CoreLogic recently released their 2015 2nd Quarter Equity Report which revealed that 759,000 properties had regained equity in the last quarter. That means that 91% of all mortgaged properties(approximately 45.9 million) are now in a positive equity position. Anand Nallathambi, president and CEO of CoreLogic, reported: “For much of the country, the negative equity epidemic is lifting. The biggest...

Information for Buyers

The National Association of Realtors’ most recent Existing Home Sales Report revealed that home sales were up rather dramatically over last year in five of the six price ranges they measure. Only those homes priced under $100,000 showed a decline (-7.7%). The decline in this price range points to the lower inventory of distressed properties available for sale and speaks to the strength of the...

// Website | About Tony | Client References | RE News | Search Listings | Featured Listings The Eastside Home Report October 2015 Edition Western Washington Market Report Another Client's Succes Story! September 2015 NWMLS Market Report: Housing market slowdown expected, but...

If you are debating listing your house for sale this year or even early next year, here is the #1 reason not to wait! Buyer Demand Continues to Outpace the Supply of Homes For Sale According to the National Association of REALTORS’ (NAR) Foot Traffic report, there are more buyers out in the market right now than at any other time in the past three years. The graph below shows the significant...

Some Highlights: The National Association of REALTORS® surveyed their members for their Confidence Index The REALTORS® Confidence Index is a key indicator of housing market strength based on a monthly survey sent to over 50,000 real estate practitioners. Practitioners are asked about their expectations for home sales, prices and market conditions. Homes sold in less than 60 days in...

There has been a lot of talk about how difficult it is to get a home mortgage in today’s lending environment. However, three recent reports have revealed that lending standards are beginning to ease. This is great news for both first time buyers and current homeowners looking to move or buy a second vacation/retirement home. Let’s look at the three reports: The MBA’s Mortgage Credit Availability...

According to the latest Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index homeownership is a better way to produce greater wealth, on average, than renting. The BH&J Index is a quarterly report that attempts to answer the question: Is it better to rent or buy a home in today’s housing market? The index examines that entire US housing market and then isolates 23 major markets for...

Last month, the National Association of Realtors (NAR) reported that housing inventory was down 4.7% from the same time last year and that the month’s inventory of homes for sale stood at 4.8 - far below the six months necessary for a normal housing market. Why is there such a shortage of inventory? The recently released Homeowner Sentiment Survey suggests that the American homeowner may not be...

The National Association of Realtors (NAR) recently released their July edition of the Housing Affordability Index. The index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data. NAR looks at the monthly mortgage payment (principal & interest) which is...

A recent survey by Ipsos found that the American public is still somewhat confused about what is actually necessary to qualify for a home mortgage loan in today’s housing market. The study pointed out two major misconceptions that we want to address today. 1. Down Payment The survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

According to the recently released BMO Harris Bank Home Buying Report, 52% of Americans say they are likely to buy a home in the next five years. Americans surveyed for the report said they would be willing to pay an average of $296,000 for a home and would average a 21% down payment. The report also had other interesting revelations. Those Looking to Buy 74% of those looking to buy a new home...

Some experts are advising that first time and move-up buyers wait until they save up 20% before they move forward with their decision to purchase a home. One of the main reasons they suggest waiting is that a buyer must purchase private mortgage insurance if they have less than the 20%. That increases the monthly payment the buyer will be responsible for. In a recent article, Freddie...

Digital Risk recently polled Millennials about the housing market. Among their findings was the fact that nearly two-thirds of the generation who have recently purchased a home, have done so with less than 20% down; with 36% putting down less than 5%! Here is a graph detailing the results: This means that more and more American’s between the ages of 18 and 34 stopped paying their...

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+...

We often talk about the financial reasons why buying a home makes sense. But often, the emotional reasons are the more powerful, or compelling reasons. The Joint Center for Housing Studies at Harvard University performs a study every year surveying participants for the reasons that American’s feel are most important in regards to homeownership. The top 4 reasons to own a home cited by...

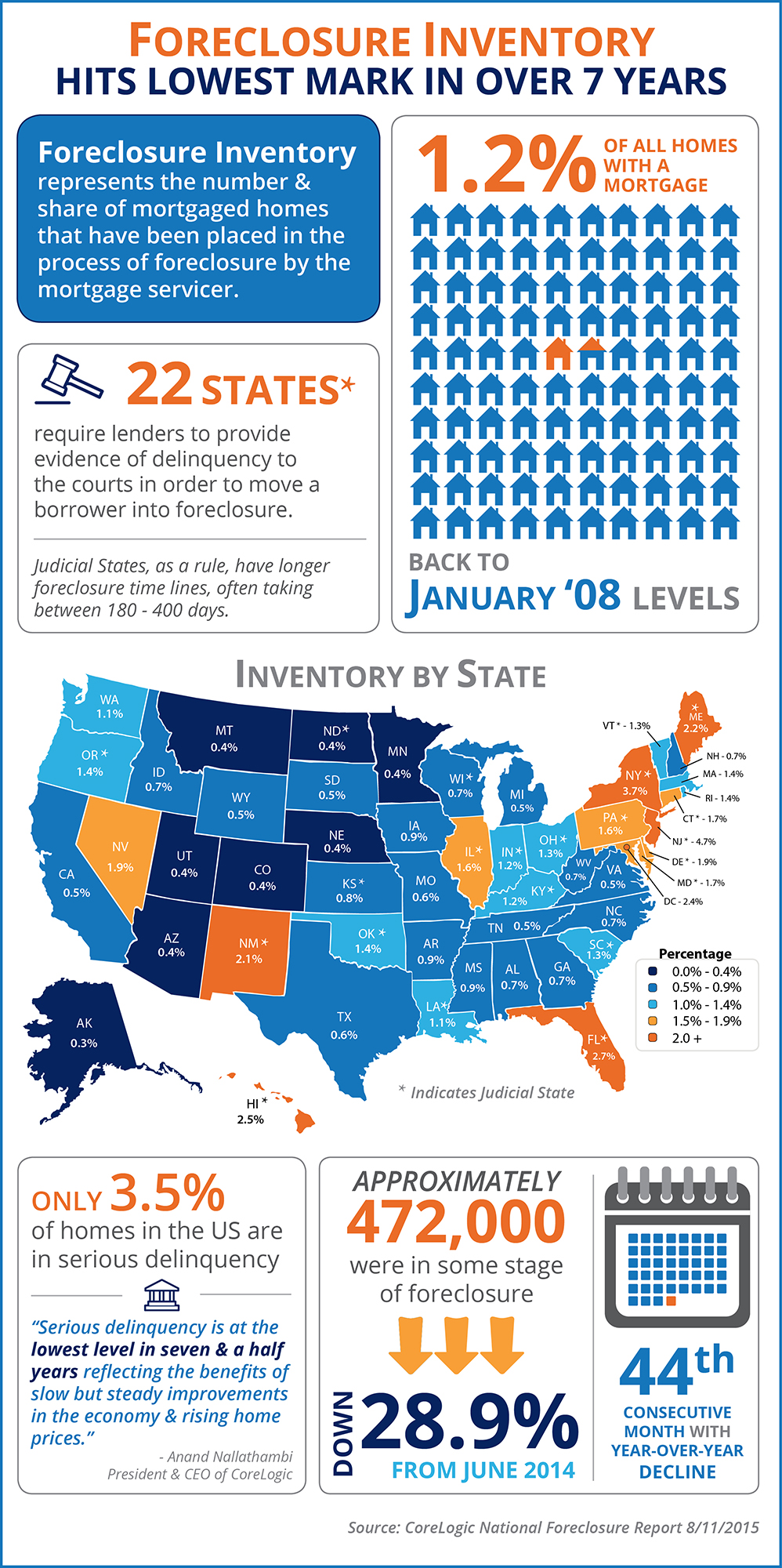

Some Highlights: The number of homes in the US in some stage of foreclosure is down 28.9% to 472,000. Only 3.5% of homes in the US are currently in serious delinquency. Foreclosure Inventory levels hit the lowest level since January 2008 at 1.2% of all homes with a...

This year, both Freddie Mac & Fannie Mae have introduced new programs that only require a 3% down payment on a mortgage in order to purchase a home. Earlier this month, the Mortgage Bankers’ Association reported that adjustable-rate mortgages (ARMs) may be making a slow comeback as the share of ARMs increased to 7.4 percent of total mortgage applications. Some see this loosening of lending...

People often ask whether or not now is a good time to buy a home. No one ever asks when a good time to rent is. However, we want to make certain that everyone understands that today is NOT a good time to rent. The Census Bureau just released their second quarter median rent numbers. Here is a graph showing rent increases from 1988 until today: At the same time, a report by Axiometrics...

Now that the housing market has stabilized, more and more homeowners are considering moving up to their dream home. With interest rates still near 4% and home values on the rise, now may be a great time to make a move. Sellers should realize that waiting while mortgage rates are increasing probably doesn’t make sense. As rates increase, the price of the house you can afford will decrease if you...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

The Joint Center for Housing Studies at Harvard University recently released their 2015 State of the Nation’s Housing report. The report concentrated on the challenges renters in this country are facing because of the diminishing supply of quality rental units and dramatically escalating rents. However, there was also information buried within the report that revealed that now is definitely the time...

There has been much talk about homeownership and whether it is a true vehicle for building wealth. A new report looks at the impact owning a home has on the financial wellbeing of people closing in on their retirement years (ages 55-64). In recently released study by the Hamilton Project, Ten Economic Facts about Financial Well-Being in Retirement, it was revealed that: 1. Middle-class households...

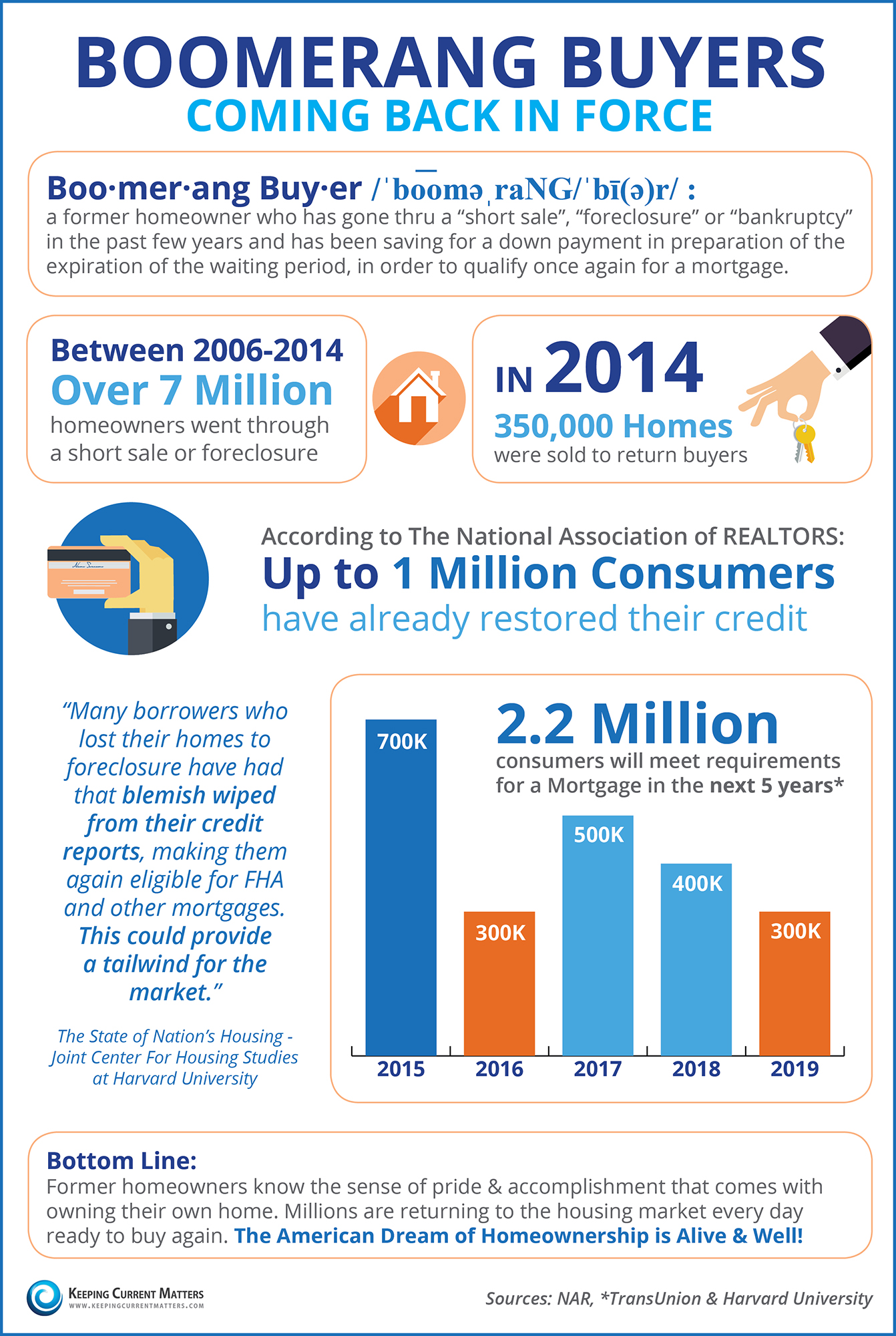

Some Highlights: What is a Boomerang Buyer? A former homeowner who has gone thru a “short sale”, “foreclosure” or “bankruptcy” in the past few years and has been saving for a down payment in preparation of the expiration of the waiting period, in order to qualify once again for a mortgage. According to NAR: Up to 1 Million consumers have already restored their credit and qualify to...

There seems to be a growing chasm between what the public believes to be needed and what is actually needed to qualify for a residential home loan. A recent survey by Ipsos reported that: Two-thirds of those surveyed believe they need a very good credit score to buy a home, with 45 percent thinking a “good credit score” is over 780. Consumers overestimate the down payment funds needed to...

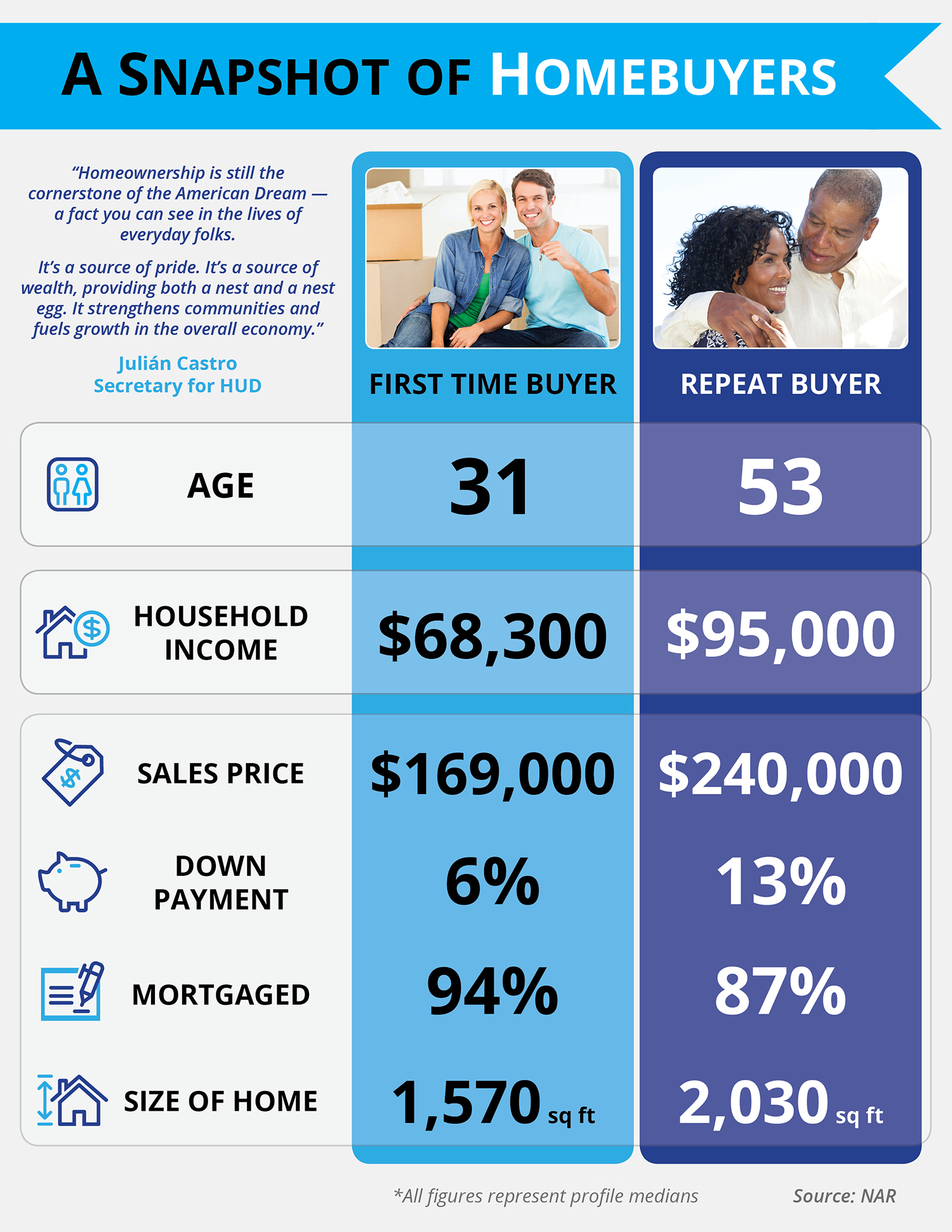

There has been much conversation regarding the lack of first time home buyers in today’s real estate market. However, three recent reports seem to suggest that they are now entering the market in increasing numbers. The most recent Existing Home Sales Report from the National Association of Realtors (NAR) reported that: “The percent share of first-time buyers rose to 32 percent in May, up from...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

KIRKLAND, Washington (July 6, 2015) - Temperatures around Western Washington were not the only thing sizzling during June. Northwest Multiple Listing Service members reported 11,453 pending sales last month, the highest volume since August 2005 when members notched 11,546 mutually accepted offers. Last month also marked the fourth consecutive month of 11,000-plus pending transactions. MLS members...

At the end of June, in every region of the country, hundreds of homeowners have a tough decision to make. The ‘listing for sale agreement’ on their house is about to expire and they now must decide to either take their house off the market (OTM), For Sale by Owner (FSBO) or list it again with the same agent or a different agent. Let’s assume you or someone you know is in this situation and...

The National Association of Realtors’ (NAR) latest Existing Home Sales Report revealed that first time homebuyers made up 32% of all sales in the month of May; marking the highest share since September 2012 and up from 27% the same time last year. NAR’s Chief Economist, Lawrence Yun, cited “strong job gains among young adults, less expensive mortgage insurance and lenders offering low down...

Last week, mortgage interest rates jumped over the 4% mark for the first time this year according to Freddie Mac’s Mortgage Market Survey. In an article in Housing Wire, a Bankrate analyst explained: “Mortgage rates rocketed higher following a stronger than expected monthly employment report. The good news on the job front further solidifies the notion that the Federal Reserve will likely begin...

Home buyers are in "full sprint" mode while sellers are stalling, according to brokers from Northwest Multiple Listing Service. As a result, MLS members are juggling severe inventory shortages and multiple offers in many Seattle neighborhoods and beyond. MLS figures for May show double-digit drops in inventory compared to a year ago and double-digit gains in both sales and prices. Commenting on the...

The inaugural Opportunity Cost Report was released recently by realtor.com. The report explained that “with interest rates and home prices expected to climb in the next year, the financial penalties of delaying or forgoing a home purchase in today's market have become very steep”. The report estimates that, based on today's dollars, the average purchaser would accumulate $217,726 in increased...

One of the biggest questions plaguing the current housing market is where mortgage interest rates will be at this time next year. Over the last two months, rates have begun to creep up (see chart). Though we don’t like to project rates moving forward, we do want you and your family to have the information you need in order to decide whether to wait before buying your first house or moving up to...

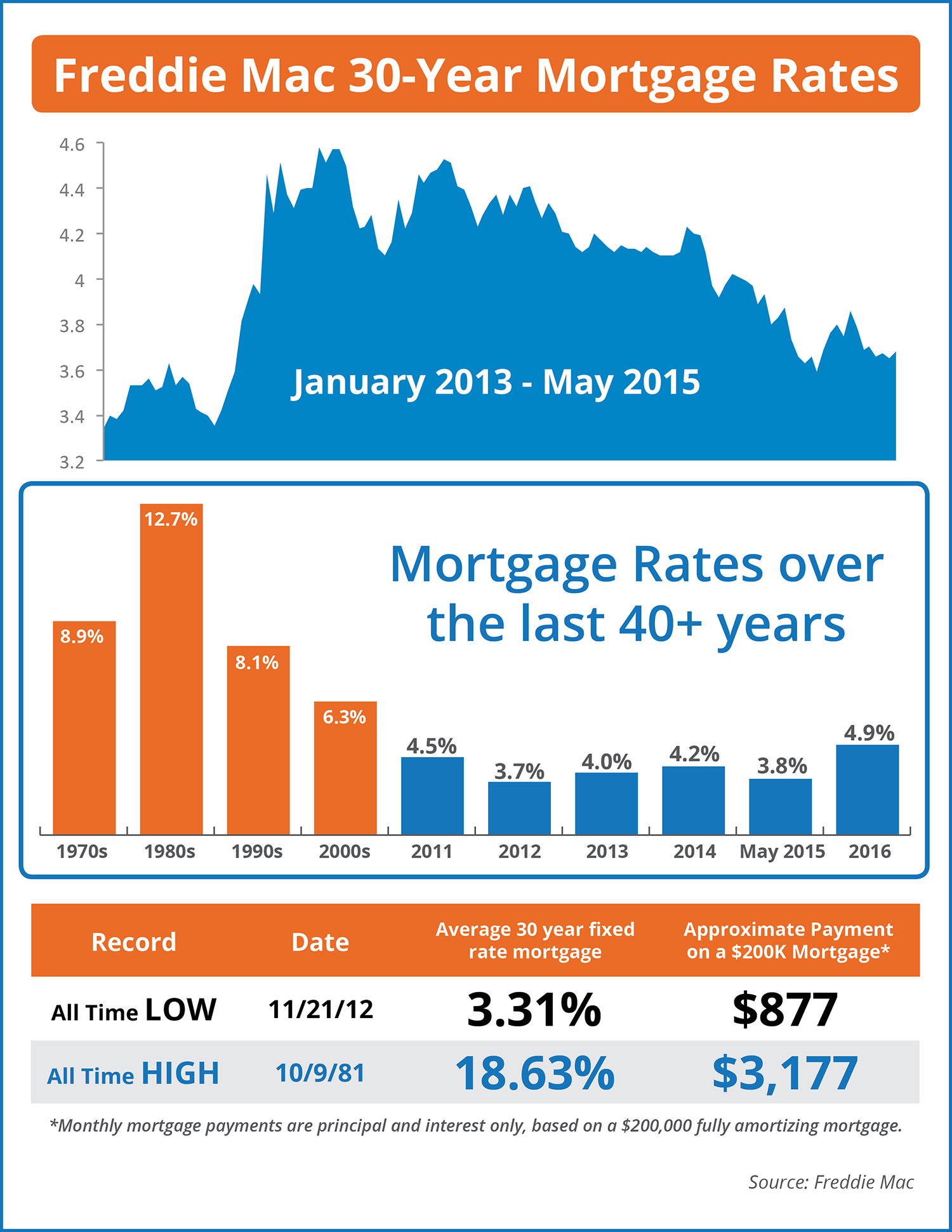

Some Highlights: 30-year mortgage rates are projected to increase by a full percentage point in 2016 Rates are still well below the past four decade averages The interest rate at which you borrow the funds to purchase your dream home makes a huge difference on your monthly...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

People often ask whether they should buy a home now or wait. Recently released data suggests that waiting may not make sense as prices seem to again be on the rise. Let’s take a look at some of the data and commentary on the subject: Ed Stansfield, chief property economist at Capital Economics: “The current tightness of supply conditions would normally be consistent with much faster price...

Modern town houses of brick and glass on urban street Each month, many people are faced with the decision of renewing their rental lease for another year or purchasing their first home. One of the questions that must be answered before they make a decision is – “Where are rents headed?” The Wall Street Journal recently wrote an article on this issue. Their conclusion: “Apartment rental...

National Homeownership Month actually started as a week-long celebration of homeownership during the Clinton administration in 1995. In 2002, President George W. Bush proclaimed June as the National Homeownership Month. Here is an excerpt from his proclamation: “Homeownership is an important part of the American Dream…A home provides shelter and a safe place where families can prosper and children...

As recently posted on the results from the latest Home Price Expectation Survey (HPES) showing where residential home prices are headed over the next five years. Today, we want to show you what the results of the report could mean to you. A good portion of every family’s wealth comes from the equity in the home they live in. As the value of their home (an asset) increases so does their equity....

The National Association of Realtors (NAR) recently released the results of their Existing Home Sales Report. Despite the fact that properties are selling faster than they have at any other time since July of 2013, existing home sales declined 3.3% from March. NAR’s Chief Economist Lawrence Yun explained the main reason for the slow: "April's setback is the result of lagging supply relative to...

A recent post by the National Association of Realtors (NAR) revealed that in the months of December 2014 through February 2015, there was an increase in the number of first-time buyers making a down payment of 6% or less as compared to last year: 2014: 61% of first time home buyers 2015: 66% of first time home buyers While the number of small down payments is lower than it was in 2009 when...

In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage throughout the 100 largest metro areas in the United States. The updated numbers actually show that the range is from an average of 16% in Honolulu (HI), all the way to 55% in Sarasota (FL), and 35% Nationwide! The other interesting findings...

Earlier this week, the National Association of Realtors (NAR) released their latest quarterly report. The report covered three important aspects of the housing market: Buyer Demand Supply of Housing Inventory Single Family Residential Prices Today, we want to break down the highlights of the report along with several quotes from Lawrence Yun, the Chief Economist at NAR. Buyer Demand Total...

We recently reported that investment purchases in 2014 fell 7.4% for the year, that combined with a diminished supply of distressed inventory allowing for big profits, has real estate investors looking for a new way to make more money in 2015. So if they don’t have new properties to buy… how would they make more money? Easy… they are going to raise your rent! A recent article from Bloomberg...

We have reported many times that the American Dream of homeownership is alive and well. The personal reasons to own differ for each buyer, with many basic similarities. Eric Belsky, the Managing Director of the Joint Center of Housing Studies at Harvard University expanded on the top 5 financial benefits of homeownership his paper - The Dream Lives On: the Future of Homeownership in America. Here...

Some Highlights: Historically the Percentage of your income needed to afford a home vs. renting was a much closer margin. Making renting make sense. Now... Renting will cost you 30.1% of your income compared to buying a median home at 15.3% of your income. Either way you're paying a mortgage... why not have it be...

Four recent news articles confirmed that most Americans still see real estate as a great long term investment. The Gallup organization polled the American people and discovered that they believe that real estate is a better long term investment than stocks/mutual funds, gold, savings or bonds: A second survey was done by Edelman Berland which showed that: At the same time, Tim Rood,...

The Census recently released their 2015 Q1 Homeownership Statistics, and many began to worry that Americans have taken a step back from the notion of homeownership. The national homeownership rate (Americans who owned vs. rented their primary residence) increased significantly during the housing boom, reaching its peak of 69.2% in 2004. The Census Bureau just reported the first quarter of 2015 ended...

Website | About Tony | Client References | Blog | Search Listings | Featured Listings The Eastside Home Report May 2015 Edition Western Washington Market Report Another Happy Client shares their Story! Pent-up demand triggering record pace of home sales around Western Washington Northwest...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

May 5th, 2015 Northwest Multiple Listing Service members notched a record high level of pending sales during April, surpassing the year-ago volume by nearly 1,800 transactions. Both closed sales and prices also surged last month as the spring market kicked into high gear. Buyer confidence and buyer ability to purchase are fueling activity, suggested Ken Anderson, the managing broker and owner of...

The first quarter of the year acted more like a spring real estate market, and it came in like a lion. Rising employment, low mortgage rates and very tight inventory created a buying frenzy. Homes sold within days of being listed — often for over asking price — frustrating buyers who faced a serious lack of homes to choose from. Further adding to the problem, many current homeowners were reluctant to...

Spring is in full force; the summer months are right around the corner. If you are debating moving up to your dream home, here are four great reasons to consider buying today instead of waiting. 1.) Buyer Demand is High & Inventory Is Low Recent numbers show that buyer demand is at the highest peak experienced in years, and inventory for sale is at a 4.6 months supply, which is still markedly...

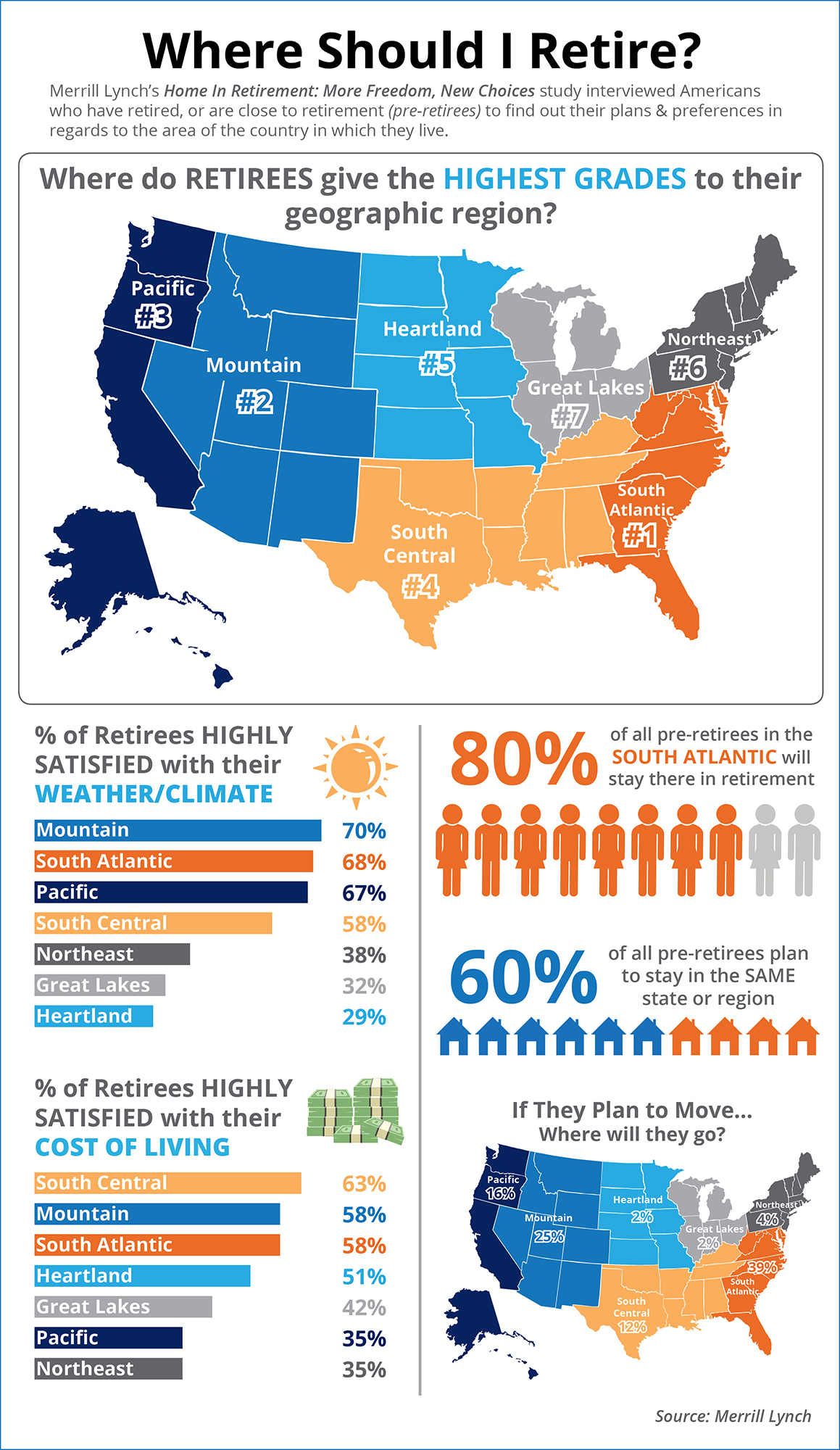

Some Highlights From The Report: •80% of all pre-retirees in the South Atlantic region plan to stay there in retirement •4 out of 10 pre-retirees plan to relocate in retirement •Retirees in the South Central Region are most satisfied with their Cost of...

If you have not bought or sold a home in a few years (or maybe decades) it is likely that there are more than a few new trends in real estate that you will encounter as you begin to interview real estate agents. One particular trend now common among many real estate brokerage firms is called the practice of “going paperless.” This can be a bit scary for some people, especially senior adults who...

Last month, we reported that billionaire John Paulson believes in the financial advantages of homeownership. He has often repeated: "I think, from an individual perspective, the best deal investment you can make is to buy a primary residence that you're the owner-occupier of.” However, he has not been the only billionaire to give such advice. As a matter of fact, that same advice has been given by...

Recently, Freddie Mac published a blog post titled Mortgage Rates: Still the Deal of the Century. They explained that, if you are planning to purchase a home, now may be the time: “If you are in the market to buy a home, today's average mortgage rates are something to celebrate compared to almost any year since 1971.” And they let their readers know that there is no guarantee that rates will...

Last week, we reported on the financial reasons purchasing a home in today’s market makes sense. The Joint Center for Housing Studies at Harvard University performs a study every year surveying participants for the reasons that American’s feel are most important in regards to homeownership. The top 4 reasons to own a home cited by respondents were not financial. 1. It means having a good place...

In a speech delivered earlier this year, Secretary for HUD Julián Castro, called 2015 “A Year of Housing Opportunity”. A recent report by The National Association of Realtors (NAR) revealed that investment home sales decreased 7.4% in 2014 to an estimated 1.02 million. What does this mean for the ‘typical’ homebuyer? Lawrence Yun, NAR’s Chief Economist gave some insight: “Despite strong...

The National Association of Realtors just released their 2015 Investment and Vacation Home Buyers Survey which revealed that vacation home sales boomed in 2014 to above their most recent peak level in 2006. NAR Chief Economist Lawrence Yun said favorable conditions are driving second-home sales: “Affluent households have greatly benefited from strong growth in the stock market in recent years,...

Everyone knows the social advantages of home ownership. However, some question the financial benefits of owning a home. Three recent studies shed some light on the issue. RealtyTrac recently released a report comparing home price appreciation to wage growth over the last two years. The study revealed that home price appreciation has outpaced wage growth in 76% of U.S. housing markets during that...

