Some industry experts are claiming that the housing market may be headed for a slowdown as we proceed through 2017, based on rising home prices and a potential jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR). Here is how NAR defines the index: “The Housing Affordability Index measures...

Information for Sellers

KIRKLAND, Washington (April 6, 2017) - Northwest Multiple Listing Service brokers expected an uptick in the number of new listings during March, and that expectation was met with a significant gain - up more than 50 percent from February. Members added 10,321 new listings last month, but they also reported an even greater number of pending sales (10,447), leaving inventory near historic...

Traditionally, spring is the busiest season for real estate. Buyers come out in force and homeowners list their houses for sale hoping to capitalize on buyer activity. This year will be no different! Buyers have already been out in force looking for their dream homes and more are on their way, but the challenge is that the inventory of homes for sale has not kept up with demand, which has lead to A...

Some Highlights: The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report. In the report, home prices are compared both regionally and by state. Based on the latest numbers, if you plan on relocating to another state, waiting to move may end up costing you more! Alaska, Delaware, West Virginia & Wyoming were the only...

The success of the housing market is strongly tied to the consumer’s confidence in the overall economy. For that reason, we believe 2017 will be a great year for real estate. Here is just a touch of the news coverage on the subject. HousingWire: “Consumers’ faith in the housing market is stronger than it’s ever been before, according to a newly released survey from Fannie...

If your house no longer fits your needs and you are planning on buying a luxury home, now is a great time to do so! We recently shared data from Trulia’s Market Mismatch Study which showed that in today’s premium home market, buyers are in control. The inventory of homes for sale in the luxury market far exceeds those searching to purchase these properties in many areas of the country. This...

Self-made millionaire David Bach was quoted in a CNBC article explaining that "the single biggest mistake millennials are making" is not purchasing a home because buying real estate is "an escalator to wealth.” Bach went on to explain: "If millennials don't buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this...

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage - either yours or your landlord’s. As Entrepreneur Magazine, a premier source for small business, explained this month in their article, “12 Practical Steps to Getting...

Some Highlights: The concept of Supply & Demand is a simple one. The best time to sell something is when the supply of that item is low & the demand for that item is high! Anything under a 6-month supply is a Seller’s Market! There has not been a 6-months inventory supply since August 2012! Buyer Demand continues to outpace Seller...

CoreLogic recently released a report entitled, United States Residential Foreclosure Crisis: 10 Years Later, in which they examined the years leading up to the crisis all the way through to present day. With a peak in 2010 when nearly 1.2 million homes were foreclosed on, over 7.7 million families lost their homes throughout the entire foreclosure crisis. Dr. Frank Nothaft, Chief Economist for...

Mortgage interest rates have risen over the last few months and projections are that they will continue their upswing throughout 2017. What impact will this have on the housing market? Here is what the experts are saying: Laurie Goodman, Co-director of the Urban Institute’s Housing Finance Policy Center: “In 1984, 1994, 2000, and 2013, every time we have rate increases, we have increases in...

A study by Edelman Berland reveals that 33% of homeowners who are contemplating selling their houses in the near future are planning to scale down. Let’s look at a few reasons why this might make sense for many homeowners, as the majority of the country is currently experiencing a seller’s market. In a blog, Dave Ramsey, the financial guru, highlighted the advantages of...

Here are four great reasons to consider buying a home today instead of waiting. 1. Prices Will Continue to Rise CoreLogic’s latest Home Price Index reports that home prices have appreciated by 6.9% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.8% over the next year. The bottom in home prices has come and gone. Home values will continue to...

Home values have risen dramatically over the last twelve months. The latest Existing Home Sales Report from the National Association of Realtors puts the annual increase in the median existing-home price at 7.1%. CoreLogic, in their most recent Home Price Insights Report, reveals that national home prices have increased by 6.9% year-over-year. The CoreLogic report broke down appreciation even...

Some Highlights: The “Cost of Waiting to Buy” is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time. Freddie Mac predicts that interest rates will increase to 4.8% by this time next year, while home prices are predicted to appreciate by 4.8% according to CoreLogic. Waiting until next year to buy could cost you...

The inventory of existing homes for sale in today’s market was recently reported to be at a 3.6-month supply according to the National Association of Realtors latest Existing Home Sales Report. Inventory is now 7.1% lower than this time last year, marking the 20th consecutive month of year-over-year drops. Historically, inventory must reach a 6-month supply for a normal market where...

Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Freddie Mac, along with Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors, is calling for mortgage rates to continue to rise over the next four quarters. This has caused some purchasers to lament the fact they may no longer be able to...

Every homeowner wants to make sure they get the best price when selling their home. But how do you guarantee that you receive maximum value for your house? Here are two keys to ensuring you get the highest price possible. 1. Price it a LITTLE LOW This may seem counterintuitive. However, let’s look at this concept for a moment. Many homeowners think that pricing their home a little OVER market...

In many areas of the country, there are not enough homes for sale to satisfy the number of buyers looking to purchase their dream homes. Experts have long proposed that a ramp-up in new, single-family home construction would be one of the many ways to overcome this inventory shortage. According to a recent survey conducted by the National Association of Home Builders (NAHB) and Wells Fargo, housing...

Just like our clocks this weekend in the majority of the country, the housing market will soon “spring forward!” Similar to tension in a spring, the lack of inventory available for sale in the market right now is what is holding back the market. Many potential sellers believe that waiting until Spring is in their best interest, and traditionally they would have been right. Buyer demand has...

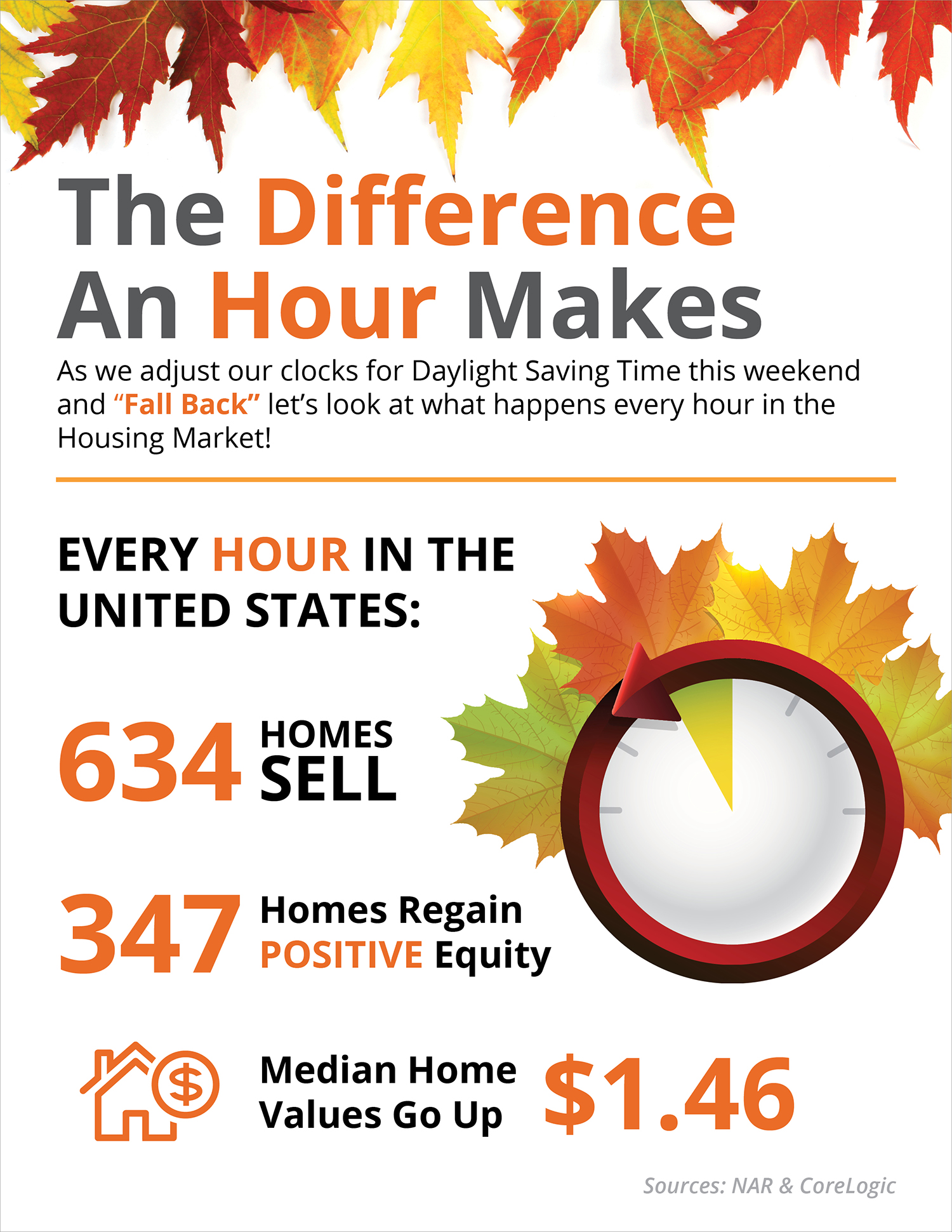

Some Highlights: Don’t forget to set your clocks forward this Sunday, March 12th at 2:00 AM EST in observance of Daylight Savings Time. Unless of course, you are a resident of Arizona or Hawaii! Every hour in the United States: 649 homes are sold, 177 homes regain equity (meaning they are no longer underwater on their mortgage), and the median home price rises...

