Going into 2023, there was a lot of talk about a possible recession that would cause the housing market to crash. Some in the media were even forecasting home prices would drop by as much as 10-20%—and that might have made you feel a bit unsure about buying a home. But here’s what actually happened: home prices went up more than usual. Brian D. Luke, Head of...

Information for Sellers

If you’ve been thinking about buying a home, mortgage rates are probably top of mind for you. They may even be why you’ve put your plans on hold for now. When rates climbed near 8% last year, some buyers found the numbers just didn’t make sense for their budget anymore. That may be the case for you too. Data from Bright MLS shows...

If you’re trying to buy a home and are having a hard time finding one you can afford, it may be time to consider a fixer-upper. That’s a house that needs a little elbow grease or some updates, but has good bones. Fixer-uppers can be a really great option if you’re looking to break into the housing market or want to stretch your budget...

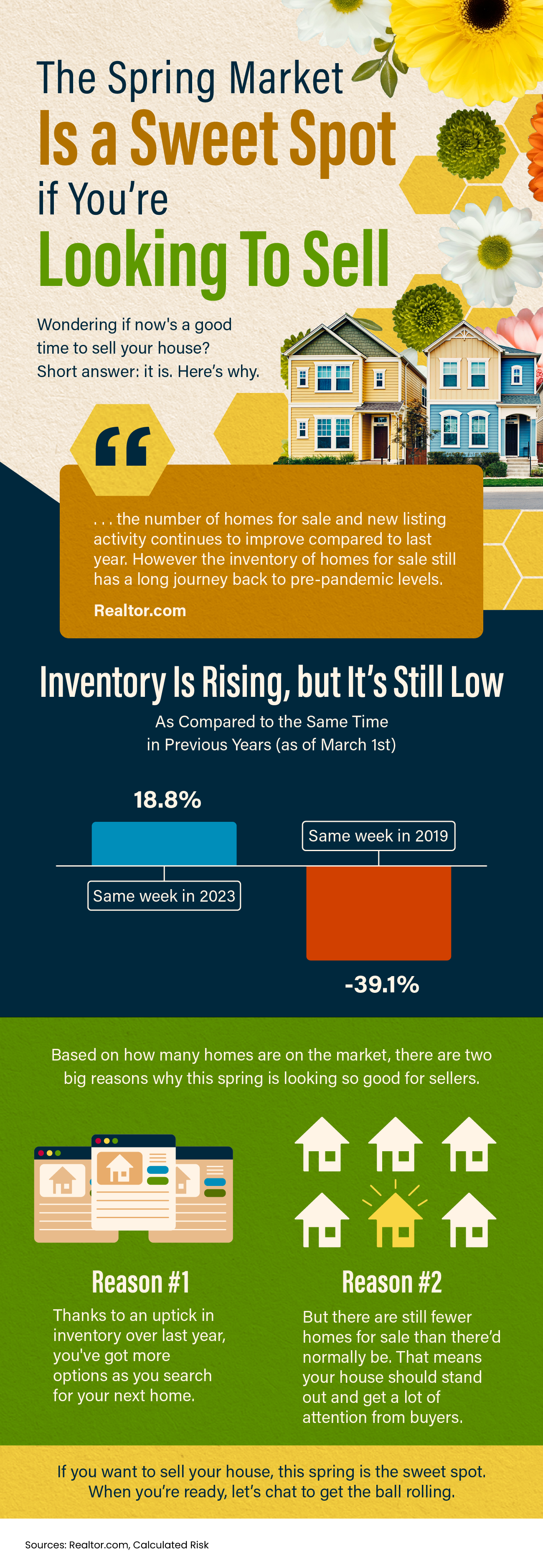

Some Highlights Wondering if now’s a good time to sell your house? Based on how many homes are on the market, there are two big reasons why this spring is looking so good for sellers. Thanks to an uptick in inventory over last year, you’ve got more options for your next home. But there are still fewer homes for sale than there’d normally be, meaning your house...

If you’re gearing up to sell your house this spring, one of the early conversations you’ll have with your agent is about how much access you want to give buyers. And you may not realize just how important it is to make your house easy to tour. Spring is the peak homebuying season, so opening up your house to as many showings as possible can really help you capitalize on all...

If you’re taking a look at your expenses as you retire, saving money where you can has a lot of appeal. One long-standing, popular way to do that is by downsizing to a smaller home. When you think about cutting down on your spending, odds are you think of frequent purchases, like groceries and other goods. But when you downsize your house, you often end up downsizing the bills that...

There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to show you why that isn’t going to happen. According to Jacob Channel, Senior Economist at LendingTree, the economy’s pretty strong: “At least right now, the...

If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An article from US Bank explains: “A credit score isn’t the only deciding...

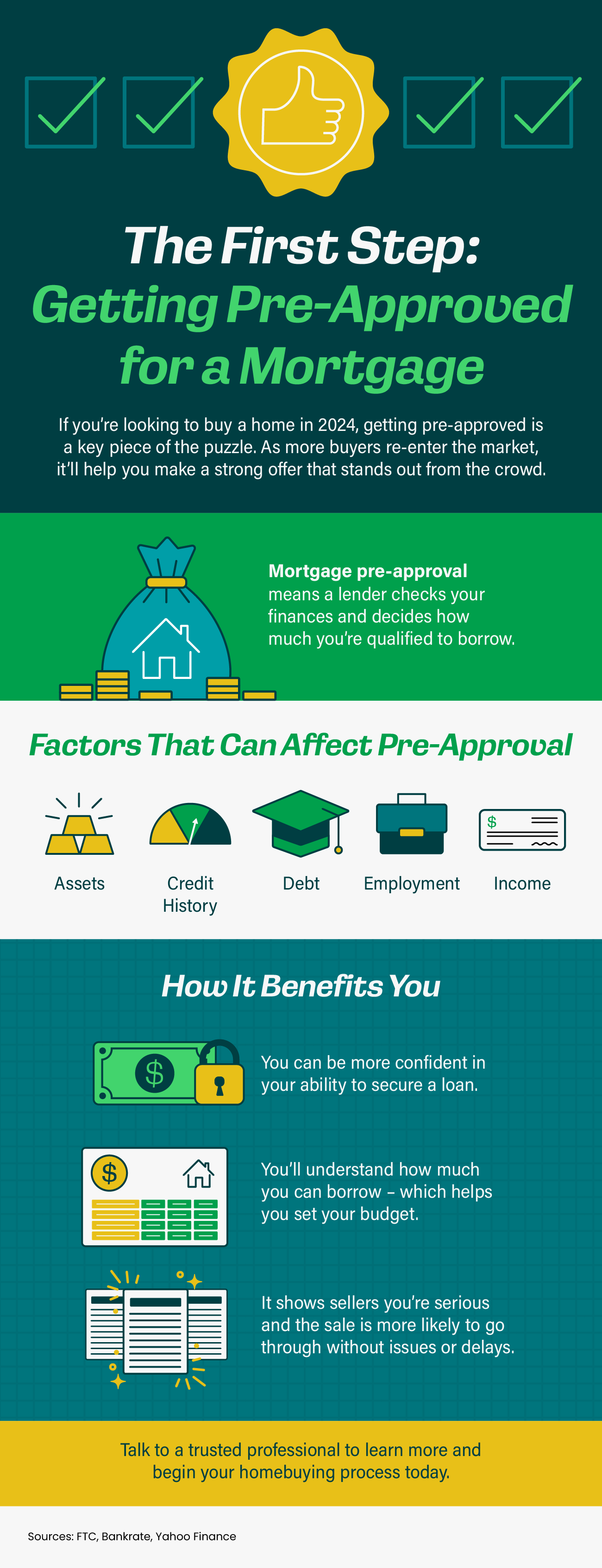

Some Highlights If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow. As more buyers re-enter the market, it’ll help you make a strong offer that stands out from the crowd. Talk to a trusted...

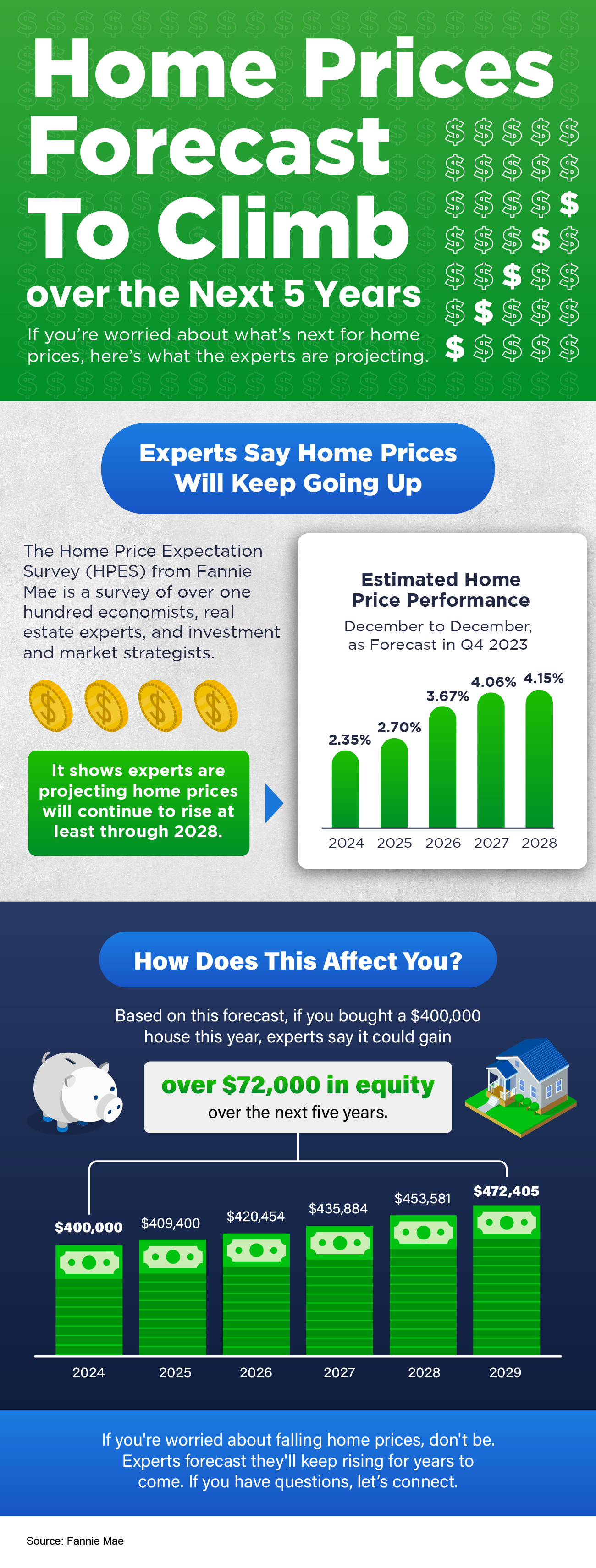

If you’re holding out hope that the housing market is going to crash and bring home prices back down, here’s a look at what the data shows. And spoiler alert: that’s not in the cards. Instead, experts say home prices are going to keep going up. Today’s market is very different than it was before the housing crash in 2008. Here’s why. It’s Harder To Get a Loan Now...

No matter how you slice it, buying or selling a home is a big decision. And when you’re going through any change in your life and you need some guidance, what do you do? You get advice from people who know what they’re talking about. Moving is no exception. You need insights from the pros to help you feel confident in your decision. Freddie Mac explains it...

Wondering if it still makes sense to sell your house right now? The short answer is, yes. And if you look at the current number of homes for sale, you’ll see two reasons why. An article from Calculated Risk shows there are 15.6% more homes for sale now compared to the same week last year. That tells us inventory has grown. But going back to 2019, the last normal year in the...

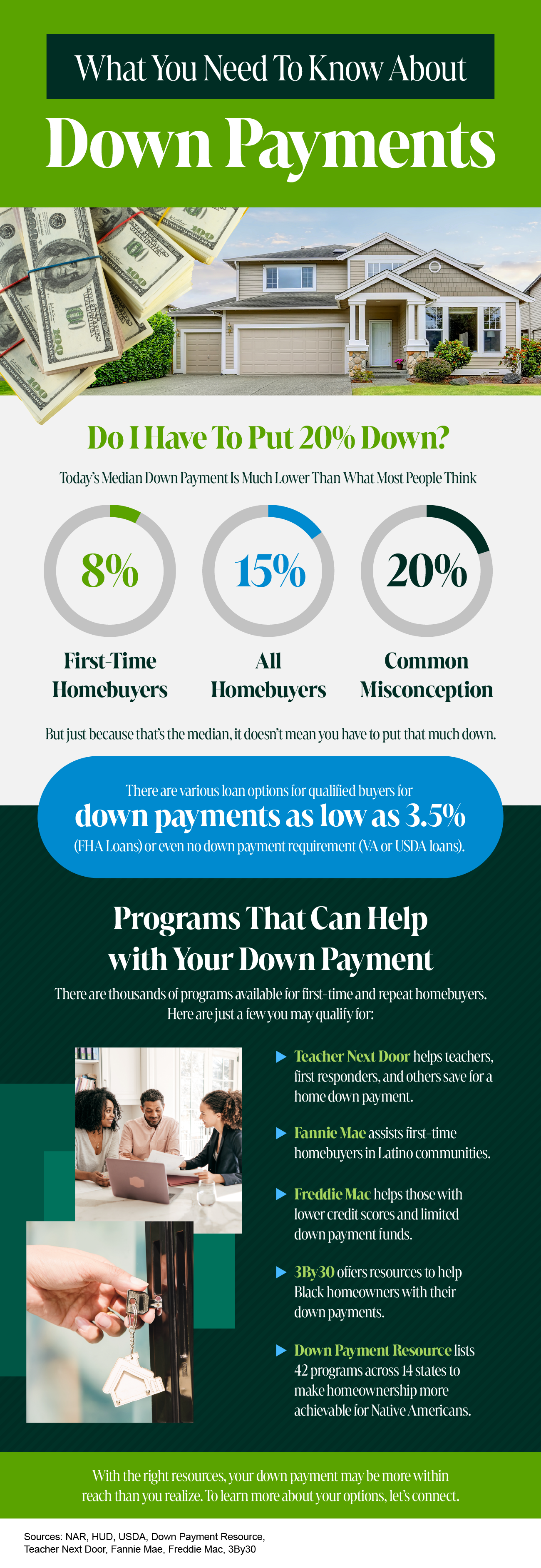

If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case. Unless specified by your loan type or lender, it’s typically not required to put 20% down. That...

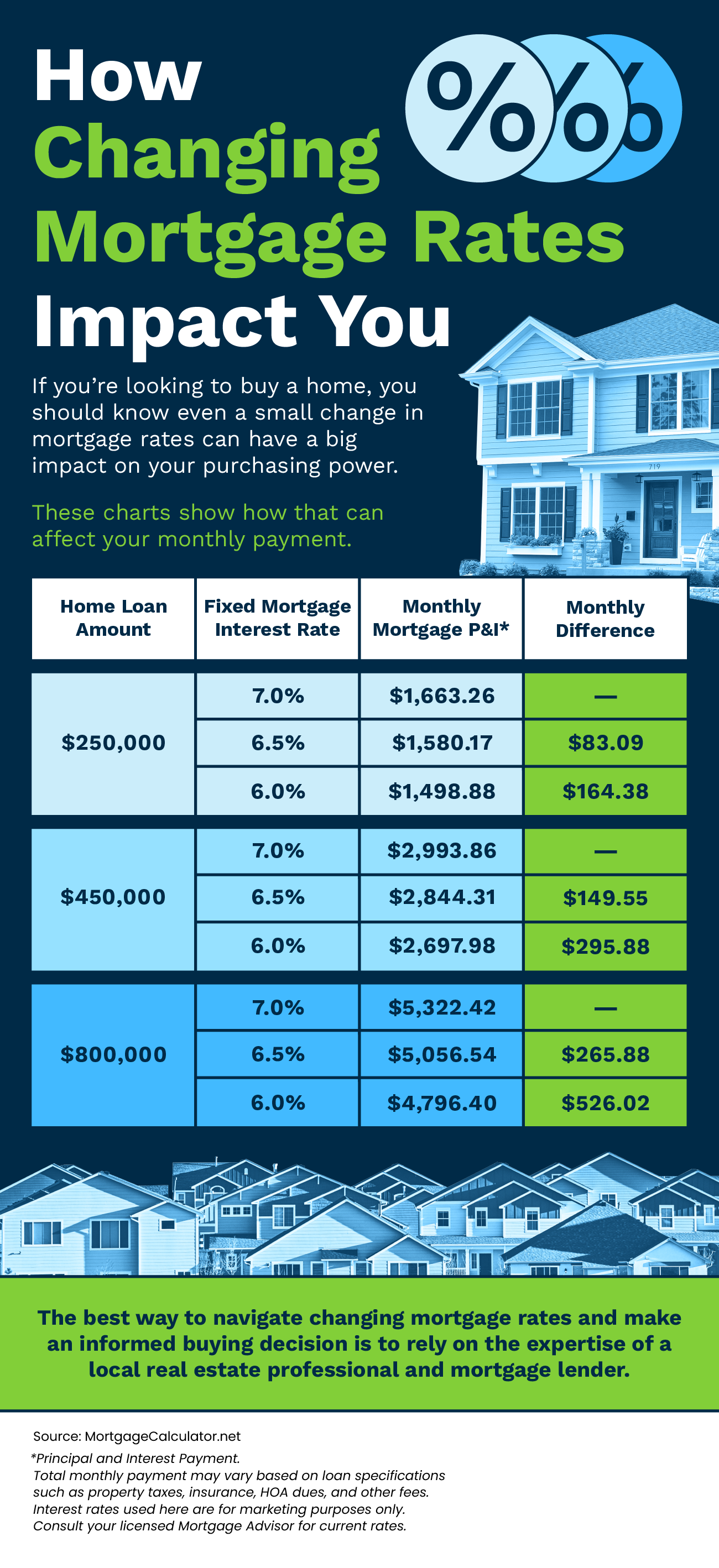

Some Highlights If you’re looking to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month. That’s because even a small change in mortgage rates can have a big impact on your purchasing power. The best way to navigate changing mortgage rates and make an informed buying...

Over the past few months, experts have revised their 2024 home price forecasts based on the latest data and market signals, and they’re even more confident prices will rise, not fall. So, let’s see exactly how experts’ thinking has shifted – and what’s caused the change. 2024 Home Price Forecasts: Then and Now The chart below shows what seven expert...

There’s a lot of confusion in the market about what’s happening with day-to-day movement in mortgage rates right now, but here’s what you really need to know: compared to the near 8% peak last fall, mortgage rates have trended down overall. And if you’re looking to buy or sell a home, this is a big deal. While they’re going to continue to bounce around a bit...

Buying your first home is a big, exciting step and a major milestone that has the power to improve your life. As a first-time homebuyer, it's a dream you can make come true, but there are some hurdles you'll need to overcome in today’s housing market – specifically the limited supply of homes for sale and ongoing affordability challenges. So, if you're...

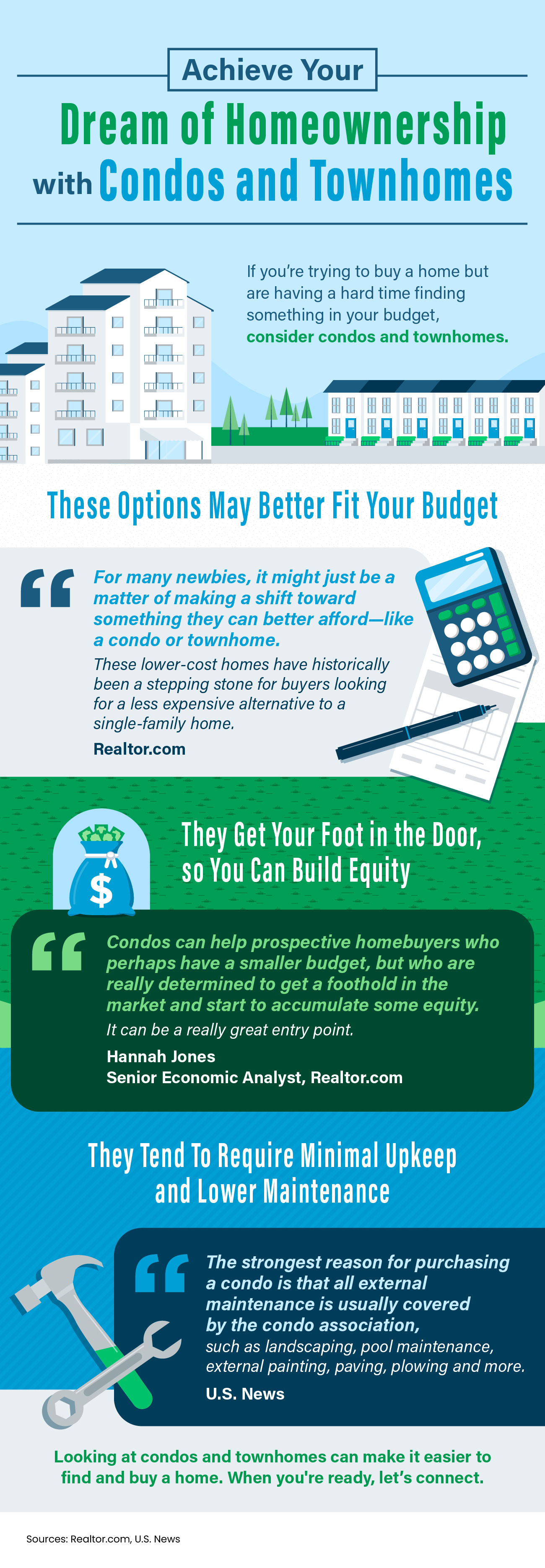

Some Highlights If you’re trying to buy a home but are having a hard time finding something in your budget, here’s something that can help: consider condos and townhomes. They may better fit your budget, can help you start building equity, and tend to require minimal upkeep and less maintenance. Looking at condos and townhomes can make it easier to find and buy...

Based on what you’re hearing in the news about home prices, you may be worried they’re falling. But here’s the thing. The headlines aren’t giving you the full picture. If you look at the national data for 2023, home prices actually showed positive growth for the year. While this varies by market, and while there were some months with slight declines nationally,...

Chances are at some point in your life you’ve heard the phrase, home is where the heart is. There’s a reason that’s said so often. Becoming a homeowner is emotional. So, if you’re trying to decide if you want to keep on renting or if you’re ready to buy a home this year, here’s why it’s so easy to fall in love with homeownership. Customizing to Your...

Homeownership is a major part of the American Dream. But, the path to achieving this dream can be quite difficult. While progress has been made to improve fair housing access, households of color still face unique challenges on the road to owning a home. Working with the right real estate experts can make all the difference for diverse buyers. It's clear that achieving homeownership...

Are you feeling a bit unsure about what’s really happening with mortgage rates? That might be because you’ve heard someone say they’re coming down. But then you read somewhere else that they’re up again. And that may leave you scratching your head and wondering what’s true. The simplest answer is: that what you read or hear will vary based on the time frame they’re looking at....

Some Highlights In today's housing market, you can still come out on top if you have the right team and plan. To win when buying a home, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd. Let’s connect today to make your winning...

As you think about the year ahead, one of your big goals may be moving. But, how do you know when to make your move? While spring is usually the peak homebuying season, you don’t actually need to wait until spring to sell. Here's why. 1. Take Advantage of Lower Mortgage Rates Last October, the 30-year fixed mortgage rates peaked at 7.79%. In January, they hit their lowest...

Have you ever heard the term “Silver Tsunami” and wondered what it's all about? If so, that might be because there’s been lot of talk about it online recently. Let's dive into what it is and why it won't drastically impact the housing market. What Does Silver Tsunami Mean? A recent article from HousingWire calls it: “. . . a colloquialism referring to aging...

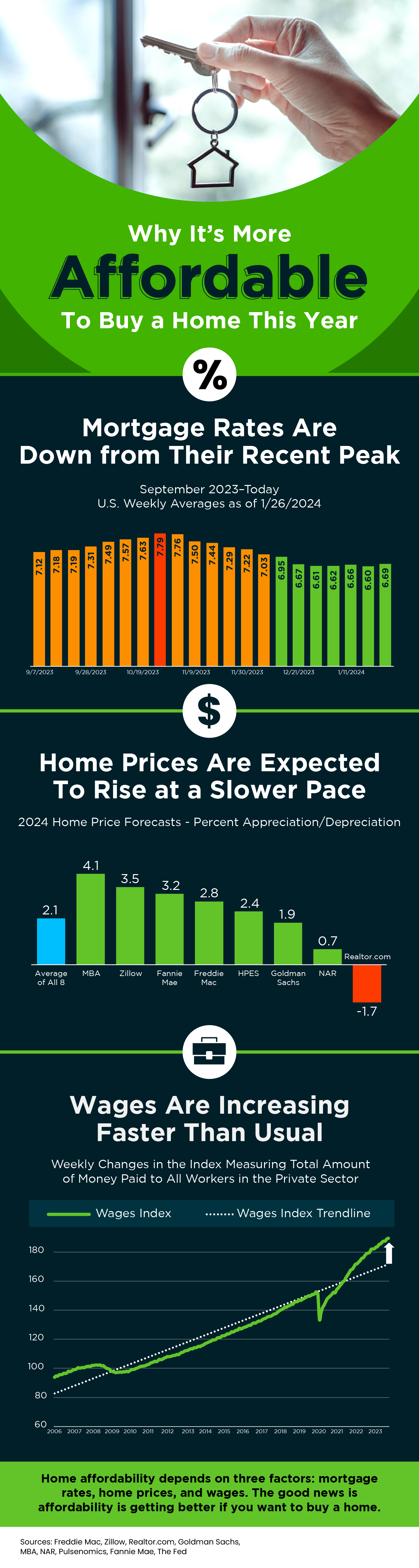

Some Highlights Home affordability depends on three factors: mortgage rates, home prices, and wages. Mortgage rates are down from their recent peak, home prices are expected to rise at a slower pace, and wages are increasing faster than usual. That’s good news if you want to buy a home because it means affordability is getting...

Has the idea of sharing a home with loved ones like your grandparents, parents, or other relatives crossed your mind? If so, you’re not alone. More buyers are choosing to go this route and buy a multi-generational home. Here’s a look at some of the top reasons why, to see if a home like this may be right for you too. Why Buyers Are Opting for Multi-Generational Living According to...

Even though home prices are going up nationally, some people are still worried they might come down. In fact, a recent survey from Fannie Mae found that 24% of people think home prices will actually decline over the next 12 months. That means almost one out of every four people are dealing with that fear, and you might be, too. To help ease that concern, here's what experts...

If one of the goals on your list is selling your house and making a move this year, you’re likely juggling a mix of excitement about what’s ahead and feeling a little sentimental about your current home. A great way to balance those emotions and make sure you’re confident in your decision is to keep these three best practices in mind when you’re ready to sell. 1....

Some Highlights Buying a home is a big deal and can feel especially complicated if you don't know the terms used during the process. If you want to become a homeowner this year, it's a good idea to learn these key housing terms and understand how they relate to the current housing market. That will help you feel confident when...

Over the past year, a lot of people have been talking about housing affordability and how tight it’s gotten. But just recently, there’s been a little bit of relief on that front. Mortgage rates have gone down since their most recent peak in October. But there’s more to being able to afford a home than just mortgage rates. To really understand home affordability, you need...

If you’ve been holding off on selling your house to make a move because you felt mortgage rates were too high, their recent downward trend is exciting news for you. Mortgage rates have descended since last October when they hit 7.79%. In fact, they’ve been below 7% for over a month now (see graph below): And while they’re not going back to the 3% we saw during...

Are you putting off your plans to sell because you’re worried you won’t be able to find a home you like when you move? If so, it may be time to consider a newly built home and the benefits that come with one. Here’s why. Near-Record Percentage of New Home Inventory Newly built homes are becoming an increasingly significant part of today’s housing inventory. According to the most...

Buying a home is a powerful decision, and it remains at the heart of the American Dream. Unlike renting, owning a home means more than just having a place to live – it offers a sense of belonging, stability, and freedom. According to Nicole Bachaud, Senior Economist at Zillow: “The American Dream is still owning a home. There’s a lot of pent-up demand for ownership; that isn’t...

Some Highlights If you’re worried about what’s next for home prices, know the HPES shows experts are projecting they’ll continue to rise at least through 2028. Based on that forecast, if you bought a $400,000 house this year, experts say it could gain over $72,000 in equity over the next five years. If you're worried about falling home prices, don't be. Many...

If you're trying to decide whether to rent or buy a home this year, here's a powerful insight that could give you the clarity and confidence you need to make your decision. Every three years, the Federal Reserve releases the Survey of Consumer Finances (SCF), which compares net worth for homeowners and renters. The latest report shows the average homeowner’s...

If you’re getting ready to buy a home, it’s exciting to jump a few steps ahead and think about moving in and making it your own. But before you get too far down the emotional path, there are some key things to keep in mind after you apply for your mortgage and before you close. Here’s a list of things to remember when you apply for your home loan. Don’t Deposit...

If you’ve owned your house for at least a couple of years, there’s something you’re going to want to know more about – and that’s home equity. If you’re not familiar with that term, Freddie Mac defines it like this: “. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.” That means your equity...

If you want to buy a home, it's important to know how mortgage rates impact what you can afford and how much you’ll pay each month. Fortunately, rates for 30-year fixed mortgages have come down significantly since the end of October and are currently under 7%, according to Freddie Mac (see graph below): This recent trend is great news for buyers. As a...

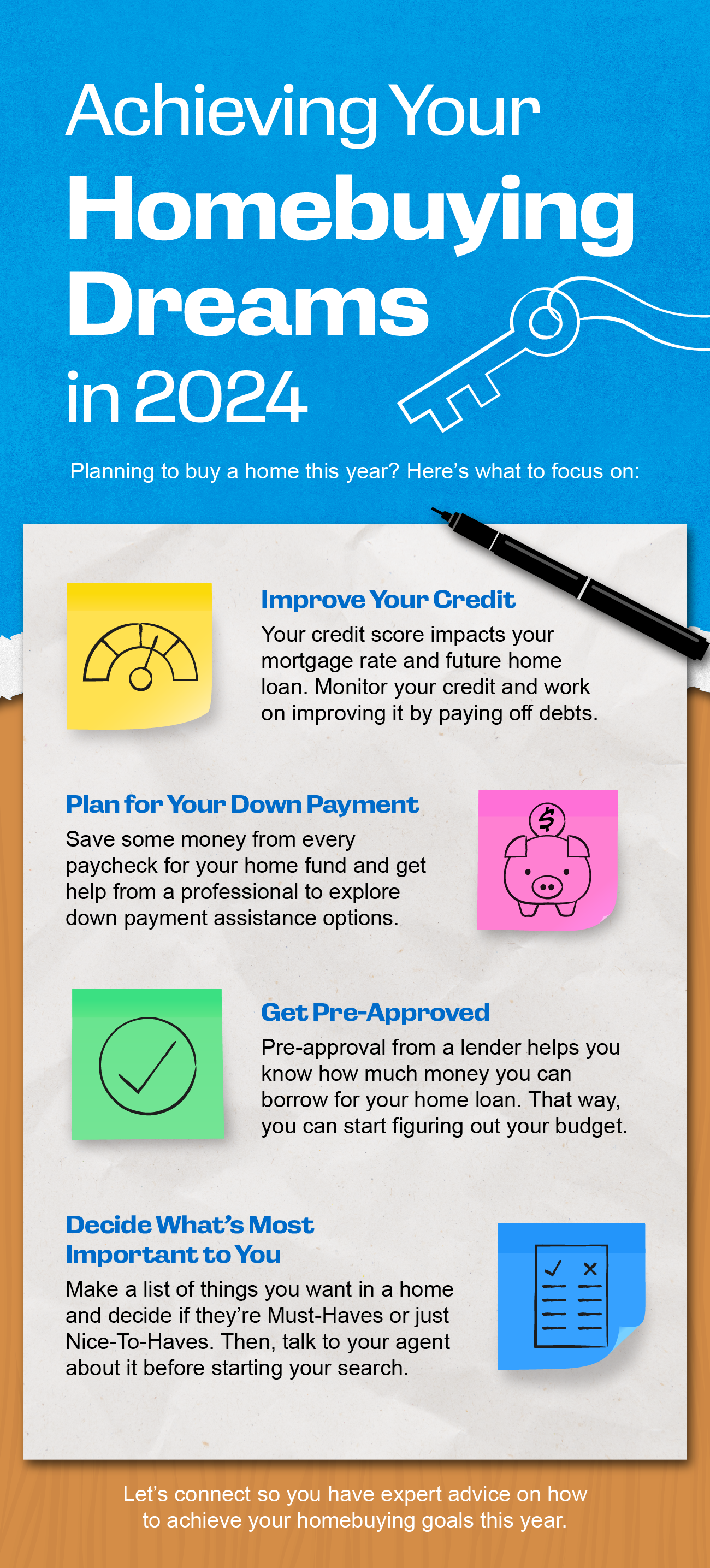

Some Highlights Planning to buy a home in 2024? Here’s what to focus on. Improve your credit score, plan for your down payment, get pre-approved, and decide what’s most important to you. Let’s connect so you have expert advice on how to achieve your homebuying goals this year. GO TO BLOG...

If you’re thinking about buying a home, pre-approval is a crucial part of the process you definitely don’t want to skip. So, before you start picturing yourself in your new living room or dining on your future all-season patio, be sure you’re working with a trusted lender to prioritize this essential step. Here’s why. While home price growth is moderating...

If you’re thinking of buying a home this year, you’re probably paying closer attention than normal to the housing market. And you’re getting your information from a variety of channels: the news, social media, your real estate agent, conversations with friends and loved ones, the list goes on and on. Most likely, home prices and mortgage rates are coming up a...

If your listing has expired and your house didn’t sell, it's completely normal to feel a mix of frustration and disappointment. Understandably, you're probably wondering what may have gone wrong. Here are three questions to think about as you figure out what to do next. Did You Limit Access to Your House? One of the biggest mistakes you can make when selling your house is restricting the...

If you’re thinking about retirement or have already retired this year, it’s a good time to consider if your current house is still a good fit for the next chapter in your life. Fortunately, you may be in a better position to make a move than you realize. Here are a few things to think about as you decide whether or not to sell and make a move. How Long You’ve Been in Your...

As the new year approaches, the idea of buying a home might be on your mind. It’s an exciting goal to set, and it's never too early to start laying the groundwork. One crucial step to prepare for homeownership is building a solid credit score. Lenders review your credit to assess your ability to make payments on time, pay back debts, and more. It’s also a factor that helps...

If you're thinking about selling your house on your own, called “For Sale by Owner” or FSBO, there are some important things to consider. Going this route means taking on a lot of responsibilities by yourself – and that can be a bit of a headache. A recent report from the National Association of Realtors (NAR) found two of the most difficult tasks for people who...

When you read about the housing market, you’ll probably come across some information about inflation or recent decisions made by the Federal Reserve (the Fed). But how do those two things impact you and your homebuying plans? Here's what you need to know. The Federal Funds Rate Hikes Have Stalled One of the Fed’s primary goals is to lower inflation. In order to do that,...

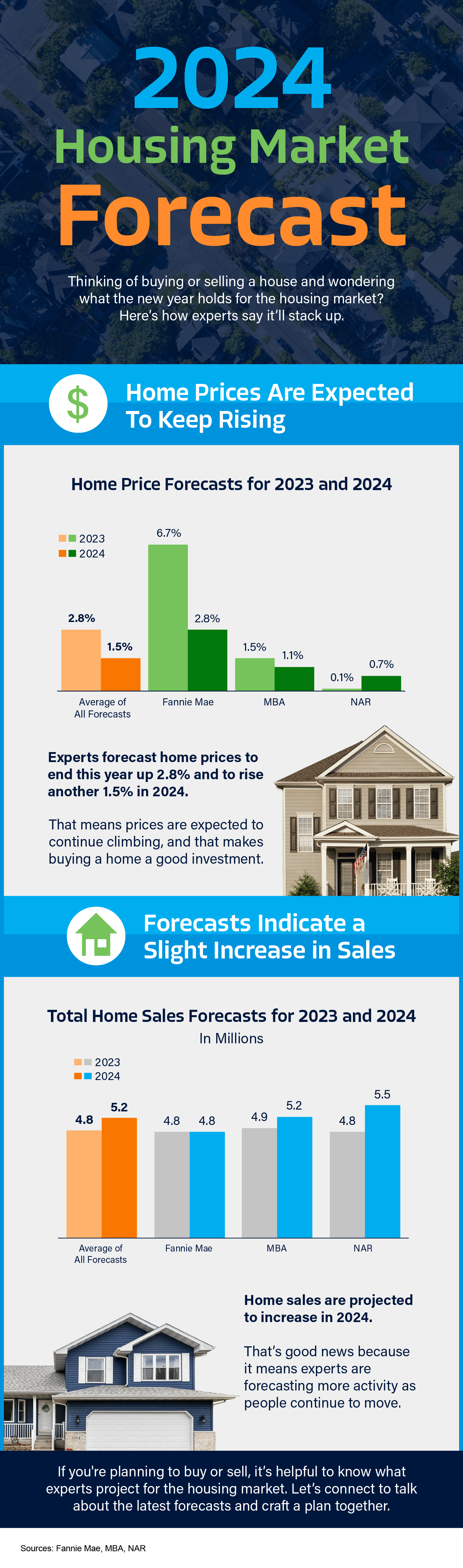

If you’re thinking about buying or selling a home soon, you probably want to know what you can expect from the housing market in 2024. In 2023, higher mortgage rates, confusion over home price headlines, and a lack of homes for sale created some challenges for buyers and sellers looking to make a move. But what’s on the horizon for the new year? The...

If you were worried buyer demand disappeared when mortgage rates went up, the data shows there are plenty of interested buyers still out there. The housing market isn't as frenzied as it was during the ‘unicorn’ years when buyer demand was through the roof, mortgage rates were historically low, and home values rose like we’ve never seen before. But that...

Some Highlights If you want to buy a home, you may not need as much for your down payment as you think. There are various loan options for qualified buyers with down payments as low as 3.5% or even no down payment requirement. There are also thousands of programs available to help homebuyers with their down payments. With the right resources, your down payment may be...

Click the images below to download your free...

Has your house been sitting on the market a while without selling? If so, you should know that’s pretty unusual, especially right now. That’s because the supply of homes available for sale is still far lower than what we’d see in a normal year. That means buyers have fewer options than they usually would, so your house should be an oasis in...

If you're thinking about moving, it's important to know what's happening in the housing market. Here's an update on the supply of homes currently for sale. Whether you're buying or selling, the number of homes in your area is something you should pay attention to. In the housing market, there are regular patterns that happen every year, called seasonality. Spring is...

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think: Data from NAR shows the median down payment hasn’t...

There’s no denying mortgage rates and home prices are higher now than they were last year and that’s impacting what you can afford. At the same time, there are still fewer homes available for sale than the norm. These are two of the biggest hurdles buyers are facing today. But there are ways to overcome these things and still make your dream...

If you’ve recently decided you’re ready to become a homeowner, chances are you’re trying to figure out what to do first. It can feel a bit overwhelming to know where to start, but the good news is you don’t have to navigate all of that alone. When it comes to buying a home, there are a lot of moving pieces. And that’s especially true in today’s housing market. The number...

Does the rising cost of just about everything these days make your dream of owning your own home feel less within reach? According to Bankrate, many people are seeking additional income through side hustles, possibly to cope with those increasing expenses and save for a home. This trend is particularly popular with younger individuals who may be dealing with student loan debt (see...

If you’re thinking about selling your house, you may have heard the supply of homes for sale is still low, and that means your house should stand out to buyers who are craving more options. But you may also be wondering, once you sell, how does the current supply impact your own move? And, will you be able to find a home you want to buy with inventory this low? One thing that can...

Even with so much data showing home prices are actually rising in most of the country, there are still a lot of people who worry there will be another price crash in the immediate future. In fact, a recent survey from Fannie Mae shows that 23% of consumers think prices will fall over the next 12 months. That’s nearly one in four people who are dealing with that...

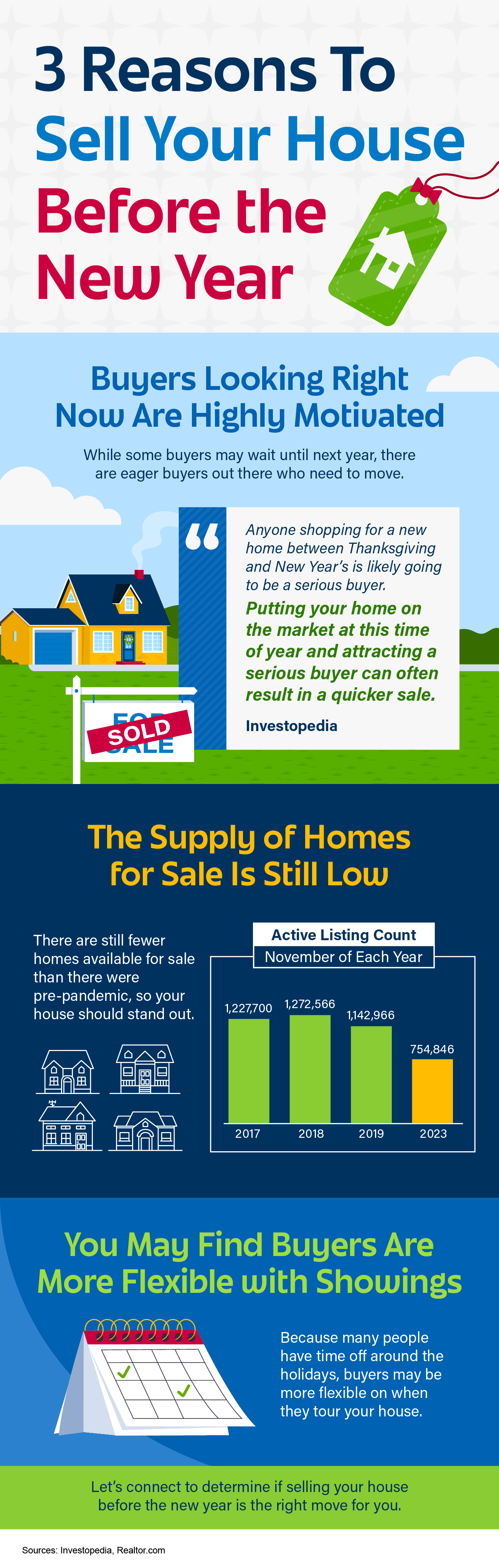

Some Highlights Here are a few reasons you may not want to hold off until the new year to sell your house. Buyers looking right now are highly motivated, the supply of homes for sale is still low, and you may find buyers are more flexible with showings this time of year. Let’s connect to determine if selling your house now is...

Everyone has their own idea of the American Dream, and it's different for each person. But, in a recent survey by Bankrate, people were asked about the achievements they believe represent the American Dream the most. The answers show that owning a home still claims the #1 spot for many Americans today (see graph below): In fact, according to the graph, owning a home is...

If you’re worried about a coming recession, you’re not alone. Over the past couple of years, there’s been a lot of recession talk. And many people worry, if we do have one, it would cause the unemployment rate to skyrocket. Some even fear that a spike in unemployment would lead to a rash of foreclosures similar to what happened 15 years ago. However, the latest Economic...

If you’re looking to make a move, you want to be sure you have the latest information on the housing market. To help make that possible, here’s an update on the supply of homes for sale today. Whether you’re looking to buy or sell, the number of homes available in your local market matters to you. Take a look below. What’s the Truth About Today’s Housing...

This time every year, homeowners who are planning to move have a decision to make: sell now or wait until after the holidays? Some sellers with homes already on the market may even remove their listing until the new year. But the truth is, many buyers want to purchase a home for the holidays, and your house might be just what they’re looking for. As an article from Fortune...

Some Highlights Thinking of buying or selling a house and wondering what the new year holds for the housing market? Experts forecast home prices to end this year up 2.8% and to rise another 1.5% in 2024. And climbing prices help make homeownership a good investment. Plus, home sales are projected to increase in 2024....

https://youtu.be/M0vAZKiXRbM?si=3buYeNlq2LZxT7Yr In this must-watch update, Tony Meier, a seasoned real estate expert from Windermere Real Estate, brings 34 years of experience to dissect the dynamic shifts in Seattle's Eastside housing market. From gearing towards a buyer's market in 2022 to witnessing a dramatic turnaround in 2023, we explore what's driving these changes and what they mean for...

If you're thinking about buying or selling a home, you might have heard that it’s tough right now because mortgage rates are higher than they’ve been over the past few years, and home prices are rising. That much is true. Take a look at the graph below. It breaks down how the current affordability situation stacks up to recent...

The new year is right around the corner, and you might be wondering if 2024 will be the right time to buy or sell a home. If you want to make the most informed decision possible, it’s important to know what the experts have to say about what's ahead for the housing market. Spoiler alert: the projections may be better than you think. Here’s why. Experts Forecast Ongoing Home Price...

If you’re considering buying a home or selling your current one to find something that better suits your needs, you may have questions about what’s happening with home prices today. Here’s what you need to know. There’s still a lot of confusion and misinformation out there. So, no matter what you may have heard, the national data shows they've actually...

Life is a journey filled with unexpected twists and turns, like the excitement of welcoming a new addition, retiring and starting a new adventure, or the bittersweet feeling of an empty nest. If something like this is changing in your own life, you may be considering buying or selling a house. That’s because through all these life-altering events, there is one common...

Some Highlights VA home loans can help people who served our country become homeowners. These loans can help qualified individuals purchase a VA-approved home or condo, build a new home, or enhance their current one. Owning a home is the American Dream, and one way to show our appreciation to veterans is by providing them with important...

https://youtu.be/vco9-GJdc_U?si=nRVH_nQIBd9xLu6i Join Tony Meier, a highly experienced real estate expert from Windermere Real Estate, as he delves into the latest trends shaping Seattle's Eastside housing market. With a notable shift in both interest rates and inventory levels, our update on November 8th, 2023, promises key insights for buyers, sellers, and market enthusiasts alike. 🏡...

For more than 79 years, Veterans Affairs (VA) home loans have helped millions of veterans buy their own homes. If you or someone you care about has served in the military, it's essential to learn about this program and its advantages. Here are some important things to know about VA loans before you buy a home. The Many Advantages of VA Home Loans VA home loans provide a pathway to...

Are you dreaming of buying your own home and wondering about how you’ll save for a down payment? You're not alone. Some people think about tapping into their 401(k) savings to make it happen. But before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert. Here’s why. The Numbers May Make...

If you’re weighing your options to decide whether it makes more sense to rent or buy a home today, here’s one key data point that could help you feel more confident in making your decision. Every three years, the Federal Reserve Board releases the Survey of Consumer Finances (SCF). That report covers the difference in net worth for both homeowners and renters....

As the year winds down, you may have decided it's time to make a move and put your house on the market. But should you sell now or wait until January? While it may be tempting to hold off until after the holidays, here are three reasons to make your move before the new year. Get One Step Ahead of Other Sellers Typically, in the residential real estate market, homeowners are less likely to list...

Some Highlights If you’re ready to buy a home but are having a hard time affording it on your own, or, if you have aging loved ones you need to care for, you might want to consider a multi-generational home. Living with siblings, parents, and even grandparents can help you save money, give or receive childcare, and spend quality time together....

According to the latest data from Fannie Mae, 23% of Americans still think home prices will go down over the next twelve months. But why do roughly 1 in 4 people feel that way? It has a lot to do with all the negative talk about home prices over the past year. Since late 2022, the media has created a lot of fear about a price crash and those concerns are still lingering....

Maybe you’re in the market for a home and are having a hard time finding the right one that fits your budget. Or perhaps you’re already a homeowner in need of extra income or a place for loved ones. Whether as a potential homebuyer or a homeowner with changing needs, accessory dwelling units, or ADUs for short, may be able to help you reach your goals. What Is an...

This analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner to help you make informed real estate decisions. WESTERN WASHINGTON ECONOMIC OVERVIEW The pace of job growth continues to slow in Western Washington, as the region added only 21,907 new positions over the past 12 months. This represented a growth...

https://youtu.be/6DDVarJsHjI?si=cq9etT5uZF03JKUA Ever pondered the real implications of postponing that home purchase by just a year in the fast-paced markets of Seattle, the Eastside, and Snohomish County? Tony Meier, a revered expert with 34 rich years under Windermere Real Estate's banner, delves deep into the numbers, shedding light on the actual costs and how it could reshape your financial...

If you've been following the news recently, you might have seen articles about an increase in foreclosures and bankruptcies. That could be making you feel uneasy, especially if you're thinking about buying or selling a house. But the truth is, even though the numbers are going up, the data shows the housing market isn’t headed for a crisis. Foreclosure Activity...

2023 Real Estate Analysis: Zillow, WSJ & Redfin’s Misjudgments & Impacts on National & Local Markets

https://youtu.be/Q03T-lgpizM?si=XqPRsYl5g9at-jXq Join Tony Meier, a seasoned real estate expert from Windermere Real Estate with an impressive 34 years of experience, as we delve deep into the misconceptions and failed predictions on the 2023 Buyer's Market by giants like Zillow, Barrons, Wall Street Journal, and Redfin. In this comprehensive analysis, we'll explore: - The disparities in expert...

https://youtu.be/8LzWG3UZdwA?si=cDuXiYZJVkAaI7DM Join Tony Meier, your trusted real estate connoisseur with a remarkable 34-year journey at Windermere Real Estate, as he navigates through Seattle's Eastside housing pulse amidst the backdrop of escalating interest rates. 2023 might have ushered in higher rates, but did it dent the market's spirit? Let's unpack! 🔍 **In this video,...

Do negative headlines and talk on social media have you feeling worried about the housing market? Maybe you’ve even seen or heard something lately that scares you and makes you wonder if you should still buy or sell a home right now. Regrettably, when news in the media isn't easy to understand, it can make people feel scared and unsure. Similarly, negative talk on social...

The idea of owning a home has always been a big part of the American Dream. It's a symbol of stability, independence, and having a place to truly call your own. But for Gen Z, the "Zoomers" born between 1997 and 2012, making that dream a reality can feel like quite the challenge today with higher mortgage rates and rising home prices. But achieving that goal of owning your first...

Are you wondering if it makes sense to buy a home right now? While today’s mortgage rates might seem a bit intimidating, here are two compelling reasons why it still may be a good time to become a homeowner. Home Values Appreciate over Time There’s been a lot of confusion around what’s happened with home prices over the past two years. While they did dip ever so...

Are you thinking about selling your house as a For Sale by Owner (FSBO)? If so, know there's a whole lot more time and expertise needed in that process than you might think. While the idea of doing it all by yourself might seem tempting, it's important to recognize the challenges you may face if you take it on all by yourself. As a recent article from Bankrate explains: “Choosing the...

If you're considering selling your house right now, it's likely because something in your life has changed. And while things like mortgage rates play a big role in your decision, you don’t want that to overshadow why you thought about making a move in the first place. It’s true mortgage rates are higher right now, and that has an impact on affordability. As a...

In today's world of rising housing costs, many buyers are looking for ways to still be able to buy a home. Some of them have found a solution in multi-generational living. Multi-generational living is when two or more adult generations live together under one roof. This includes siblings, parents, or even grandparents. Here’s an in-depth look at why more buyers are choosing this option...

Mortgage rates have been back on the rise recently and that’s getting a lot of attention from the press. If you’ve been following the headlines, you may have even seen rates recently reached their highest level in over two decades (see graph below): That can feel like a little bit of a gut punch if you’re thinking about making a move. If you’re wondering...

Some Highlights When deciding between buying a home or renting, think about these three important factors. Buying a home means avoiding rising rents, owning a tangible and valuable asset, and growing your wealth over time. If you’re ready to enjoy the advantages of owning a home, let’s connect to discuss...

Take a moment to imagine where you want to be in a few years. You might be thinking about your job, money, wanting more stability, or goals you want to reach soon. Is homeownership a part of that vision? If it is, you should know owning a home has a whole lot of financial benefits. One of the many reasons to buy a home is that it’s a great way to build wealth and gain...

Some Highlights If you’re thinking about buying a home this year, be sure to consider the long-term financial advantages of homeownership, like home equity. On average, people who bought homes 32 years ago have seen their home’s value nearly triple over that time. If you’re wondering if buying a home is a good idea, remember rising home...

The increasing effects of natural disasters are leading to new obstacles in residential real estate. As a recent article from CoreLogic explains: “As the specter of climate change looms large, the world braces for unprecedented challenges. In the world of real estate, one of those challenges will be the effects of natural catastrophes on property portfolios, homeowners, and...

Are you considering buying your first home? If so, it can be helpful to know what led other people to make that decision. According to a recent survey of first-time homebuyers by PulteGroup: “When asked why they purchased their first home recently, the answer was simple: because they wanted to. Either the desire to stop renting or recognition that homeownership is a smart...

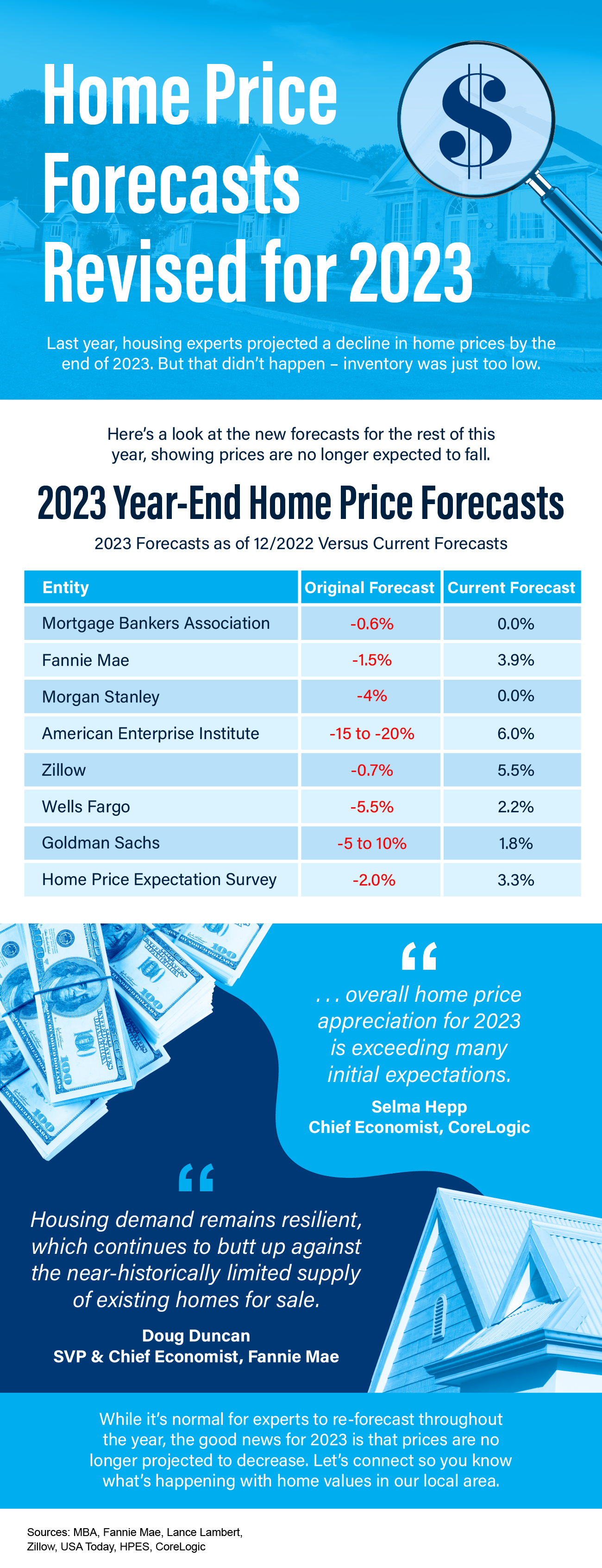

During the fourth quarter of last year, some housing experts projected home prices were going to crash in 2023. The media ran with those forecasts and put out headlines calling for doom and gloom in the housing market. All of this negative news coverage made a lot of people have doubts about the strength of the residential real estate market. If it made you question if you should...

If you’re thinking about buying a home soon, higher mortgage rates, rising home prices, and ongoing affordability concerns may make you wonder if it still makes sense to buy a home right now. While those market factors are important, there's more to consider. You should think about the long-term benefits of homeownership too. Think about this: if you know people who bought a...

Some Highlights Wondering why the supply of homes for sale is limited today? There are a few factors at play. Lack of building over time, the mortgage rate lock-in effect, and people staying in their houses longer are three of the main reasons why supply is low. But real estate agents know exactly where to look and what to do to...

If your listing expired and your house didn’t sell, you’re likely feeling a little frustrated. Not to mention, you're also probably wondering what went wrong. Here are three questions to think about as you figure out what to do next. Did You Limit Access to Your House? One of the biggest mistakes you can make when selling your house is restricting the days and times...

You might remember the housing crash in 2008, even if you didn't own a home at the time. If you’re worried there’s going to be a repeat of what happened back then, there's good news – the housing market now is different from 2008. One important reason is there aren't enough homes for sale. That means there’s an undersupply, not an oversupply like the last time. For the...

If you’re thinking of making a move, one of the biggest questions you have right now is probably: what’s happening with home prices? Despite what you may be hearing in the news, nationally, home prices aren’t falling. It’s just that price growth is beginning to normalize. Here’s the context you need to really understand that trend. In the housing...

If you’re looking to buy a home this fall, there are a few things you need to know. Affordability is tight with today’s mortgage rates and rising home prices. At the same time, there’s a limited number of homes on the market right now and that’s creating some competition among buyers. But, if you’re strategic, there are ways to navigate these waters. The first thing...

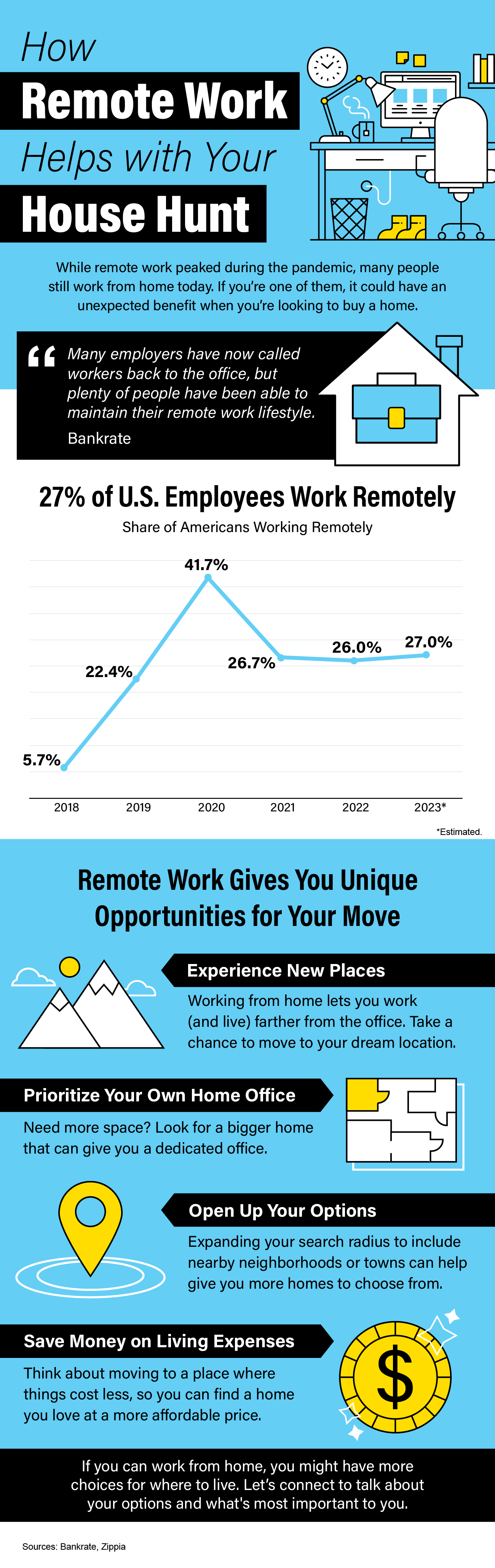

Some Highlights While remote work peaked during the pandemic, many people still work from home today. If you’re one of them, it could have an unexpected benefit when you’re looking to buy a home. If you can work from home, you might have more choices for where to live. Let’s connect to talk about your options and what's most important to...

Buying and owning your own home can have a big impact on your life. While there are financial reasons to become a homeowner, it's essential to think about the non-financial benefits that make a home more than just a place to live. Here are some of the top non-financial reasons to buy a home. According to Fannie Mae, 94% of survey respondents say “Having Control Over What You Do...

The way Americans work has changed in recent years, and remote work is at the forefront of this shift. