Listed at $1,295,000

Click Here For Full Details, Dozens of Photos, 3D and 4K Video Tour at the Property Website

The spacious 1,800 s.f. floorplan features 4 bedrooms, 2.25 baths on a 9,078 s.f. lot in Glenterra of English Hill. Special features include: Entertainment sized ironwood deck with built-in seating, and fully remodeled kitchen with stainless steel appliances including double oven, wine cooler, and large center island, backed to greenbelt and English Hill Trail.

Inviting, spacious entry welcomes you with beautiful wood floors, and abundance of natural light. Formal living & dining room includes wall of windows, soaring ceiling, and space for entertaining. The Nook and family room sit on the main floor, complete with decorative light fixture and ample space for gathering. Large, fully remodeled kitchen with granite counters, Subway tile backsplash, newer stainless steel appliances with double oven, wine cooler, large center island with breakfast bar, abundance of custom cabinetry, and two separate sliders leading to the back yard. Updated powder room in the hall on main floor, perfect for guests!

Gorgeous primary suite with walk-in closet and spacious, and fully updated primary bath. Stunning primary bath features beautiful slate flooring, double vanity with quartz counters, and tile-wrapped walk-in shower. Three additional large bedrooms on the upper level, with abundance of natural light. Updated main hall bathroom with tile flooring, quartz counter and tile-wrapped shower over tub.

The beautiful back yard backs to greenbelt on two sides and exudes privacy. Large deck with built-in seating, covered BBQ area, lush plantings and additional space for gardening. Nearby English Hill Trail running through the greenbelt!

Attached two car garage with ample storage options including staircase to attic storage area.

Northshore Schools – Sunrise Elementary, Timbercrest Middle & Woodinville High.