If you are debating purchasing a home right now, you are surely getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home. There are 3 questions you should ask before purchasing in today’s...

There has been a lot of discussion about how difficult it is to get a home mortgage in this market. There is no doubt that the process is not as easy as it was eight to ten years ago and that’s probably good news. However, it does appear that availability to mortgage money is increasing with each passing day. The Mortgage Bankers’ Association publishes the Mortgage Credit Availability Index...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

The most recent Pending Homes Sales Index from the National Association of Realtors revealed that homes going into contract in February increased to their highest level since June 2013. The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed,...

Website | About Tony | Client References | Blog | Search Listings | Featured Listings The Eastside Home Report April 2015 Edition Electronics Recycling and Shredding Event - April 25th, 2015 You’re invited to my FREE Annual Client Shredding & e-Waste Recycling Event Saturday, April...

Matthew Rognlie, from the Department of Economics at MIT, recently released a paper: Deciphering the Fall and Rise in the Net Capital Share. One of the major findings of the report is that homeownership is and has been for the last fifty years a major component to family wealth. An article on the study in The Economist notes one of the findings of the study: “The return on non-housing wealth, in...

KIRKLAND, Washington (April 6, 2015) - Buyer anxiety is rising as the pace of home sales is faster than brokers are able to replenish inventory, according to members of Northwest Multiple Listing Service. Figures just released for March show 11,408 pending sales during the month while only 10,505 sellers listed their homes for sale during the same period. "The frenzy market has returned and is in...

Some Important Points To Consider: The latest Freddie Mac Primary Mortgage Market Survey reports the 30-year fixed rate at 3.7%. Freddie Mac's projection for Q2 2016 is that the rate will be 4.7% (a full percentage point higher) The Home Price Expectation Survey predicts that home prices will appreciate by 4.4% during this same time The impact waiting a year to purchase your dream home can...

Whether you are a first time or a move-up buyer, there are two factors that will impact the amount of house you can afford in your price range: home prices & mortgage rates. Let’s look at what the experts are predicting over the next twelve months for these two areas: PRICES Over 100 economists, real estate experts and investment & market strategists were recently polled as a part of the...

Within the next five years, Baby Boomers are projected to have the largest household growth of any other generation during that same time period, according to the Joint Center for Housing Studies of Harvard. Let’s take a look at why… In Merrill Lynch’s latest study, “Home in Retirement: More Freedom, New Choices” they surveyed nearly 6,000 adults ages 21 and older about housing. Crossing...

Today, Freddie Mac is scheduled to start buying mortgages with down payments of only three percent – the first time down payments have been this low on Freddie Mac loans in nearly five years. The program is called Freddie Mac Home Possible AdvantageSM. In a recent Executive Perspectives, Dave Lowman EVP, Single-Family Business Freddie Mac, explained the potential impact this program will have on...

Billionaire money manager John Paulson was interviewed at the Delivering Alpha Conference presented by CNBC and Institutional Investor. During his session he boldly stated: "I still think, from an individual perspective, the best deal investment you can make is to buy a primary residence that you're the owner-occupier of.” Who is John Paulson? Paulson is the person who, back in 2005 &...

There are many benefits to homeownership, one of top ones, is being able to protect yourself from rising rents and lock in your housing cost for the life of your mortgage. The National Association of Realtors (NAR) just released their findings of a study in which they studied “income growth, housing costs and changes in the share of renter and owner-occupied households over the past five years in...

A recent Demand Institute report revealed “nearly half of all American households plan to move at some point in the future.” Seventy-five percent of those surveyed in the report cited one or more ‘location-related reasons’ for their eagerness to move. Here are the top 5 reasons: Safer Neighborhood – 30% Closer to Family – 27% Change of Climate – 26% Closer to Work –...

After the housing market bust we experienced across the country in 2008, many experts have been quick to warn that a new bubble may be forming in some areas. One particular example of this is a recent article pointing toward the California Bay Area’s price gains over the last 18 months. The quickest and easiest way to show how far we’ve come and how far we still need to go in regards to the...

There have been some who have voiced doubt as to whether or not the younger generations still consider buying a home as being part of the “American Dream”. A recent study by Merrill Lynch puts that doubt to rest. According to their research, every living generation still maintains that owning a home is in fact important. Here are the numbers: This should not surprise us as many studies...

A recent Bloomberg Business article reports that both Lowes & Home Depot experienced fourth quarter profits that beat revenue projections by the most in six quarters. So what does that mean to the housing market? Consumer Confidence Lowe’s Chief Executive Officer Robert Niblock said, “Consumers are feeling better about their jobs, their wages and certainly feeling better about the value of...

Click here to watch the video and read this months...

KIRKLAND, Washington (March 5, 2015) - Favorable weather and restored confidence are propelling home buying activity around Western Washington to the highest level in nearly a decade, according to Northwest Multiple Listing Service sources. "The pent-up demand being unleashed has rocketed pending sales back to the levels of our record year in 2006," said Ken Anderson, president/designated broker at...

For the last several years, home sellers had to compete with huge inventories of distressed properties (foreclosures and short sales). The great news is that the supply of these properties is falling like a rock in the vast majority of housing markets (only 11% of homes sold in January). Many homeowners are now thinking of selling as the impact of this substantially discounted competition has...

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to look at where rates are headed when deciding to buy now or wait until next year. Below is a chart created using Freddie Mac’s February 2015 U.S. Economic & Housing Marketing Outlook. As you can see interest rates are...

In a recent post, we explained that the supply of homes for sale in December was at its lowest level in over a year. The January National Housing Trend Report from realtor.com now reveals that inventory in January has decreased another 6.7% month over month and 8.7% year over year. This is occurring at the same time that buyer activity (demand) remains strong. This prompted realtor.com’s Chief...

If you are planning on becoming a homeowner, or moving up to the home of your dreams in 2015, here are four great reasons to consider buying a home now, instead of waiting until spring. 1. Prices Will Continue to Rise The Home Price Expectation Survey polls a distinguished panel of over 100 economists, investment strategists, and housing market analysts. Their most recent report projects appreciation...

We all learned in school that when selling anything, you will get the most money if the demand for that item is high and the inventory of that item is low. It is the well-known Theory of Supply & Demand. If you are thinking of selling your home, here are two graphs that strongly suggest that the time is now. Here is why… DEMAND According to research at the National Association of Realtors...

Many believed that when the housing market crashed, so too would the desire of American’s to own a home again. Many reports have shown that, especially among younger generations, the American Dream of homeownership is still very much alive. Julián Castro, Secretary for HUD, recently summed up what it means to own a home in a speech at the National Press Club. "Homeownership is still the...

According to the latest CoreLogic National Foreclosure Report, “approximately 552,000 homes in the US were in some state of foreclosure as of December 2014”. This figure is down 34.3% from the 840,000 homes in December of 2013. December marked the 38th consecutive month in which there were year-over-year declines. Anand Nallathambl, the President and CEO of CoreLogic, is hopeful for the...

Two recently released reports reveal that the American public is starting to feel much better about the U.S. economy. The University of Michigan’s Surveys of Consumers showed that: “Consumer optimism reached the highest level in the past decade in the January 2015 survey…Consumers judged prospects for the national economy as the best in a decade, with half of all consumers expecting the economic...

Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. Every three years the Federal Reserve conducts a Survey of Consumer Finances in which they collect data across all economic and social groups. Some of the findings...

The housing market has taken a great turn toward recovery over the last few years. The opinions of the American public toward real estate took longer to recover, until recently. For the first time since 2006, Americans have an overall positive view of real estate, giving the industry a 12% positive ranking in a Gallup poll. Americans were asked to rate 24 different business sectors and...

As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned only about price but also about the ‘long term cost’ of the home. Let us explain. There are many factors that influence the ‘cost’ of a home. Two of the major ones are the home’s appreciation over...

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet, maybe it's not priced properly. After all 13,808 houses sold yesterday, 13,808 will sell today and 13,808 will sell tomorrow. 13,808! That is the average number of homes that sell each and...

The headlines agree mortgage interest rates have dropped substantially below initial projections. Many who are considering purchasing a home, or moving up to their dream home, might think that they should wait to buy, because rates may continue to fall. A recent article on the Economists’ Outlook blog by the National Association of REALTORS® (NAR) provides insight into one major factor in the...

If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home. There are three questions you should ask before purchasing in...

Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. In most areas, prices are still below those of a few years ago. Also, interest rates are still near 4%. However, sellers should realize that waiting to make the move while mortgage rates are projected to increase probably doesn’t make sense. As rates increase,...

Every home must be sold TWICE! Once to the buyer, and once to the bank appraiser if a mortgage is involved. The second sale may have just become more difficult. A new program announced by Fannie Mae may slow down the home-sale closing process by causing more disputes over prices between sellers and buyers. In a recent Washington Post article they explained the basics of the program: “Starting...

There are many people out there who debated purchasing a home over the course of the last year, but ultimately did not. Whatever their reasons were for delaying, let’s look at whether the decision to wait to buy made sense. What happened in 2014? The 30 year fixed rate on January 2, 2014 was 4.53% as reported by Freddie Mac. Looking at the chart below, your monthly mortgage payment with principal...

A recently released study revealed that a whopping $441 Billion was spent on rents in the U.S. in 2014. This represents an increase of over $20 Billion from the year before. As shown on the chart below, rents have increased consistently over the last 20+ years. However, the recent increases have been astounding. Why such a jump? Many Millennials have postponed the purchase of their first home...

KIRKLAND, Washington (Jan. 6, 2015) - Real estate brokers around Western Washington reported a strong finish to 2014. December's sales outpaced the same month a year ago by double digits, according to new figures from Northwest Multiple Listing Service. "December was one of the best Decembers on record," observed J. Lennox Scott, chairman and CEO of John L. Scott Real Estate upon reviewing the...

The holiday season is behind us, time to focus on what exciting new experiences 2015 can bring! If you are planning on becoming a homeowner, or moving up to the home of your dreams in 2015, here are four great reasons to consider buying a home now, instead of waiting until spring. 1. Prices Will Continue to Rise The Home Price Expectation Survey polls a distinguished panel of over 100 economists,...

We finished 2014 with the 30 year fixed mortgage rate at 3.87% as per Freddie Mac. This is very close to the historic lows in the spring of 2013. However, the Mortgage Bankers Association projects mortgage rates to be about 5% by the end of 2015. The website Investopedia agrees and gives some perspective on the 5% rate: “Barring another financial and housing market implosion, and if the economy...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

According to Freddie Mac’s latest U.S. Economic & Housing Market Outlook, U.S. home sales in 2015 will show increase to the numbers associated with a normal real estate market. Here is their projection: “We are projecting a 4 percent rise in sales to 5.6 million, which would mark the highest level of annual sales since 2007.” And their optimism was seconded by both the National Association...

Last week, we reported on the financial reasons that the New York Times felt that homeownership was important. The Joint Center for Housing Studies at Harvard University performs a study every year surveying participants for the reasons that American’s feel are most important in regards to homeownership. There’s No Place Like Home The top 4 reasons to own a home cited by respondents were not...

The New York Times recently published an editorial entitled, “Homeownership and Wealth Creation.” The housing market has made a strong recovery, not only in sales and prices, but also in the confidence of consumers and experts as an investment. The article explains: “Homeownership long has been central to Americans’ ability to amass wealth; even with the substantial decline in wealth after...

Below are the headlines from three separate news releases issued over a one month period: 11/3/2014 - Millions of Potential New Households Waiting Out the Recovery 11/11/2014 - Experts: First-Time Homebuyers' Weak Finances Holding Back Housing Market And then, the contrarian view: 12/2/2014 - In 2015, Millennials Will Be Biggest Home Buying Group It sure seems that the group that...

Yesterday, HousingWire reported that both Fannie Mae and Freddie Mac formally announced their 3% down options on home purchases. Fannie Mae’s plan will be effective December 13, 2014 while the Freddie Mac plan will be available March 23, 2015. The HW article quotes FHFA Director Mel Watt: “The new lending guidelines released today by Fannie Mae and Freddie Mac will enable creditworthy...

The Mortgage Bankers Association, the National Association of Realtors, Fannie Mae and Freddie Mac are each projecting mortgage interest rates to increase substantially over the next twelve months. What will that mean to the housing market in 2015? Last week, we posted a graph showing that home prices appreciated each of the last four times mortgage interest rates dramatically increased. Today,...

CNBC’s Diana Olick recently reported that rents in the residential housing sector continued to rise in 2014. She interviewed Jed Kolko, Chief Economist at Trulia, who revealed: "Rents are rising because of strong demand that supply hasn't kept up with. Nearly all the new households are renters, and young people moving out of their parents' homes will keep fueling rental demand." Where are rents...

KIRKLAND, Washington (Dec. 4, 2014) - Buyer interest remains high and many good values exist for those whose holiday wish list includes a new home, according to brokers with Northwest Multiple Listing Service. A new report from the MLS summarizing November activity shows year-over-year gains in pending sales, closed sales and median prices. The report encompasses 21 counties, mostly in Western...

As we finish 2014, it appears the real estate market is once again on solid footing and ready to advance forward over the next few years. The strength of the market can be viewed using two metrics: projected home values and projected house sales. We recently reported that the Home Price Expectation Survey revealed future home values will continue to appreciate nicely. Today we want to look at...

In a recent video update on the housing market, Frank Nothaft, Freddie Mac’s chief economist, stated that with both mortgage interest rates and home prices projected to increase in 2015 buying now makes sense. “If you are planning to buy a home in the next year, it’s better to do it sooner rather than later.” Here are the latest mortgage interest rate projections from four major housing...

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+...

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership - The Dream Lives On: the Future of Homeownership in America. In his paper, Belsky reveals five financial reasons people should consider buying a...

Whether you are buying or selling a home, it can be quite an adventurous journey. You need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO. The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but have rather been...

It's that time of year, the seasons are changing and with them bring thoughts of the upcoming holidays, family get togethers, and planning for a new year. Those who are on the fence about whether now is the right time to buy don't have to look much farther to find four great reasons to consider buying a home now, instead of waiting. 1. Prices Will Continue to Rise The Home Price Expectation Survey...

In Trulia’s latest Rent vs. Buy Report, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage throughout the 100 largest metro areas in the United States. The updated numbers actually show that the range is from an average of 17% in Honolulu, all the way to 63% in Detroit, and 38% Nationwide! This is up from an average of only 5% cheaper in...

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either your mortgage or your landlord’s. As a paper from the Joint Center for Housing Studies at Harvard University explains: “Households must consume...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

KIRKLAND, Washington (Nov. 5, 2014) - Home buyers are back, and they're savvy and selective, according to officials who commented on the latest statistics from Northwest Multiple Listing Service. For sellers, that means pricing a home correctly at the start is vital, said industry veteran Kathy Estey, a member of the MLS board of directors. The new report summarizing October activity shows...

A recent study by the Joint Center for Housing Studies at Harvard University revealed when renters were asked why they do no plan to own in the future, financial constraints were a more common response than the perceived lifestyle benefits they may receive from renting. Today, we want to go over those financial challenges and see if we can put some fears to rest and also clear up some misconceptions....

There is a common misconception that many buyers have regarding the down payment necessary to purchase a home. Multiple studies reveal that 40-50% of Americans believe you need between 15-20% of a down payment to be eligible to purchase a home. This misconception came about as the government just last year debated new guidelines for residential mortgages because of the housing collapse in 2007....

The Gallup organization conducts an annual report entitled the Economy and Personal Finances Poll, which asks Americans to choose the best option for long-term investment. It was no surprise that real estate returned to the top position over other investment categories (gold, stocks/mutual funds, savings accounts/CDs and bonds). Back in 2011, gold was the most popular long-term investment among...

If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home. There are three questions you should ask before purchasing in...

Billionaire money manager John Paulson was interview at the Delivering Alpha Conference presented by CNBC and Institutional Investor. During his session he boldly stated: "I still think, from an individual perspective, the best deal investment you can make is to buy a primary residence that you're the owner-occupier of.” Who is John Paulson? Paulson is the person who, back in 2005 & 2006, made a...

A recent study has concluded that 39% of buyers prefer to rent out their last residence rather than sell it when purchasing their next home. The study cites that many homeowners were able to refinance and “locked in a very low mortgage rate in recent years. That low rate, combined with a strong rental market, means they can charge more in rent than they pay in mortgage each month... so they are...

In real estate there is a difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned about price but instead about the ‘long term cost’ of the home. Let us explain. Recently, we reported that a nationwide panel of over one...

Discover Home Loans conducted an interesting survey that revealed how prepared homebuyers are for the actual mortgage process. The survey reported that 94% of prospective buyers believe they are making a good investment decision if they buy a home. The survey also explained that 66% of buyers reach out to real estate agents to help determine whether buying a certain home would be a good...

KIRKLAND, Washington (Oct. 6, 2014) – Pending sales of homes around Western Washington surged more than 13 percent in September compared to a year ago, and listing activity picked up slightly, fueling both broker optimism and words of advice for sellers. Along with increases in the number of mutually accepted offers, the latest report from Northwest Multiple Listing Service shows year-over-year...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

A recent survey by Zelman & Associates revealed that 38% of those between the ages of 25-29 years old and 42% of those between the ages of 30-34 years old believe that a minimum of 15% is required as a down payment to purchase a home. A recent questionnaire administered by Freddie Mac showed that over 50% of all respondents thought 20% was required as a down payment. In actually, a purchaser may...

Many clients have asked where interest rates are headed over the next several months. While no one has a crystal ball, we did want to share what some experts are saying on the subject. HSH.com “For now, and likely through the summer, we may see data-driven bumps and dips in rates. Although we managed a slight dip presently, a bump is in order before long.” Freddie Mac “In the next few...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

KIRKLAND, Wash. (April 3, 2014) – Northwest Multiple Listing Service brokers reported rising prices on fewer sales during March compared to a year ago, citing inventory shortages as the main reason. Members of the MLS reported 9,183 pending sales (mutually accepted offers) during the month, about 300 fewer than the same period a year ago for a 3.2 percent drop. Compared to February, pending sales...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

The housing market has turned a corner. Two years of solid appreciation in the Seattle area shows that to be true. In addition, the Federal Government is easing their support for the bond market, so the ability to get a loan at a discounted rate is coming to an end. Here is the change seen on the Eastside from 2012 to 2013: What will waiting cost you in 2014? If we take a conservative look at value...

Yes, in fact it is one of the best investments you can make! The graphic above is based upon national numbers, here is what King County looks like: Residential Median Price in 2000 = $250,000 Residential Median Price in 2013 = $415,000 Total Increase = 66% As much as my investment adviser would hate for me to tell you this, the Seattle area's real estate market remains one of the best...

Now that the recession has ended, the divorce rate is back on the rise. The number of Americans getting divorces rose for the third year in a row to about 2.4 million in 2012, according to census data. The divorce rate had plunged to a 40-year low in 2009. "Whatever the social and emotional impact, the broad economic effects of the increase are clear: It is contributing to the formation of new...

DAILY REAL ESTATE NEWS | TUESDAY, FEBRUARY 25, 2014 Now that the worst of the foreclosure crisis is in the rearview mirror, former home owners who lost their homes to a short sale or foreclosure are re-entering the housing market. They've spent the last few years rebuilding their credit — and they're ready to buy again. "We're about three years past the peak of the foreclosures, and that's...

Investors Target 'Hipster' ZIPs for Flipping DAILY REAL ESTATE NEWS | WEDNESDAY, FEBRUARY 19, 2014 Hipsters usually refers to a subculture of 20-something or 30-something men and women who follow the latest lifestyle trends and fashion. Many hipsters have delayed forming their own households and are living with their parents longer to get more control over their finances and find steadier...

DAILY REAL ESTATE NEWS | THURSDAY, FEBRUARY 13, 2014 Mortgage delinquencies nationwide have plummeted to their lowest level in more than five years, as more home owners are coming out of the red on their payments, according to credit reporting agency TransUnion. The number of borrowers who are at least two months behind on their mortgage payments dropped to 3.85 percent in the fourth quarter of...

DAILY REAL ESTATE NEWS | WEDNESDAY, FEBRUARY 12, 2014 Strong year-over-year price gains are starting to take a bite into housing affordability, particularly in the West, according to the National Association of REALTORS®’ latest quarterly report. The median single-family home price rose in 73 percent of the markets, or 119 out of 164 metro areas, in the fourth quarter of 2013, with 26...

DAILY REAL ESTATE NEWS | TUESDAY, FEBRUARY 11, 2014 The spring selling rush may already be under way, as some home owners are already throwing their properties on the market to take advantage of rebounding home prices and improved equity. Paul Reid, a real estate agent in Temecula, Calif., says some sellers are listing properties earlier than usual in anticipation of the spring...

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

KIRKLAND, Wash. (Feb. 5, 2014) – Home sales during January may not have been as super as the Seahawks’ performances, but brokers cite several reasons for optimism during 2014. “We are finally going to be looking at the ‘housing crisis’ in the rear view mirror,” said Mike Gain, CEO and president of Berkshire Hathaway HomeServices Northwest Real Estate. “In 2014 we are definitely in full...

Advice site Lifehacker.com recently reminded its readers to protect against four different kinds of infestations: spiders; mice, rats, and other rodents; attic critters such as squirrels and raccoons; and bugs that nestle in firewood. A partial solution shared by the first three problems is making sure that all points of entry are sealed, from tiny cracks to holes in the roof. Once that's accomplished,...

If You Want to Flip, Do It Now DAILY REAL ESTATE NEWS | MONDAY, FEBRUARY 03, 2014 In 2013, home flips snagged sellers a tidy profit. But the trend may not continue. RealtyTrac's Home Flipping Report for the fourth quarter of 2013 showed single-family home flips were up 16 percent from 2012 and up 114 percent from 2011. The average gross profit for a home flip—defined as a home being...

Homebuilder Says It's Upbeat Enough to Raise Prices Again DAILY REAL ESTATE NEWS | WEDNESDAY, JANUARY 29, 2014 D.R. Horton, the largest U.S. home builder by homes sold, announced that strong sales will allow the company to raise prices for an early start of the spring home-selling season. The homebuilder announced a 4 percent increase in sales contracts in the first fiscal quarter ending Dec....

NWMLS April 5th, 2012 “Buyer Ready” Home Shoppers Have Edge as Brokers Report Rise in Multiple Offers KIRKLAND, Wash. (April 5, 2012) – The housing market in the Puget Sound region is pointing toward a sustainable recovery, according to several brokers who commented on the March activity report from Northwest Multiple Listing Service. MLS Members reported 9,126 pending sales during March, a...

From the Northwest Multiple Listing Service: FOR IMMEDIATE RELEASE: March 5, 2012 Washington homebuyers realizing "market may have reached bottom of cycle" KIRKLAND, Wash. (March 5, 2012) – With spring on the horizon and consumer confidence on the rise, members of Northwest Multiple Listing Service are reporting positive gains in activity. Pending sales for February increased more than 27...

Inventory is way down from our peak levels! In 2008 there were nearly 16,000 homes for sale in King County, now we have less than half that! Inventory is absorbing at levels we have not seen since the market correction began! Absorption levels in mid-30’s would typically mean the median price is on the rise. So what does this mean to you and your...

Repost of a Press Release from http://www.waschoolexcellence.org/ Full text of the Washington State Supreme Court Decision on Jan 5th 2012 can be found here: Education in the New: Washington Supreme Court Decision In a clear win for children, the Washington State Supreme Court ruled unanimously today that the state was violating its constitutional paramount duty to amply fund K-12 education. This is a...

Better times are ahead for the real estate market in the new year, according to several forecasts and recent surveys. Fiserv, a financial information services firm, predicts that 95 percent of the 384 metro areas it tracks will see prices rise in 2012. Many surveys and economists are forecasting a very modest increase for the housing market in the new year, but after several years of dropping prices...

The Seattle Times confirms what I see too.... It is an incredible opportunity to buy a home today! "Thanks to declining prices and record-low interest rates, houses in King County are more affordable now than they've been in at least 17 years, a new score card says." For their complete story, click here. Tony Meier Making Real Estate Easy, Fun & Profitable! Serving Buyers, Sellers & Their...

Nationally, median list prices have risen 1.60 percent to $190,000, based on year-over-year data from September. However, some cities haven’t fared so well. California continues to have the most cities seeing some of the largest drops in median list prices the past year. Of the cities that have seen the largest drops in list prices year-over-year from September 2011, California cities make up half of...

My associates over at CW Title have prepared this great graphic to show the life of an Escrow. Click on the image for a larger version. Tony Meier Making Real Estate Easy, Fun & Profitable! Serving Buyers, Sellers & Their Referrals Since 1989 Windermere Real Estate/NE EastsideHomes.com – Seattle’s Eastside Real Estate...

Sales of existing-home sales rose in March, continuing an uneven recovery that began after sales bottomed last July, according to the NATIONAL ASSOCIATION OF REALTORS®. Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 3.7 percent to a seasonally adjusted annual rate of 5.10 million in March from an upwardly revised 4.92...

Gov. Chris Gregoire signed a bill Thursday that makes Washington the third state to adopt a foreclosure-mediation program, after Nevada and Maryland. By Sanjay Bhatt Seattle Times staff reporter The bill, the "Foreclosure Fairness Act," gives distressed homeowners working with housing counselors or attorneys the right to in-person mediation with the bank or company servicing their mortgage. Washington,...

Housing Shortage on the Horizon? Mike Castleman, founder and CEO of Metrostudy, which tracks real-time data of the country’s inventory of new homes, says a housing shortage is looming that will soon will create a huge surge in demand for new homes. As such, now is the time to buy, he says. In the 41 cities Metrostudy covers, 78,000 houses are either vacant and for sale, or under construction — that...

Generation X—young families and adults ages 31 to 45—are likely to lead the home-buying recovery as it gets underway, according to real estate experts who spoke at an educational webinar produced by the National Association of Home Builders (NAHB) in partnership with Builder magazine. These potential home buyers are most likely to think it’s a good time to get off the fence—and have strong...

Australian builder plans 500 houses in Seattle market One of Australia's largest homebuilders is entering the U.S. market with a bet on King, Snohomish and Pierce counties. By Eric Pryne Seattle Times business reporter One of Australia's largest homebuilders is jumping into the Seattle market. Henley Properties said Monday it plans to build 500 houses in King, Snohomish and...

Buffett Says Buying His Home for $31,500 Was Third-Best Investment He Made By Kathleen M. Howley - Feb 28, 2011 Billionaire Warren Buffett said buying a home was the third-best investment he ever made, after the rings he bought for his first wife, Susan Thompson, and, after her death, his second wife, Astrid Menks. “For the $31,500 I paid for our house, my family and I gained 52 years of terrific...

Generation X — adults ages 31 to 45 — are expected to lead the recovery in the housing market, according to real estate experts in a recent webinar produced by the National Association of Home Builders. During the event, speakers highlighted results of a survey of 10,000 buyers in 27 metro areas. While Generation X isn’t the largest population group — making up 32 percent of the population...

If you answered... not very, then you are like most people. The recent incidents in Japan heighten the awareness that we should be prepared for whatever mother nature or mankind can through at us! With this in mind... I have gathered a copy of the Washington State Emergency Resource Guide for you to download at the link below: Washington State Emergency Resource Guide I hope you will take the time to...

Tax Time Less Taxing for Home Owners With a little more than one month before income taxes are due, many of the nation’s 75 million home owners may be appreciating the value of home ownership just a bit more as they take advantage of the tax benefits of owning a home. “Owning a home offers myriad benefits throughout the year, but some of the financial advantages of home ownership are most apparent at...

h2>Become a moisture detective to keep your investment in good repair and get rid of household smells. It’s time to see what winter’s wind, rain and snow have done to your home and make fixes quickly to head off water-related damage. First, head outside. Outside Spiff up the front entry. One way to stay on top of your home’s maintenance and protect your investment is to look at it as...

The number of foreclosure notices filed in February declined 14 percent compared with last month, and foreclosure notices dropped 27 percent compared to last year at this time. That marks the largest year-over-year decline that RealtyTrac, a foreclosure tracking site, has ever recorded. The number of U.S. homes in some stage of foreclosure fell drastically last month, reaching a 36-month low, RealtyTrac...

Kiplingers 10 Best Cities for the Next Decade They're prosperous, innovative, and they'll generate plenty of jobs, too.By the Editors of Kiplinger's Personal Finance Magazine From Kiplinger's Personal Finance magazine, July 2010 We live in challenging times. Unemployment remains high, and the U.S. lead in technology and science is slipping as many foreign countries gain ground. But some U.S. cities,...

Housing markets: Best recovery bets 6 of 10 Seattle Median home price: $375,000 Drop since market peak: 24.4% Forecast gain by 9/2012: 3.7% Seattle is a good mix of new and old economies, with Microsoft, Amazon and Boeing offering good, well-paying jobs. And that has been key to getting the city's economy off life support, with the unemployment rate dropping below 9% in...

Washington, DC, January 20, 2011 Existing-home sales rose sharply in December, when sales increased for the fifth time in the past six months, according to the National Association of REALTORS®. Existing-home sales1, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 12.3 percent to a seasonally adjusted annual rate of 5.28 million in December from an...

Redmond Listing - 3670 sf two story home in Mount Clare Estates on English Hill

12904 176th Pl NE, Redmond WA 98052 - $449,900 Completely remodeled home in Olde Morrison on English Hill. The well laid out floorplan boasts 1930 s.f. and features 3 bedrooms, 2.5 baths on a private lot! Many recent updates include - remodeled kitchen and baths, new carpets, refinished hardwood floors, new molding and doors! Sunken formal living room with bay windows. Formal dining room...

The King County Real Estate Market Takes a Breather as Tax Credit Expires... The fevered pace that led up to the tax credit deadline appears to have slowed some. Time will tell if this a brief pause or something more significant. Keep watch on my blog for more details . BTW... I personally had 3 sales during the last 7 days as represented on the image below, so it was not slow for me. Two were before...

Another tremendous week in pending sales! · 3rd best week for King County since July 18, 2007 - Year to date sales are up 64% · 5th best week for Eastside(areas 500-600) since July 18, 2007 - Year to date sales are up 88% Posted By:Tony MeierEastside & Seattle RealtorEastsideHomesBlog.comEastsideHomes.comSeattle's Eastside Real Estate...

13724 175th Ct NE, English Hill, Redmond Nestled in a quiet cul-de-sac in Amberley on English Hill, sits this charming Burnstead built, two story home. The gracious floorplan boasts 1990 s.f. and features 3 bedrooms, 2.25 baths and wood windows on a very private 7,316 s.f. lot! Many recent updates include - high quality roof, new carpets on the main floor, new slab granite counters in the...

Buyers in King County continue to grab up homes before the tax credit expires. With 2 weeks left to secure a home and the credit, there isn't much time left! If I can help you take advantage of the credit, give me a call at 425-466-1000. Posted By: Tony Meier Eastside & Seattle Realtor EastsideHomesBlog.com EastsideHomes.com Seattle's Eastside Real Estate...

Interest rates are likely to remain low into 2011, Federal Reserve policymakers hinted this week in at least two presentations. These indications came one week after the Fed shut down its program to buy mortgage-backed securities, which had kept rates at or near record lows in recent months. In a speech Thursday, Fed Governor Daniel Tarullo said, "The relatively modest pace of recovery, the continued...

Six consecutive weeks of top ten sales! Posted By:Tony MeierEastside & Seattle RealtorEastsideHomesBlog.comEastsideHomes.comSeattle's Eastside Real Estate...

With the deadline for the Homebuyer’s tax credit fast approaching, some potential homebuyers have questions regarding the tax credit and how it works. Here are some of the most frequently asked questions 1 How is the tax credit claimed?The tax credit is claimed as part of the homeowner’s Federal income tax return. This is done on IRSForm 5405 with a copy of the Settlement Statement for the home...

The market continues to exhibit strength with 5 consecutve weeks of top 10 sales! Posted By:Tony MeierEastside & Seattle RealtorEastsideHomesBlog.comEastsideHomes.comSeattle's Eastside Real Estate...

Four consecutive week's of top 10 sales activity! Posted By:Tony MeierEastside & Seattle RealtorEastsideHomesBlog.comEastsideHomes.comSeattle's Eastside Real Estate...

Recently I received this testimonial from clients who purchased in Sammamish "My wife and I recently hired Tony to help us buy a house to start the next phase of our lives. He was fantastic, and a pleasure to work with. He handled our pickiness, had tons of knowledge about arcane home stuff that was incredibly useful in picking the right house, and did immense amounts of work while we...

Sales continue their strong pace! · Second best week in King County since 07-18-07. Year to date sales up 64% · Second best week on the Eastside since 07-18-07 . Year to date up 98%!! Posted By:Tony MeierEastside & Seattle RealtorEastsideHomesBlog.comEastsideHomes.comSeattle's Eastside Real Estate...

The decline in home sales in February was a disappointment to the housing industry, but Fannie Mae’s analysts say it is temporary and a sustainable turnaround is likely by the end of the year.Fannie Mae Chief Economist Doug Duncan points to evidence that a recovery is on its way, including an increase in consumer spending, an improving service sector, and the likelihood that employers will begin hiring...

The Federal Reserve renewed its commitment to keep key interest rates near zero for an “extended period,” but also confirmed that it will stop buying mortgage-backed securities at the end of March.The Fed, whose regular meeting began Tuesday, said that “housing starts have been flat at depressed levels” and “employers remain reluctant to add to payrolls” as a reason for extending the cap on...

Newly listed Sheffield home on English Hill in Redmond! 14340 172nd Ave NE, Redmond Elegant & updated two story on private, 35,100 s.f lot in Sheffield on English Hill. Fantastic Buchan built home features 4 bedrooms, 2.5 baths, den & bonus - approx. 3110 s.f. Recent updates include high quality roof & bamboo floors on main level. Dramatic two story foyer with open...

Newly listed Coventry home on English Hill in Redmond! 17420 NE 140th Pl, Redmond SOLD IN 11 DAYS! Nestled in a quiet cul-de-sac in Coventry on English Hill, sits this charming Burnstead built, two story home. The gracious floorplan boasts 2040 s.f. and features 3 bedrooms, 2.25 baths plus den on a very private 7,497 s.f. lot! Many recent updates include - high quality roof, neutral paint,...

Posted By:Tony MeierEastside & Seattle RealtorEastsideHomesBlog.comEastsideHomes.comSeattle's Eastside Real Estate...

"Tony, you really earned our respect. You even found someone to show us around when we could only come up on a weekend you were out of town. You always returned by emails and calls promptly. I really liked the fact that you read into what we were looking for in a home. You knew the areas well and even gave pointers about the commute times I could face for work. I...