That headline might be a little aggressive. However, as the data on the 2017 housing market begins to roll in, we can definitely say one thing: If you are considering selling, IT IS TIME TO LIST YOUR HOME! The February numbers are not in yet, but the January numbers were sensational. Lawrence Yun, Chief Economist for the National Association of Realtors, said: “Much of the country saw robust...

Over the next five years, home prices are expected to appreciate 3.22% per year on average and to grow by 17.3% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey. So, what does this mean for homeowners and their equity position? As an example, let’s assume a young couple purchased and closed on a $250,000 home in January. If we look at only the...

If you have contemplated selling, this is the year you have been waiting for to cash in on the market! The perfect circumstances await Sellers in 2017. The Northwest MLS just reported record low inventory in the Puget Sound. In February 2017, the MLS recorded its lowest level of inventory ever. This gives seller's a significant edge. Read more here. 59 million Buyers are expected to...

Some Highlights: For the 5th year in a row, the Northeast saw a concentration of “High Outbound” activity. For the first time ever, South Dakota held the top spot for “High Inbound” states. Much of America’s outbound activity can be attributed to Boomers relocating to warmer climates after...

KIRKLAND (March 6, 2017) - Home buyers are in a spring mood, but sellers are still hibernating, suggested one broker while commenting about the latest statistics from Northwest Multiple Listing Service. Figures for February and feedback from brokers indicate record-low inventory is spurring multiple offers, rising prices, fewer sales, and frustrated house-hunters. Year over-year pending sales...

There is no doubt that historically low mortgage interest rates were a major impetus to housing recovery over the last several years. However, many industry experts are showing concern about the possible effect that the rising rates will have moving forward. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are all projecting that mortgage...

According to a recent survey conducted by ClosingCorp, over half of all homebuyers are surprised by the closing costs required to obtain their mortgage. After surveying 1,000 first-time and repeat homebuyers, the results revealed that 17% of homebuyers were surprised that closing costs were required at all, while another 35% were stunned by how much higher the fees were than expected. “Homebuyers...

The National Association of Realtors (NAR) keeps historical data on many aspects of homeownership. One of the data points that has changed dramatically is the median tenure of a family in a home. As the graph below shows, for over twenty years (1985-2008), the median tenure averaged exactly six years. However, since 2008, that average is almost nine years – an increase of almost...

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts, and investment & market strategists about where they believe prices are headed over the next five years. They then average the projections of...

Highlights: Sales of existing homes reached the highest pace in a decade at a seasonally adjusted annual rate of 5.69 million. January marked the 59th consecutive month of year-over-year price gains as the median home price rose 7.1% to $228,900. NAR’s Chief Economist, Lawrence Yun had this to say, “Much of the country saw robust sales activity last month as strong hiring and improved...

The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans: “Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number...

So, you’ve decided to sell your house. You’ve hired a real estate professional to help you with the entire process, and they have asked you what level of access you want to provide to potential buyers. There are four elements to a quality listing. At the top of the list is Access, followed by Condition, Financing, and Price. There are many levels of access that you can provide to your agent so...

According to a survey conducted by Bankrate.com, one in four Americans are considering buying a home this year. If this statistic proves to be true, that means that 59 million people will be looking to enter the housing market in 2017. The survey also revealed 3 key takeaways: Those most likely to buy are ‘Older Millennials’ (ages 27-36) or ‘Generation X’ (ages 37-52)...

According to the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, the U.S. housing market has continued to move deeper into buy territory, supporting the belief that housing markets across the country remain a sound investment. The BH&J Index is a quarterly report that attempts to answer the question: In today’s housing market, is it better to rent or buy a home? The...

Some Highlights: Historically, the choice between renting or buying a home has been a close decision. Looking at the percentage of income needed to rent a median-priced home today (30%), vs. the percentage needed to buy a median-priced home (15%), the choice becomes obvious. Every market is different. Before you renew your lease again, find out if you could use your housing costs to own a home...

The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans: “Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number...

Recently there has been a lot of talk about home prices and if they are accelerating too quickly. As we mentioned before, in some areas of the country, seller supply (homes for sale) cannot keep up with the number of buyers out looking for a home, which has caused prices to rise. The great news about rising prices, however, is that according to CoreLogic’s US Economic Outlook, the...

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in the real estate market. Ask yourself the following 3 questions to help determine if now is a good time for you to buy in today’s market. 1. Why am I buying a...

According to the National Association of REALTORS most recent Profile of Home Buyers & Sellers, married couples once again dominated the first-time homebuyer statistics in 2016 at 58% of all buyers. It is no surprise that having two incomes to save for down payments and contribute to monthly housing costs makes buying a home more attainable. But, many couples are also deciding to buy a home...

A recent study of more than 7 million home sales over the past four years revealed that the season in which a home is listed may be able to shed some light on the likelihood that the home will sell for more than asking price, as well as how quickly the sale will close. It’s no surprise that listing a home for sale during the spring saw the largest return, as the spring is traditionally the busiest...

Highlights: Hiring a real estate professional to guide you through the process of buying a home or selling your house can be one of the best decisions you make! They are there for you to help with paperwork, explaining the process, negotiations, and helping you with pricing (both when making an offer or setting the right price for your home). One of the top reasons to hire a real estate...

The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans: “Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number...

The most recent Pending Homes Sales Index from the National Association of Realtors revealed a slight bump in contracts with an increase of 1.6% in December. This news comes as existing home sales are also forecasted to be on pace for 5.54 million in 2017, a 1.7% increase over 2016, which was the best year for sales in a decade. The Pending Home Sales Index is a leading indicator for the housing...

The most recent Housing Pulse Survey released by the National Association of Realtors revealed that the two major reasons Americans prefer owning their own home instead of renting are: They want the opportunity to build equity. They want a stable and safe environment. Building Equity In a recent article by The Mortgage Reports, they report that “buying and owning a home is...

In this day and age of being able to shop for anything anywhere, it is really important to know what you’re looking for when you start your home search. If you’ve been thinking about buying a home of your own for some time now, you’ve probably come up with a list of things that you’d LOVE to have in your new home. Many new homebuyers fantasize about the amenities that they see on television...

KIRKLAND, Washington (Feb. 6, 2017) - Western Washington's "high velocity" market continued during January with the number of pending sales (7,745) outgaining the number of new listings (6,507), according to new figures from Northwest Multiple Listing Service. "Properties are moving through the market at an unusually fast pace," remarked John Deely, chairman of the board at Northwest MLS and the...

The housing crisis is finally in the rear-view mirror as the real estate market moves down the road to a complete recovery. Home values are up. Home sales are up. Distressed sales (foreclosures and short sales) have fallen dramatically. It seems that 2017 will be the year that the housing market races forward again. However, there is one thing that may cause the industry to tap the brakes: a lack of...

Highlights: Watching the Big Game at home with your friends & family offers many advantages. There’s more room to entertain a large crowd, and you don’t have to worry about complaints to your landlord if you cheer too loudly! The kitchen is big enough to make as many appetizers as you want, and if some of your guests are only there to watch the commercials, they can do so on a...

The price of any item is determined by the supply of that item, as well as the market demand. The National Association of REALTORS (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for their monthly REALTORS Confidence Index. Their latest edition sheds some light on the relationship between Seller...

So you’ve been searching for that perfect house to call a ‘home,’ and you finally found one! The price is right, and in such a competitive market that you want to make sure you make a good offer so that you can guarantee your dream of making this house yours comes true! Freddie Mac covered “4 Tips for Making an Offer” in their latest Executive Perspective. Here are the...

Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.” Myth #1: “I Need a 20% Down Payment” Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the...

Is spring closer than we think? Depending on which groundhog you listen to today, you may have less time than you think to get your home on the market before the busy spring season. Many sellers feel that the spring is the best time to place their homes on the market as buyer demand traditionally increases at that time of year. However, the next six weeks before spring hits also have their own...

So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. More often than not, your agent may have made your offer contingent on a clean home inspection. This contingency allows you to renegotiate the price paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action...

It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their homes on the market until then. The question is whether or not that will be a good strategy this year. The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to...

According to ATTOM Data Solutions’ 2017 Rental Affordability Report, buying a home is more affordable than renting in 354 of the 540 U.S. counties they analyzed. The report found that “making monthly house payments on a median-priced home — including mortgage, property taxes and insurance — is more affordable than the fair market rent on a three-bedroom property in 354 of the 540 counties...

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don't hesitate to contact me. ECONOMIC OVERVIEW Washington State finished the year on a high with...

There are many potential homebuyers, and even sellers, who believe that they need at least a 20% down payment in order to buy a home or move on to their next home. Time after time, we have dispelled this myth by showing that many loan programs allow you to put down as little as 3% (or 0% with a VA loan). If you have saved up your down payment and are ready to start your home search, one other piece...

Highlights: When listing your house for sale your top goal will be to get the home sold for the best price possible! There are many small projects that you can do to ensure this happens! Your real estate agent will have a list of specific suggestions for getting your house ready for market and is a great resource for finding local contractors who can...

Some industry experts are saying that the housing market may be heading for a slowdown in 2017 based on rising home prices and a jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR). Here is how NAR defines the index: “The Housing Affordability Index measures whether or not a typical family...

In many markets across the country, the number of buyers searching for their dream homes greatly outnumbers the amount of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search. Even if you are in a market that is not...

It appears that Americans are regaining faith in the U.S. economy. The following indexes have each shown a dramatic jump in consumer confidence in their latest surveys: The University of Michigan Consumer Sentiment Index National Federation of Independent Businesses' Small Business Optimism Index CNBC All-America Economic Survey The Conference Board Consumer Confidence Survey It...

Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to do it on their own. In today’s market: you need an experienced professional! You Need an Expert Guide if You Are Traveling a Dangerous Path The field of real estate is loaded with land mines; you need a true expert to guide you through the dangerous...

We were blessed to be involved in 51 transactions in 2016, helping individuals and families buy or sell homes across the Eastside, in Seattle and North/South from there. Here is what our clients told us was important in their decision to use our services. Experience - 28 years of full-time experience and transaction knowledge spanning well over 1000 homes closed. This gave our clients the assurance...

Last week, CNBC ran an article quoting self-made millionaire David Bach explaining that not purchasing a home is "the single biggest mistake millennials are making"because buying real estate is "an escalator to wealth.” Bach went on to explain: "If millennials don't buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38...

The National Association of Realtors’ most recent Existing Home Sales Report revealed that, compared to last year, home sales are up dramatically in five of the six price ranges they measure. Homes priced between $100-250K showed a 20.7% increase year-over-year. This is an impressive increase, showing that November was an excellent month for home sales in this price...

The latest Existing Home Sales Report from the National Association of Realtors (NAR)revealed a direct correlation between a lack of inventory and rising prices. We are all familiar with the concept of supply and demand. As the demand for an item increases the supply of that same item goes down, driving prices up. Year-over-year inventory levels have dropped each of the last 18 months, as...

As we are about to bring in the New Year, families across the country will be deciding if this is the year that they will sell their current house and move into their dream home. Many will decide that it is smarter to wait until the spring “buyer’s market” to list their house. In the past, that might have made sense. However, this winter is not like recent years. The recent jump in mortgage...

KIRKLAND, Washington (Jan. 5, 2017) - Like many other months of 2016, December was frustrating for buyers across Washington state as they encountered depleted inventory and rising prices. Post-election hikes in interest rates - with more on the horizon -- added to would-be homeowners' worries. Northwest Multiple Listing Service statistics for December show year-over-year drops in new listings, but...

When it comes to buying a home, whether you are a rookie homebuyer or have gone through the process many times, having a local real estate expert who is well versed in the neighborhood you are looking to move into, as well as the trends of that area, should be your goal. One great example of an agent who is in your corner and is always looking out for your best interests is one of the main...

KIRKLAND, Washington (Dec. 5, 2016) - Pending sales of homes hit an all-time high for the month of November according to the latest statistics from Northwest Multiple Listing Service. The report covering 23 counties around Washington state also shows the number of new listings added during the month plunged to the lowest level in 11 months, prompting MLS leaders to predict a busy winter for residential...

Whether you are buying or selling a home, it can be quite an adventurous journey; you need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO. The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been...

People across the country are beginning to think about what their life will look like next year. It happens every fall; we ponder whether we should relocate to a different part of the country to find better year-round weather, or perhaps move across the state for better job opportunities. Homeowners in this situation must consider whether they should sell their house now or wait. If you are one of...

If you are planning on listing your home for sale, make sure that you don’t overlook the condition of your kitchen. A recent article on realtor.com listed “7 Signs Your Kitchen Is Way Overdue for a Renovation,” in which they warned: “Dated kitchens—just like bathrooms—are a major barrier for resale. Buyers want modern amenities and styling, and most aren’t interested in renovating...

KIRKLAND, Washington (Nov. 4, 2016) – Home sales around Western Washington outgained new listings again in October, fueling competition for scarce inventory and pushing prices higher. Some seasonal slowdown is still expected – and the Nov. 8 elections may be in play as well, according to brokers at Northwest Multiple Listing Service who commented on last month’s activity. MLS members reported...

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don't hesitate to contact me. ECONOMIC OVERVIEW Annual employment growth in Washington...

CoreLogic released their most current Home Price Index last week. In the report, they revealed home appreciation in three categories: percentage appreciation over the last year, over the last month and projected over the next twelve months. Here are state maps for each category: The Past – home appreciation over the last 12 months The Present – home appreciation over the last...

KIRKLAND, Washington (Oct. 5, 2016) - It's still a seller's market, but some leaders from Northwest Multiple Listing Service think the imbalance may be easing in some areas, pointing to a slower pace of sales and moderating prices. Others aren't convinced, citing mixed indicators. Northwest MLS statistics summarizing September activity show year-over-year gains in the volumes of new listings (up...

According to the latest Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, the U.S. housing market has continued to move deeper into buy territory, supporting the belief that housing markets across the country remain a sound investment. The BH&J Index is a quarterly report that attempts to answer the question: In today’s housing market, is it better to rent or buy a home? The...

The National Association of Realtors, The Mortgage Bankers’ Association, Freddie Mac and Fannie Mae are all projecting that home sales will increase in 2017. Here is a chart showing what each entity is projecting in sales for this year and the next. As we can see, each is projecting sizable increases in home sales next year. If you have considered selling your house recently, now may be the...

It’s that time of year; the seasons are changing and with them come thoughts of the upcoming holidays, family get-togethers, and planning for a new year. Those who are on the fence about whether or not now is the right time to buy don’t have to look much further to find four great reasons to consider buying a home now, instead of waiting. 1. Prices Will Continue to Rise CoreLogic’s latest Home...

The price of any item is determined by the supply of that item, as well as the market demand. The National Association of REALTORS (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for their monthly REALTORS Confidence Index. Their latest edition sheds some light on the relationship between Seller Traffic (supply) and...

There are some industry pundits claiming that residential home values have risen too quickly and that current levels are on the verge of another housing bubble. It is easy to see how this thinking has taken form if we look at a graph of home prices from 2000 to today. The graph definitely looks like a rollercoaster ride. And, as prices begin to reach 2006 levels again, it “seems logical”...

School is back in session, the holidays are right around the corner, you might not think that now is the best time to sell your house. But with inventory below historic numbers and demand still strong, you could be missing out on a great opportunity for your family. Here are five reasons why you should consider selling your house this fall: 1. Demand Is Strong The latest Realtors’ Confidence...

Listed at $1,100,000 Complete details here: This custom built home has been completely remodeled and is located on a private 34,999 s.f. lot. Ideally positioned in the easily accessible Bristol View Neighborhood of Redmond, the home features 4 bedrooms, 5 separate bathrooms, den, bonus, rec. room, craft room, 4,950 s.f. and a park-like lot. Wonderful home for entertainment with cozy spaces in a...

KIRKLAND, Washington (Sept. 7, 2016) - Home sales in Western Washington continued to outpace year-ago activity, but member-brokers at Northwest Multiple Listing Service say persistent inventory shortages are constraining activity. Despite a sparse selection in many areas, an expected summer slowdown, and "appraisal conundrums," Northwest MLS members notched 11,898 pending sales during August,...

KIRKLAND, Washington (Aug.4, 2016) - Home prices are still rising but the supply of homes is improving, prompting brokers to suggest some relief is in sight for would-be buyers. "We might actually be starting to move very slowly back toward a more balanced market," said OB Jacobi, president of Windermere Real Estate, in commenting on July's figures from Northwest Multiple Listing Service. The MLS...

According to a Merrill Lynch study, “an estimated 4.2 million retirees moved into a new home last year alone.” Two-thirds of retirees say that they are likely to move at least once during retirement. As one participant in the study stated: “In retirement, you have the chance to live anywhere you want. Or you can just stay where you are. There hasn’t been another time in life when we’ve...

Some Highlights: The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices & interest rates were to increase over a period of time. Freddie Mac predicts interest rates to rise to 4.6% by next year. CoreLogic predicts home prices to appreciate by 5.3% over the next 12 months. If you are ready and willing to buy your dream home, find out if you...

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in the real estate market. Answering the following 3 questions will help you determine if now is actually a good time for you to buy in today’s market. 1. Why am...

Some Highlights: Interest Rates are still below historic numbers. 88% of property managers raised their rent in the last 12 months! Credit score requirements to be approved for a mortgage continue to...

The Consumer Price Index (CPI) was released by the Labor Department last week. An analysis by Market Watch revealed the cost of rent was 3.8% higher than a year ago for the second straight month in June. That’s the strongest yearly price gain since 2007. This coincides with a report released earlier this month in which AxioMetrics announced that rents are continuing to increase in 2016. The...

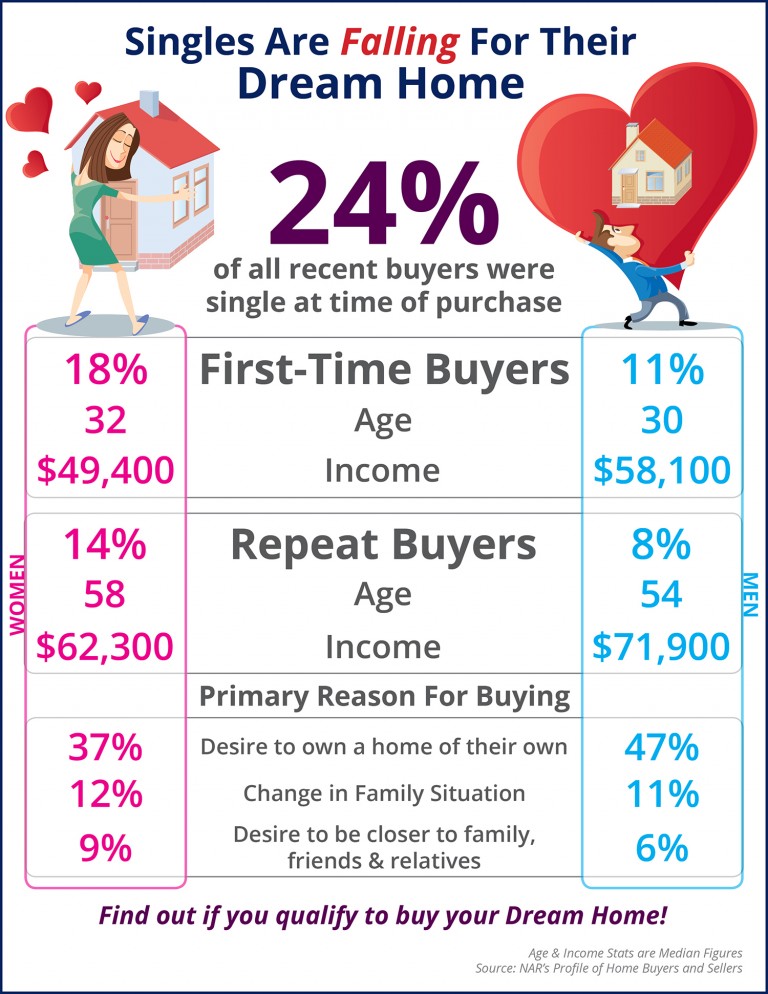

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family. Others may think they are too young. And still others might think their current income would never enable them to qualify for a mortgage. We want to share what the typical...

In their current edition of the Home Price Expectation Survey released last week, Pulsenomics asked this question of the 100+ economists, real estate experts and investment & market strategists they surveyed: “In your opinion, what is the primary driver of recent home value growth in the U.S.?” Here are the top four reasons given by those surveyed: As we have stated before, the current...

Some Highlights: Real estate outranks stocks/mutual funds, gold, savings accounts/CDs, and bonds as the best long-term investment among Americans. Real estate is ranked as the best long-term investment among all age groups. Millennials rank both real estate and savings/CDs at 26% when it comes to the best long-term...

With home prices expected to appreciate by over 5% this year, some are beginning to worry about a new housing bubble forming. Warren Buffet addressed this issue last week in an article by Fortune Magazine. He simply explained: “I don’t see a nationwide bubble in real estate right now at all.” Later, when questioned whether real estate and/or mortgaging could present the same challenges for the...

KIRKLAND, Washington (June 6, 2016) - Just as expected, the month of May had an uptick in new listings (12,272), but just as many buyers (12,275) made offers on homes during the month to keep inventory depleted, according to the latest figures from Northwest Multiple Listing Service. "Inventory is being squeezed from all directions," reported Frank Wilson, branch managing broker at John L. Scott in...

In CoreLogic’s latest Home Price Index, they revealed home appreciation in three categories: percentage appreciation over the last year, over the last month, and projected appreciation over the next twelve months. Here are state maps for each category: The Past – home appreciation over the last 12 months The Present – home appreciation over the last month The Future – home...

Every four years people question what effect the Presidential election might have on the national housing market. Let’s take a look at what is currently taking place. The New York Times ran an article earlier this week where they explained: “A growing body of research shows that during presidential election years — particularly ones like this when there is such uncertainty about the nation’s...

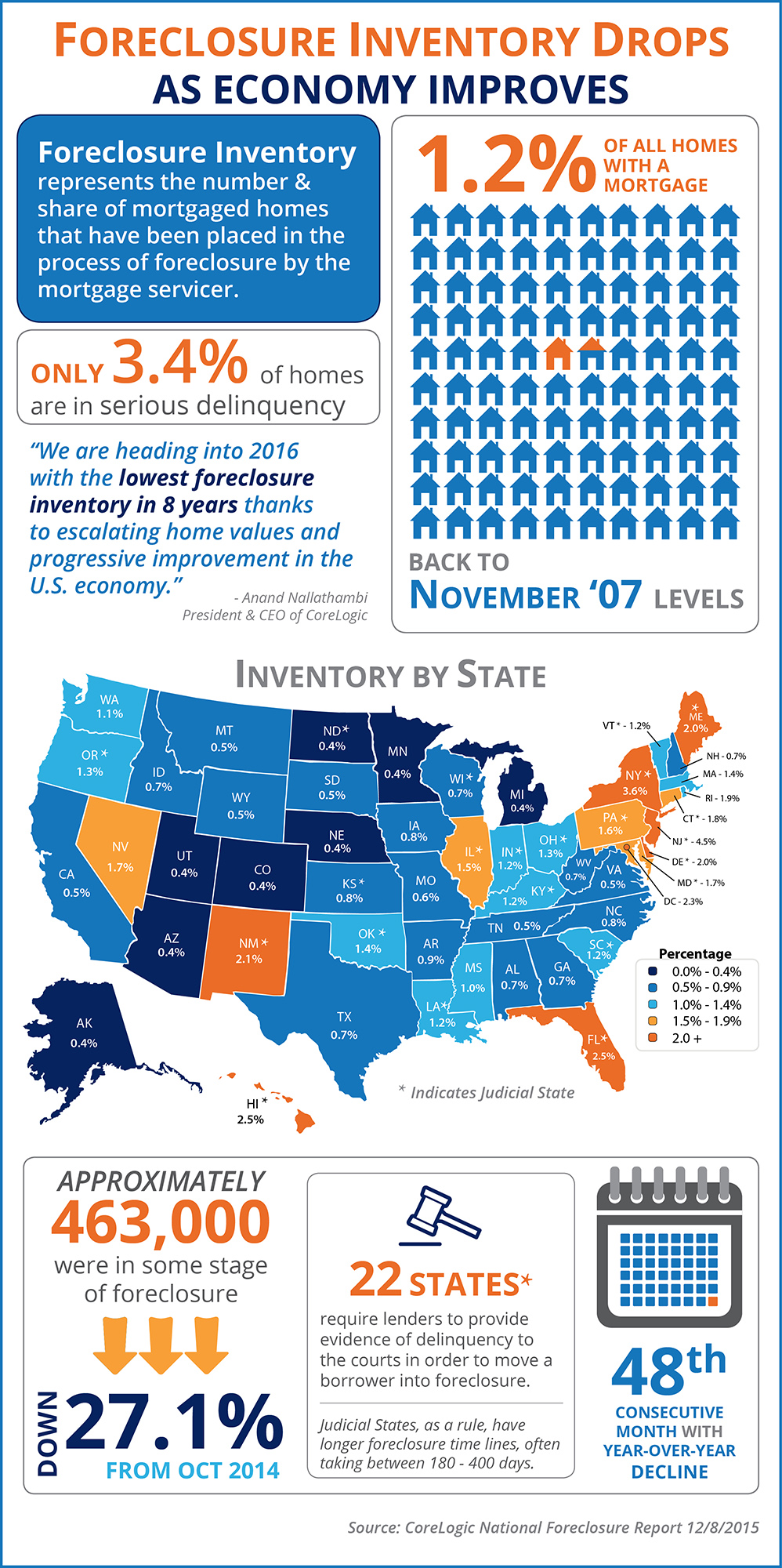

Recently, there has been a lot of talk about the size of the foreclosure inventory in the nation. There has been some speculation that distressed property inventories are about to skyrocket. Today, we want to reveal what is actually taking place in this segment of the housing market. CoreLogic, in their most recent National Foreclosure Report, reported that foreclosure inventory has decreased by...

A study by Edelman Berland reveals that 33% of homeowners who are contemplating selling their house in the near future are planning to scale down. Let’s look at a few reasons why this might make sense for many homeowners, as the majority of the country is currently experiencing a seller’s market. In a recent blog, Dave Ramsey, the financial guru, highlighted the advantages of selling...

The latest report from Freddie Mac shows that the 30-year fixed-rate mortgage averaged 3.61% last week, slightly down from the week before (3.66%), and nearly 20 points lower than a year ago (3.80%). This is great news for homebuyers who are dealing with rising prices due to a low inventory of homes for sale in many areas of the country. Freddie Mac expressed their optimism for the rates to remain...

With the overall economy just inching along, some experts are questioning whether the housing market can continue its momentum throughout the rest of the year. People are beginning to ask questions such as: *Will disappointing economic news adversely impact housing? *Is affordability a major concern in today’s real estate market? *Are we approaching a new housing bubble? *Are mortgage standards...

The National Association of Realtors’ most recent Existing Home Sales Report revealed that home sales were up rather dramatically over last year in five of the six price ranges they measure. Only those homes priced under $100,000 showed a decline (-4.6%). The decline in this price range points to the lower inventory of distressed properties available for sale and speaks to the strength of the...

The price of any item is determined by the supply of that item, and the market demand. The National Association of Realtors (NAR) recently released their latest Existing Home Sales Report which gives insight into today’s market conditions. Inventory Levels & Demand Sales of existing homes rose 5.1% month-over-month in March and are 1.5% higher than this time last year. Sales rose in all four...

KIRKLAND, Washington (May 5, 2016) - Northwest Multiple Listing Service reported strong gains in the volume of new listings its members added during April (up 13.6 percent from March), but inventory remained well below the supply needed for a more balanced market. MLS leaders say the lopsided market is prompting some anxious buyers to take ill-advised risks. Prices showed some signs of moderating...

A survey by Ipsos found that the American public is still somewhat confused about what is actually necessary to qualify for a home mortgage loan in today’s housing market. The study pointed out two major misconceptions that we want to address today. 1. Down Payment The survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report,...

In today’s market, where demand is outpacing supply in many regions of the country, pricing a house is one of the biggest challenges real estate professionals face. Sellers often want to price their home higher than recommended, and many agents go along with the idea to keep their clients happy. However, the best agents realize that telling the homeowner the truth is more important than getting the...

Home values continue to climb and are projected to increase by about 5% over the next twelve months. That is great news for anyone who owns a home. However, it could present a challenge for a family trying to sell their house. If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that closed recently) to defend the sales price...

The housing market is really heating up and buyer demand is dramatically increasing as we enter the spring season. However, one challenge to the current market is a major shortage of inventory. Below are a few comments made in the last month by industry experts. Lawrence Yun, Chief Economist of NAR “Looking ahead, the key for sustained momentum and more sales than last spring is a continuous stream...

In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States. The updated numbers actually show that the range is an average of 5% less expensive in Orange County (CA) all the way up to 46% in Houston (TX), and 36% Nationwide! Other interesting...

If you thought about selling your house this year, now may be the time to do it. The inventory of homes for sale is well below historic norms and buyer demand is skyrocketing. We were still in high school when we learned the concept of supply and demand: the best time to sell something is when supply of that item is low and demand for that item is high. That defines today’s real estate...

In a study conducted by Builder.com, researchers determined that nationwide, it would take “nearly eight years” for a first-time buyer to save enough for a down payment on their dream home. Depending on where you live, median rents, incomes and home prices all vary. By determining the percentage of income a renter spends on housing in each state, and the amount needed for a 10% down payment,...

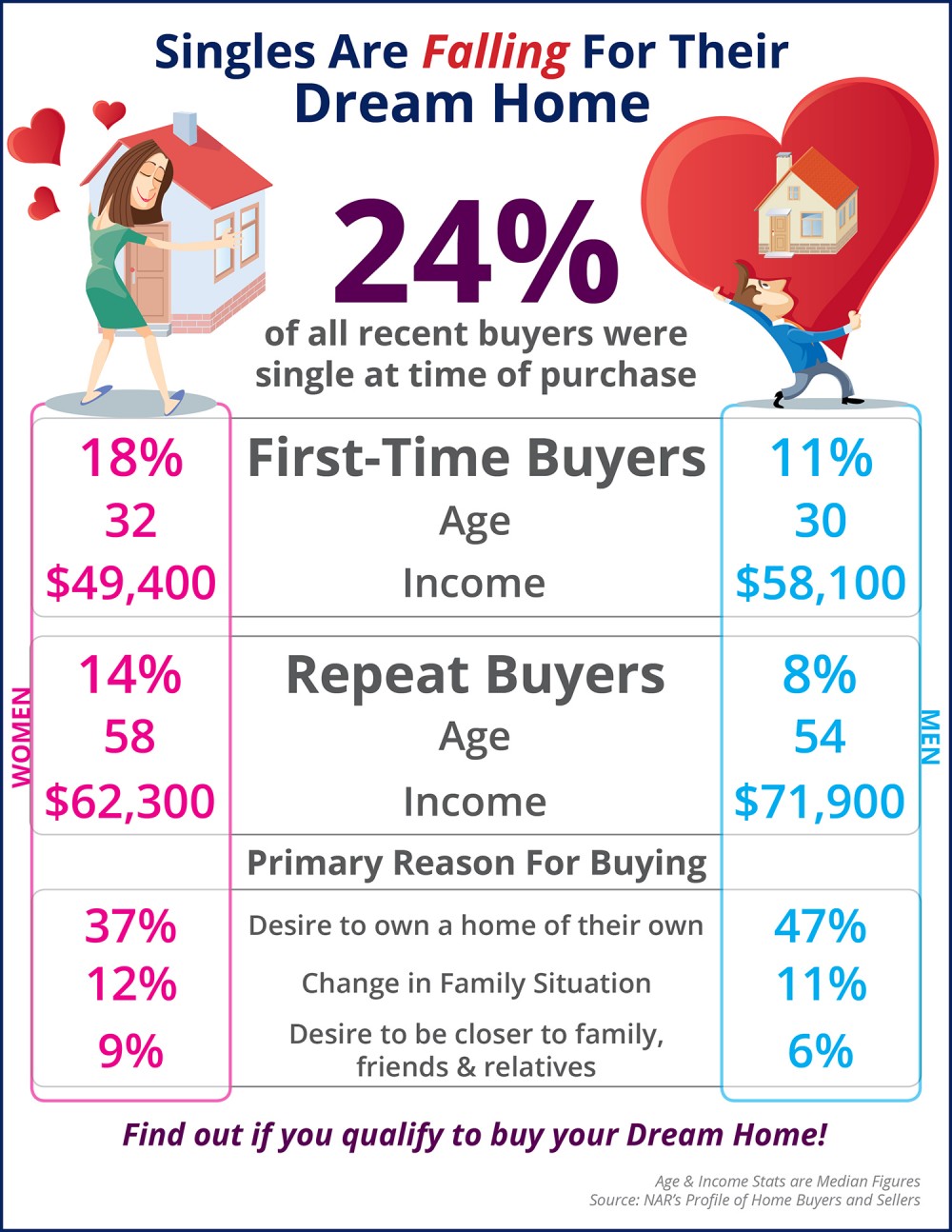

Some Highlights: 24% of all recent home buyers were single at the time of purchase. 47% of single men cite the desire to own a home of their own as the primary reason to buy. 18% of first-time buyers were single...

How Housing Matters is a joint project of the Urban Land Institute and the MacArthur Foundation. It is “an online resource for the most rigorous research and practical information on how a quality, stable, affordable home in a vibrant community contributes to individual and community success”. A recent story they published, The First Rung on the Ladder to Economic Opportunity Is Housing,...

A few weeks ago, Jonathan Smoke, the Chief Economist at realtor.com, exclaimed: “All indicators point to this spring being the busiest since 2006.” Now, Freddie Mac has doubled down on that claim and is saying that 2016 will be the best year that the real estate industry has seen in a decade. In their March Housing Outlook Report,Freddie Mac explained: “Despite the challenges facing the...

There are some renters that have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either your mortgage or your landlord’s. As The Joint Center for Housing Studies at Harvard University explains: “Households must consume housing whether...

Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. Prices are still below those of a few years ago and interest rates have stayed near historic lows. Sellers should realize that waiting to make the move when mortgage rates are projected to increase probably doesn’t make sense. As rates increase, the price of the...

Some Highlights: Harvard University's Joint Center of Housing Studies recently released the top financial & emotional reasons to own a home. Owning is a good way to build up wealth that can be passed along to your family as it is usually a form of "forced savings." Whether you rent or own, you are paying a mortgage. Yours when you own, your landlord's when you...

Some of the housing headlines are causing concern for some consumers who are in the process of either buying or selling a home. Pundits are concerned over the lack of new construction or the month-over-month sales numbers. Let’s set the record straight; 2015 was a good year for residential real estate in the United States and 2016 is starting out stronger. Here is a graph of total homes sold (new...

KIRKLAND, Washington (April 4, 2016) - Traffic isn't the only thing that is gridlocked around many Puget Sound communities. "We're experiencing gridlock in the Puget Sound housing market," suggested J. Lennox Scott in reaction to the latest statistics from Northwest Multiple Listing Service. MLS figures show pending sales across the 23 counties it serves dropped about 4.5 percent in March compared...

The National Association of Realtors (NAR) just announced that the February Pending Home Sales Index reached its highest reading since July 2015. What is the Pending Home Sales Index (PHSI)? NAR’s PHSI is “a forward-looking indicator based on contract signings”. The higher the Pending Home Sales Index number, the more contracts have been signed by buyers that will soon translate to sales....

CoreLogic’s latest Equity Report revealed that one million borrowers regained equity in their homes in 2015. The outlook for 2016 remains positive as well, as an additional 850,000 properties would regain equity if home prices rose another 5% this year. The study also revealed: 95% of homes valued over $200,000 now have a positive equity position 87% of homes valued under $200,000 have...

In school we all learned the Theory of Supply and Demand. When the demand for an item is greater than the supply of that item, the price will surely rise. SUPPLY The National Association of Realtors (NAR) recently reported that the inventory of homes for sale stands at a 4.4-month supply. This is considerably lower than the 6-month inventory necessary for a normal market. DEMAND Every month...

When a homeowner decides to sell their house, they obviously want the best possible price with the least amount of hassles. However, for the vast majority of sellers, the most important result is to actually get the home sold. In order to accomplish all three goals, a seller should realize the importance of using a real estate professional. We realize that technology has changed the purchaser’s...

Some Highlights: Many buyers are purchasing a home with a down payment as little as 3%. You may already qualify for a loan, even if you don't have perfect credit. Take advantage of the knowledge of your local professionals who are there to help you determine how much you can...

Going into the 2016 spring market, the biggest challenge the real estate industry has is the lack of available housing inventory for sale. Here are a few experts and their thoughts on the subject: David Crowe, Chief Economist for the National Association of Home Builders: “Many sellers may not have an absolute decision as to whether to buy an existing home or a new home. So the low inventory of...

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. One major challenge in such a market is the bank appraisal. If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that closed recently) to defend the price when performing the appraisal for the bank. Every month,...

As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first-time or repeat buyer, you must not be concerned only about price but also about the ‘long term cost’ of the home. Let us explain. There are many factors that influence the ‘cost’ of a home. Two of the major ones are the home’s appreciation...

We recently reported that home prices are continuing to rise across most of the nation. This has created concern in some pundits that a housing bubble, like we saw ten years ago, is forming again. We want to explain why these concerns are unfounded. The current increase in home values can be easily explained by the theory of supply and demand. Right now, the number of families looking to purchase a...

According to the latest Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index homeownership is a better way to produce greater wealth, on average, than renting. The BH&J Index is a quarterly report that attempts to answer the question: Is it better to rent or buy a home in today’s housing market? The index examines the entire US housing market and then isolates 23 major markets for...

There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. As we have said before, mortgage interest rates are still near historic lows and rents continue to rise. Housing Cost & Net Worth Whether you rent or buy, you have a monthly housing cost. As a buyer, you are contributing to YOUR net worth. Every mortgage...

Some Highlights: The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report. In the report, home prices are compared both regionally and by state. Based on the latest numbers, waiting to move may end up costing you...

Yesterday, we discussed the reasons why homeownership makes sense, financially. Today we wanted to touch on the emotional or ‘real’ reasons that many Americans strive to become homeowners. The Joint Center for Housing Studies at Harvard University performs a study every year surveying participants for the reasons that American’s feel are most important in regards to...

In a recent blog post on Marginal Revolution, economist Alex Tabarrok discussed homeownership as an investment. Here is what Mr. Tabarrok had to say: “Housing is overrated as a financial investment. First, it’s not good to have a significant share of your wealth locked into a single asset. Diversification is better and it’s easier to diversify with stocks. Second, unless you are renting the...

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet, maybe it's not priced properly. After all 14,986 houses sold yesterday, 14,986 will sell today and 14,986 will sell tomorrow. 14,986! That is the average number of homes that sell each and...

KIRKLAND, Washington (March 7, 2016) - Home prices in King County hit new highs in February as buyers tried to outbid each other for the sparse inventory in much of Western Washington. "We're in for another crazy spring real estate market," predicts J. Lennox Scott, chairman and CEO of John L. Scott, Inc. With the number of single family homes for sale in King County down nearly 30 percent from a...

The National Association of Realtors (NAR) released their latest Quarterly Metro Home Pricereport earlier this month. The report revealed that home prices are not only continuing to rise but that the increases are accelerating. Lawrence Yun, Chief Economist at NAR, discussed the impact of low inventory on buyers in the report: "Without a significant ramp-up in new home construction and more homeowners...

I am keenly aware of how my role has evolved for our sellers over the last few years. Creating a compelling presentation for our client's homes has always been important. However, in the market we have had since 2013, extracting value from competing offers is where the real money is made for our clients! As illustrated in one of our recent articles... "Instead of the seller trying to ‘win’ the...

Every homeowner wants to make sure they maximize their financial reward when selling their home. But how do you guarantee that you receive maximum value for your house? Here are two keys to ensuring you get the highest price possible. 1. Price it a LITTLE LOW This may seem counterintuitive. However, let’s look at this concept for a moment. Many homeowners think that pricing their home a little OVER...

Just two weeks ago, we posted an article discussing where mortgage interest rates may be heading over the next twelve months. We quoted projections from Fannie Mae, Freddie Mac, the Mortgage Bankers’ Association and the National Association of Realtors. Each predicted that rates would begin to rise slowly and steadily throughout 2016. However, shaky economic news and a volatile stock...

With spring right around the corner, you may be wondering if you should wait to enter the housing market. Here are four great reasons to consider buying a home today instead of waiting. Prices Will Continue to Rise CoreLogic’s latest Home Price Index reports that home prices have appreciated by 6.3% over the last 12 months. The same report predicts that prices will continue to increase at...

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where they believe prices are headed over the next five years. They then average the projections of...

During the recession, many young adults graduating from college were forced to move back in with their parents. This caused new household formations to drop dramatically from the long term average of 1.2 million formations annually to half that number. However, this may be the year this turns back around. According to the Urban Land Institute’s report, Emerging Trends in Real Estate, household...

CoreLogic’s latest Equity Report revealed that 256,000 properties regained equity in the third quarter of 2015. This is great news for the country, as 92% of all mortgaged properties are now in a positive equity situation. Price Appreciation = Good News For Homeowners Frank Nothaft, CoreLogic’s Chief Economist, explains: “Home price growth continued to lift borrower equity positions and...

You’ve decided to sell your house. You begin to interview potential real estate agents to help you through the process. You need someone you trust enough to: Set the market value on possibly the largest asset your family owns (your home) Set the time schedule for the successful liquidation of that asset Set the fee for the services required to liquidate that asset An agent must be...

According to the National Association of Realtors’ (NAR) Existing Home Sales Report, homes were on market for an average of 58 days in December. This was slightly longer than the 54 days in November, but still better than the 66 days experienced in December 2014. 32% of homes across the country were on the market for less than a month! Colorado, Utah and Delaware led all states as homes are...

Some Highlights: For the 4th year in a row the Northeast saw a concentration of High Outbound activity. Oregon held on to the top stop of High Inbound states for the 3rd year in a row. Much of this Outbound activity can be attributed to Boomers relocating to warmer climates after...

KIRKLAND, Washington (February 4, 2016) - Depleted inventory is contributing to "overwhelming" traffic at open houses, shifts in strategies for both buyers and sellers, and escalating prices, according to officials with the Northwest Multiple Listing Service. Dick Beeson, a former chairman of the MLS board, said the lack of inventory in almost every county is, "without question, a 2016 game...

First American Title issues a quarterly report, the Real Estate Sentiment Index (RESI), which“measures title agent sentiment on a variety of key market metrics and industry issues”. Their 2015 4th Quarter Edition revealed some interesting information regarding possible challenges with appraisal values as we head into 2016. “The fourth quarter RESI found that title agents continue to believe that...

Is spring closer than we think? Depending on which Groundhog you witnessed today, you may have less time than you think to get your home on the market before the busy spring season. Many sellers feel that the spring is the best time to place their home on the market as buyer demand traditionally increases at that time of year. However, the next six weeks before spring hits also have their own...

It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their home on the market until then. The question is whether or not that will be a good strategy this year. The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the...

TransUnion recently released the results of a new study titled “The Bubble, the Burst and Now - What Happened to the Consumer?” The study revealed that 1.5 million homeowners that were negatively impacted by the housing crisis could re-enter the housing market in the next three years. TransUnion defined “negatively impacted” as… “…those who were 60+ days past due on a mortgage loan,...

Fannie Mae recently released their “What do consumers know about the Mortgage Qualification Criteria?” Study. The study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home. Here are three takeaways: 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary 86% of Americans either don’t...

KIRKLAND, Wash. (Jan. 21, 2016) – Members of Northwest Multiple Listing Service reported 88,331 closed sales during 2015, outgaining the prior year’s volume of 77,276 transactions for a 14.3 percent increase. Measured by dollars, last year’s sales of single family homes and condominiums were valued at more than $34 billion. Compared to 2014, that dollar volume represents a gain of nearly 23...

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family. Others may think they are too young. And still others might think their current income would never enable them to qualify for a mortgage. We want to share what the typical first time...

The National Economic Forecast 1.The U.S. will continue to expand with real GDP growth of 2.3% in 2016. Although a positive number, the forecasted rate of growth suggests that we will be modestly underperforming in 2016. On a positive note, oil prices are likely to remain well below long-term averages, which puts more money into consumers’ pockets in terms of disposable incomes. However, I...

KIRKLAND, Washington (January 6, 2016) - Home prices have "clearly recovered" in King County and a few other areas served by Northwest Multiple Listing Service. Many member-brokers say prices are likely to keep rising as a backlog of buyers competes for depleted inventory. Those were among reactions from brokers upon reviewing the December statistics from the MLS. The latest report shows the year...

If you are debating listing your house for sale this year, here is the #1 reason not to wait! Buyer Demand Continues to Outpace the Supply of Homes For Sale The National Association of REALTORS’ (NAR) Chief Economist, Lawrence Yun recently commented on the inventory shortage: “While feedback from REALTORS® continues to suggest healthy levels of buyer interest, available listings that are...

Some Highlights: Happy New Year! If you plan to buy your dream home or sell your house in 2016, resolve to use a real estate professional! Real Estate Professionals are there for you through the entire process to help with paperwork, negotiations, pricing, and so much more! Let's get together to discuss the difference having a professional in your corner can...

In a recent study conducted by Builder.com, researchers determined that nationwide it would take“nearly eight years” for a first-time buyer to save enough for a down payment on their dream home. Depending on where you live, median rents, incomes and home prices all vary. By determining the percentage a renter spends on housing in each state and the amount needed for a 10% down payment, they were...

In today's market, with homes selling quickly and prices rising, some homeowners might consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons this might not be a good idea for the vast majority of sellers. Here are five of those reasons: 1. There Are Too Many People to Negotiate With Here is a list of some of the people with...

As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. The Mortgage Bankers Association (MBA), the National Association of Realtors, Fannie Mae and Freddie Mac all projected that mortgage interest rates will increase by...

Some Highlights: Foreclosure Inventory has dropped year-over-year for the last 4 years (48 months). Only 3.4% of US homes are in serious delinquency. 29 states have a foreclosure inventory rate lower than the national average. For more information you can download the full report...

CoreLogic released their most current Home Price Index last week. In the report, they revealed home appreciation in three categories: percentage appreciation over the last year, over the last month and projected over the next twelve months. Here are state maps for each category: The Past – home appreciation over the last 12 months The Present – home appreciation over the last month The...

A recent survey by Ipsos found that the American public is still somewhat confused about what is actually necessary to qualify for a home mortgage loan in today’s housing market. The study pointed out two major misconceptions that we want to address today. 1. Down Payment The survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the...

We all realize that the best time to sell anything is when demand is high and the supply of that item is limited. The last two major reports issued by the National Association of Realtors (NAR) revealed information that suggests that now is a great time to sell your house. Let’s look at the data covered by the latest Pending Home Sales Report and Existing Home Sales Report. THE PENDING HOME...

KIRKLAND, Washington (December 4, 2015) - Inventory remains "critically low," but there are fewer house-hunters in the hunt during this holiday season so motivated sellers and buyers are seeing success, according to brokers with Northwest Multiple Listing Service. Its just-released statistics for November show year-over-year gains in pending sales, closed sales, and prices, but a steep decline in...

The monthly mortgage payment on a home is determined by two elements: the price of the house and the interest rate you pay on your mortgage. Recently released reports are revealing that the experts expect both elements to increase in 2016. HOME PRICES CoreLogic has projected a nationwide 5.2% home value appreciation for the next twelve months. Here is their breakdown by state: MORTGAGE INTEREST...

Last week, an article in the Washington Post discussed a new ‘threat’ homebuyers will soon be facing: higher mortgage rates. The article revealed: “The Mortgage Bankers Association expects that rates on 30-year loans could reach 4.8 percent by the end of next year, topping 5 percent in 2017. Rates haven’t been that high since the recession.” How can this impact the housing market? The...

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either your mortgage or your landlord’s. As The Joint Center for Housing Studies at Harvard University explains: “Households must consume housing whether they own...

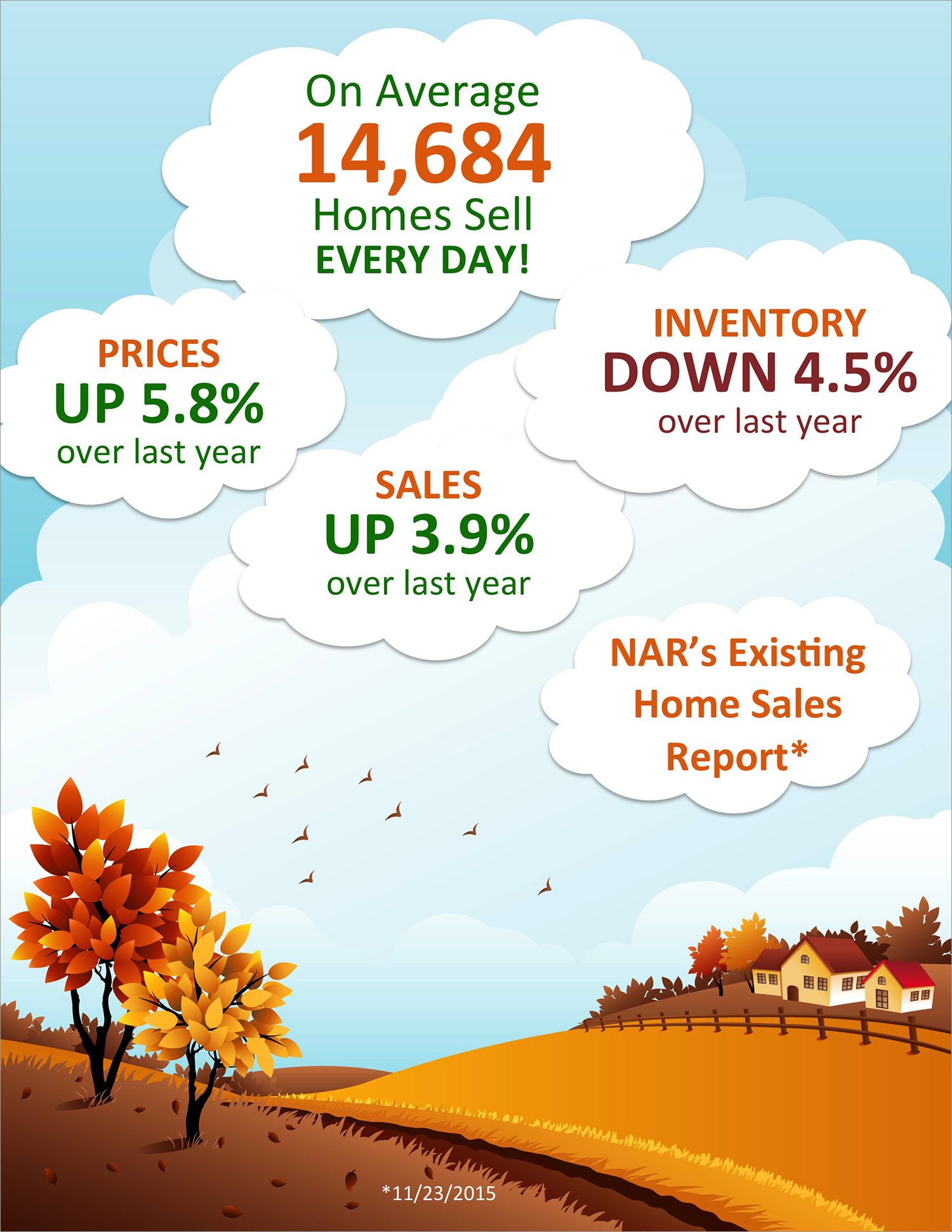

Some Highlights: The annual adjusted sales are currently at a 5.36 million pace. 14,684 homes sell every day in the United States. October marked the 44th consecutive month of price...

The National Association of Realtors (NAR) just released their Existing Home Sales Report revealing that distressed property sales accounted for 6% of sales in October. This is down from 9% in 2014 and the lowest figure since NAR began tracking distressed sales in October 2008. Below is a graph that shows just how far the market has come since January 2012 when distressed sales accounted for 35% of...

In a recent article by the Wharton School of Business at the University of Pennsylvania, it was revealed that some Millennials are not looking to purchase a home simply because they don’t believe they can qualify for a mortgage. The article quoted Jessica Lautz, the National Association of Realtors’ Managing Director of Survey Research, as saying that there is a significant population that does...

There are many reasons, both financial and non-financial, that homeownership remains an important part of the American Dream. One of the biggest reasons is the fact that it helps build family wealth. Recently, Freddie Mac wrote about the power of home equity. They explained: “In the simplest terms, equity is the difference between how much your home is worth and how much you owe on your mortgage....

Some Highlights: 24% of all recent home buyers were single at the time of purchase 47% of single men cite the desire to own a home of their own as the primary reason to buy 18% of first-time buyers were single...

Every homeowner wants to make sure they maximize the financial reward when selling their home. But, how do you guarantee that you receive maximum value for your house? Here are two keys to insuring you get the highest price possible. 1. Price it a LITTLE LOW This may seem counterintuitive. However, let’s look at this concept for a moment. Many homeowners think that pricing their home a little OVER...

When a homeowner decides to sell their house, they obviously want the best possible price with the least amount of hassles. However, for the vast majority of sellers, the most important result is to actually get the home sold. In order to accomplish all three goals, a seller should realize the importance of using a real estate professional. We realize that technology has changed the purchaser’s...

The most recent Housing Pulse Survey released by the National Association of Realtors revealed that the two major reasons Americans prefer owning their own home instead of renting are: They want the opportunity to build equity. They want a stable and safe environment. Building Equity In a recent article, John Taylor, CEO of the National Community Reinvestment Coalition, explained that those...

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to look at where rates are headed when deciding to buy now or wait until next year. Below is a chart created using Freddie Mac’s October 2015 U.S. Economic & Housing Marketing Outlook. As you can see interest rates are...

Every year at this time, many homeowners decide to wait until after the holidays to put their home on the market for the first time. Others who already have their home on the market decide to take it off the market until after the holidays. Here are six great reasons not to wait: 1. Relocation buyers are out there. Companies are not concerned with holiday time and if the buyers have kids, they want...

// Website | About Tony | Client References | Blog | Search Listings | Featured Listings The Eastside Home Report November 2015 Edition Western Washington Market ReportAnother Client's Succes Story! October 2015 NWMLS Market Report: With holidays approaching, real estate brokers usually expect a slowdown..."Today we have one of the best markets we've ever...

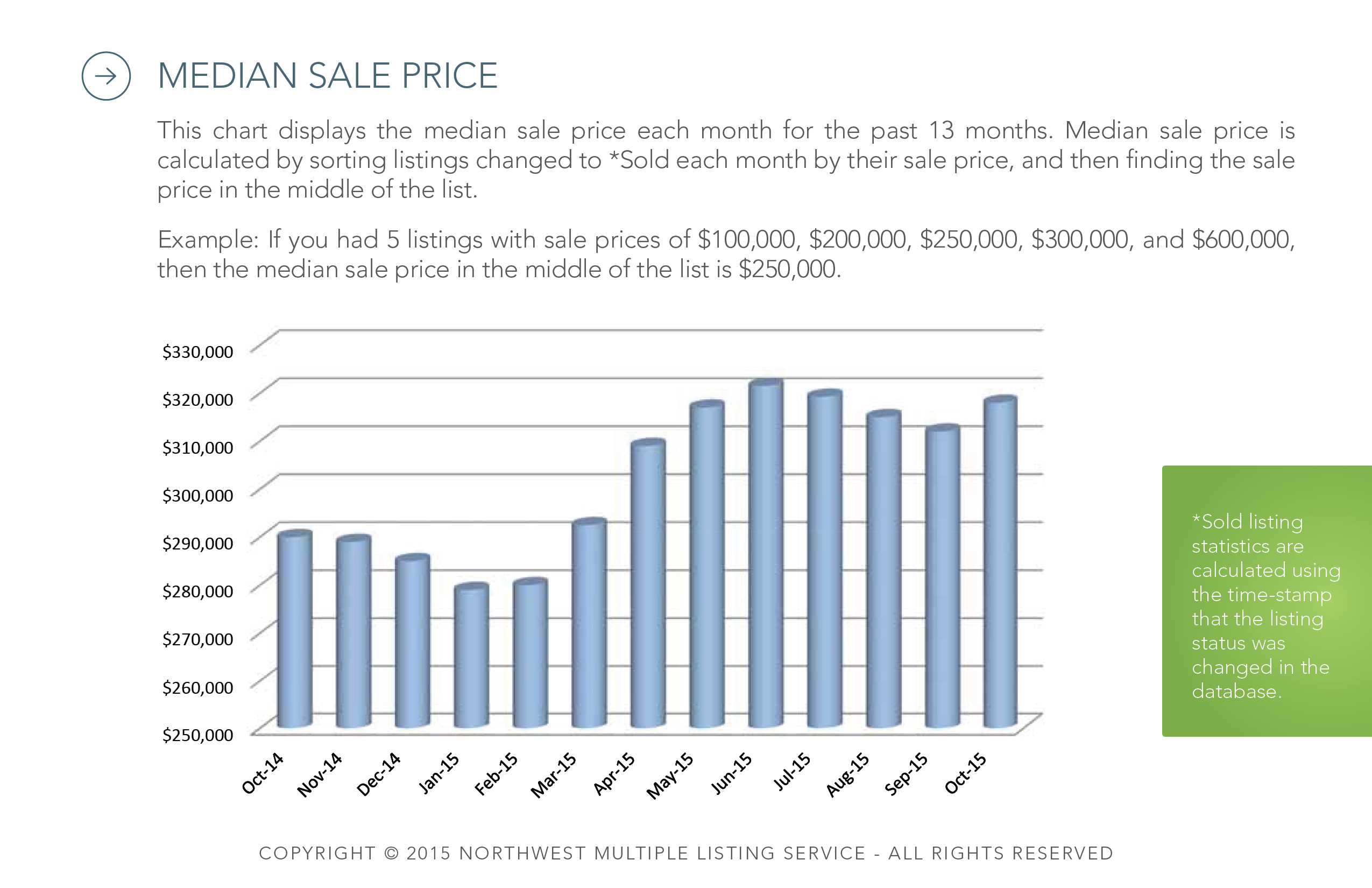

Here are the latest market charts from the MLS. Click on each image below for a larger version. Active Listings vs. Sold Listings Number of Pending Listings Median Sales Price For more information our the Seattle and Eastside Real Estate Market contact Tony Meier...

KIRKLAND, Washington (November 5, 2015) - With holidays approaching, real estate brokers usually expect a slowdown as buyers and sellers shift their attention elsewhere. "This year is different," say some industry leaders. "Today we have one of the best markets we've ever seen for sellers," observed Ken Anderson, managing broker and owner at Coldwell Banker Evergreen in Olympia. "Buyers are still...

The residential housing market has been hot. Home sales have bounced back solidly and are now at their second highest pace since February 2007. Demand remains strong going into the winter. Many real estate professionals are reporting that multiple offers are occurring regularly and listings are actually selling above listing price. What about your house? If your house hasn’t sold, it is probably the...

Within the next five years, Baby Boomers are projected to have the largest household growth of any other generation during that same time period, according to the Joint Center for Housing Studies of Harvard. Let’s take a look at why…In a recent Merrill Lynch study, “Home in Retirement: More Freedom, New Choices” they surveyed nearly 6,000 adults ages 21 and older about housing. Crossing...

There have been some who have voiced doubt as to whether or not the younger generations still consider buying a home as being part of the “American Dream”. A study by Merrill Lynch puts that doubt to rest. According to their research, every living generation still maintains that owning a home is in fact important. Here are the numbers: This should not surprise us as many studies have...

According to a joint study released by Google and the National Association of Realtors, 2 of 3 people searching for a prospective real estate professional research them “extensively online prior to working with them". And, that number is probably increasing every day. Are social media channels such as Facebook really a good place to gather information about an agent before using them? If so, what...

Every Hour in the US Housing Market: 634 Homes Sell 347 Homes Regain Positive Equity Median Home Values Go Up...

The Mortgage Bankers’ Association (MBA) recently released a report: ‘Housing Demand: Demographics And The Numbers Behind The Coming Multi-Million Increase In Households’. In this study, the MBA“utilized a comprehensive analysis of data from 1976 to 2014, a period encompassing several market and housing cycles, to provide a projection of much stronger housing demand over the next...

Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to go it on their own. In today’s market: you need an experienced professional! You Need an Expert Guide if you are Traveling a Dangerous Path The field of real estate is loaded with land mines. You need a true expert to guide you through the dangerous...

Some Highlights: 36% of Americans think they need a 20% down payment to buy a home. 44% of Millennials who purchased a home this year have put down less than 10%. 71% of loan applications were approved last month The average credit score of approved loans was 723 in September (the lowest recorded score since Ellie Mae began tracking in August...

Every three years the Federal Reserve conducts a Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner’s net worth is 36 times greater than that of a renter ($194,500 vs. $5,400). In a recent Forbes article the National Association of Realtors’ (NAR) Chief Economist...

Many have been wondering when the much anticipated move by Millennials’ into homeownership would actually take place. We know the belief in owning a home is there. According to a recent Merrill Lynch study, eighty one percent of Millennials believe “homeownership is an important part of the American Dream”. This compares favorably to previous generations. The...

With residential real estate values rising quite substantially in most parts of the country over the last few years, many homeowners are seeing a major increase in their family’s wealth as equity continues to build in their house. A recent study by the Joint Center of Housing Studies at Harvard University revealed that home equity grew nicely last year and has grown dramatically over the last five...

In the latest Rent vs. Buy Report from Trulia, they explained that home ownership remains cheaper than renting with a traditional 30-year fixed rate mortgage throughout the 100 largest metro areas in the United States. The updated numbers actually show that the range is from an average of 16% in Honolulu (HI), all the way to 55% in Sarasota (FL), and 35% Nationwide! The other...

According to the latest report from the US Census Bureau and the Department of Housing and Urban Development, newly constructed home sales jumped 5.7% month-over-month and 21.6% year-over-year to an annual pace of 552,000. Many buyers are looking to the new homes market to make up for the lack of existing home sales inventory. National Association of Home Builders Chief Economist David Crowe...

It's that time of year; the seasons are changing and with them bring thoughts of the upcoming holidays, family get-togethers, and planning for a new year. Those who are on the fence about whether now is the right time to buy don't have to look much farther to find four great reasons to consider buying a home now, instead of waiting. 1. Prices Will Continue to Rise The Home Price...

Some Highlights: The median price of a newly constructed home is currently $292,700. Sales are up 5.7% month-over-month and 21.6% year-over-year. Many buyers are looking to new homes as an option due to the lack of inventory of existing homes for...