Listed at $997,800

Listed at $997,800

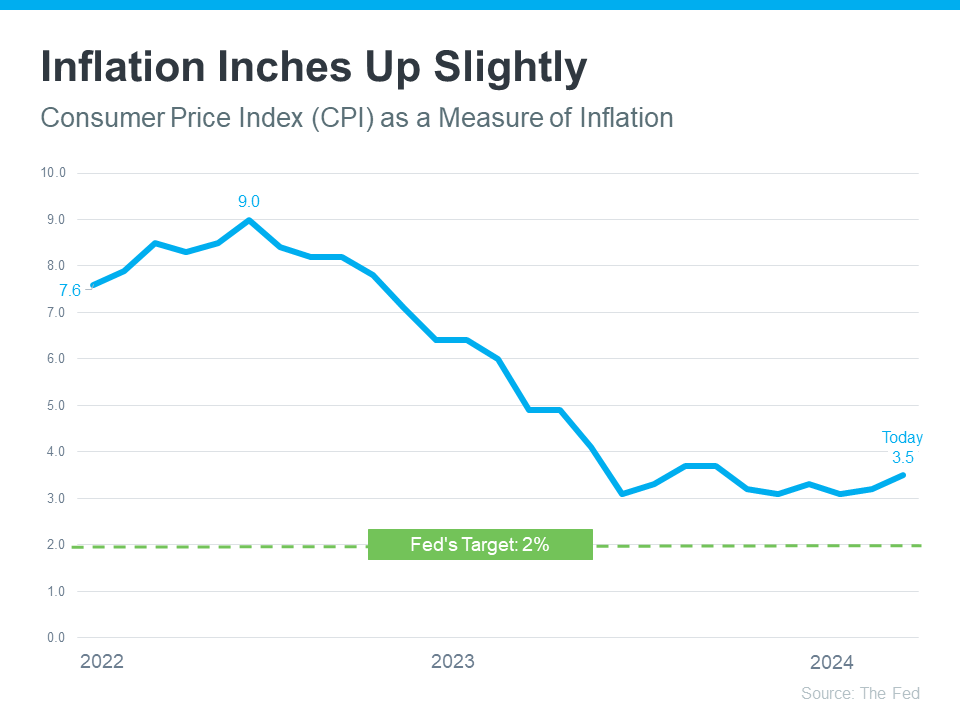

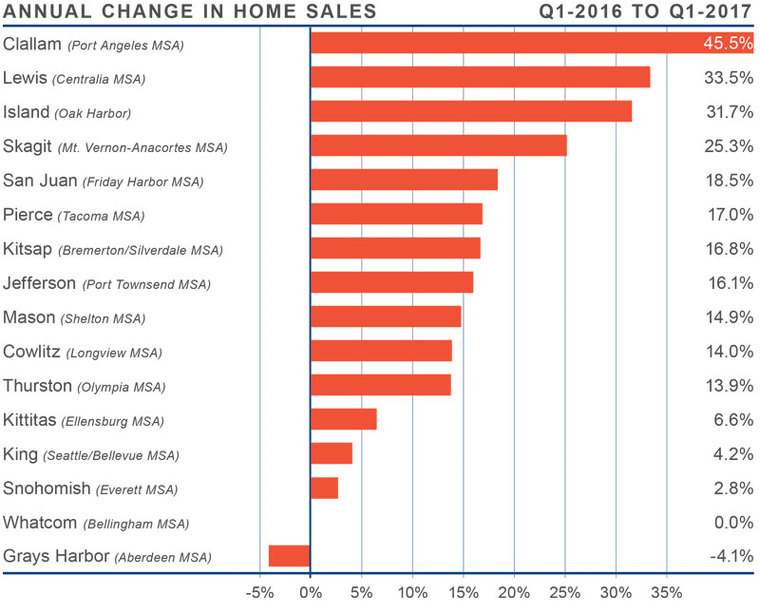

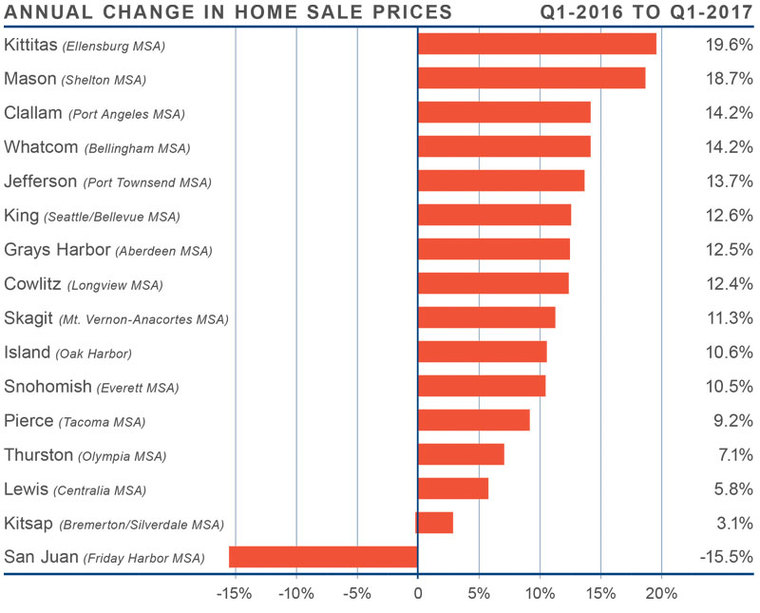

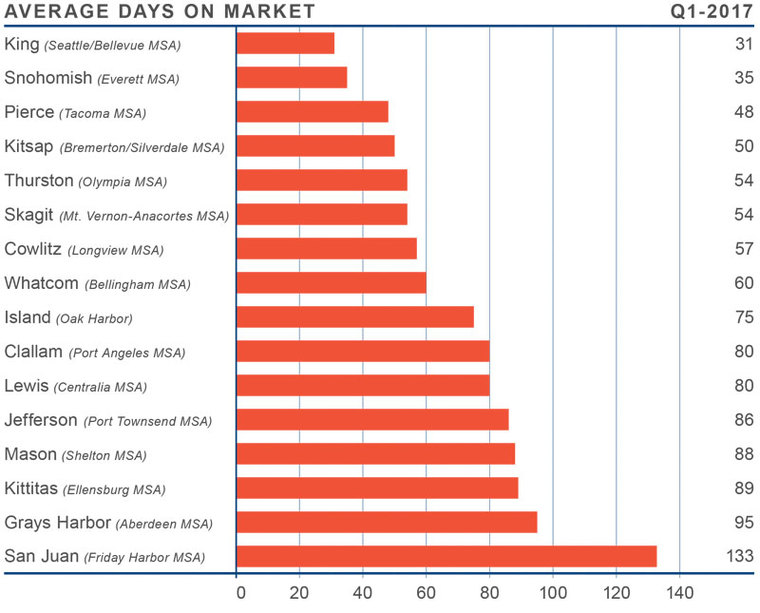

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

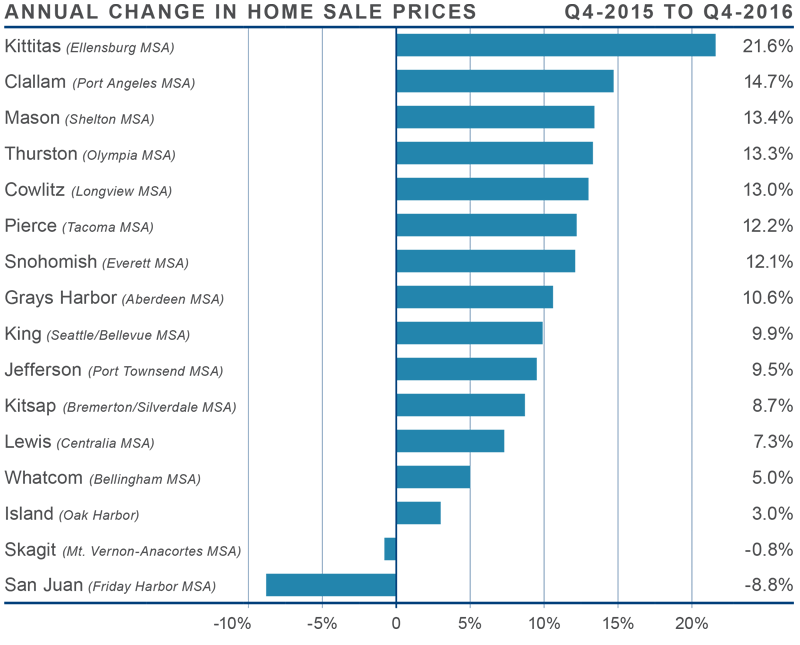

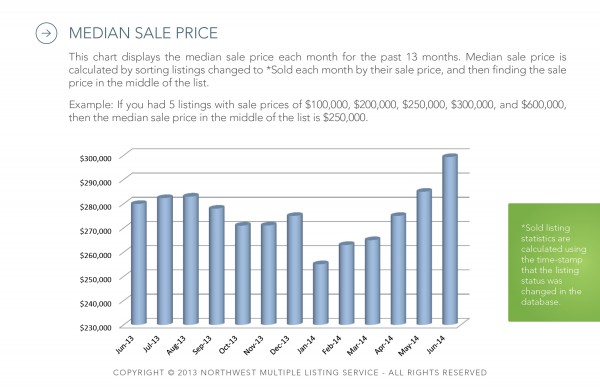

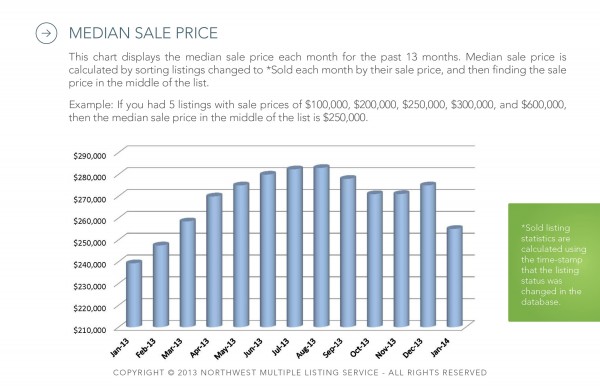

The region’s average sales price is now $409,351.

The region’s average sales price is now $409,351.

![5 Reasons to Love Using A RE Pro [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/01/30155328/5-Reasons-to-Love-STM-1046x1354.jpg)