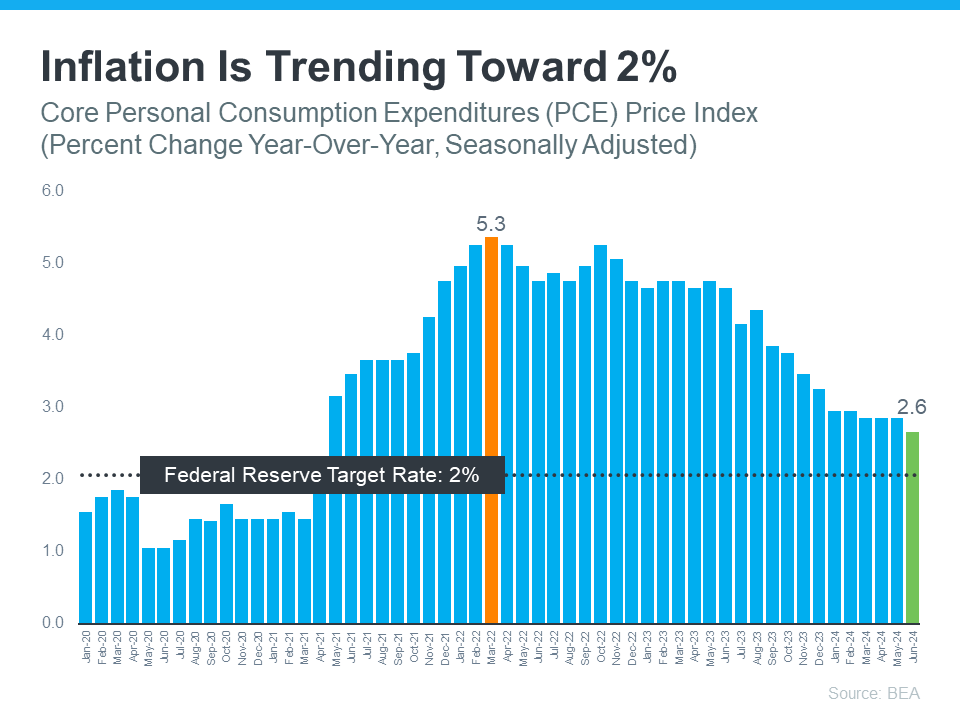

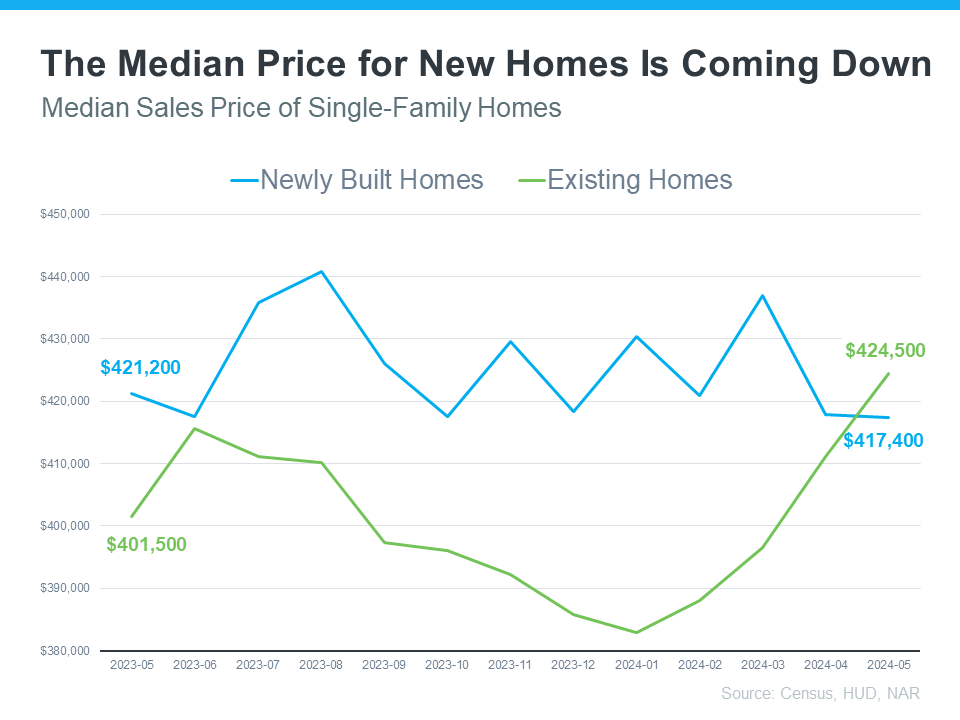

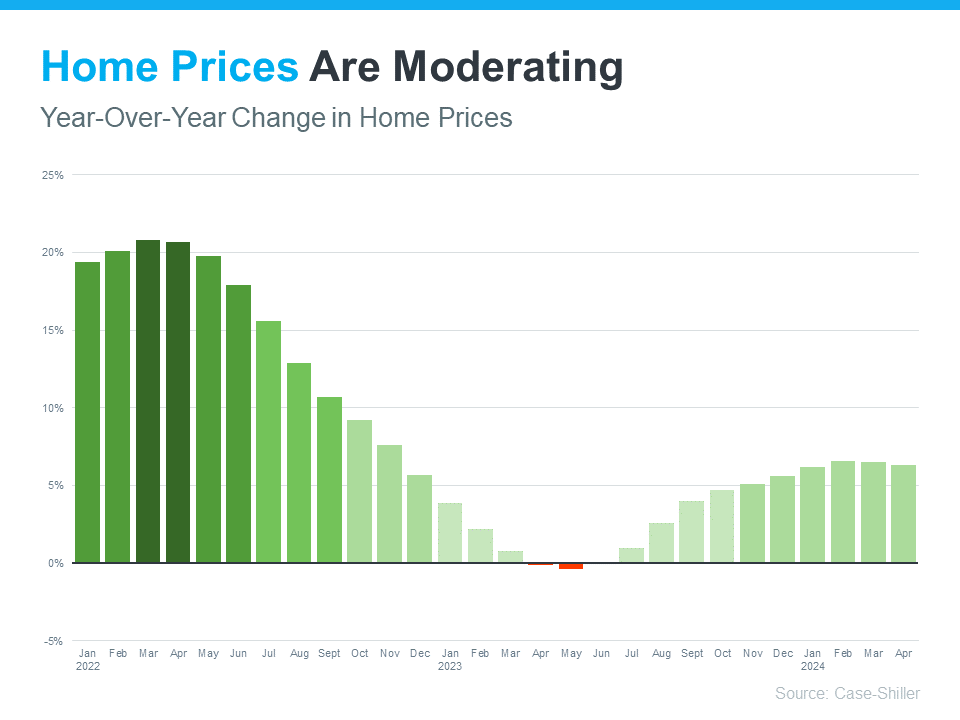

Wondering what the second half of the year holds for the housing market? Here’s what expert forecasts say. Home prices are expected to climb moderately. Mortgage rates are forecast to come down slightly. And, home sales are projected to hold steady. If you have questions about what to expect for the rest of the year, DM me so we can have a conversation about what it means for you and your plans.

Wondering what the second half of the year holds for the housing market? Here’s what expert forecasts say. Home prices are expected to climb moderately. Mortgage rates are forecast to come down slightly. And, home sales are projected to hold steady. If you have questions about what to expect for the rest of the year, DM me so we can have a conversation about what it means for you and your plans.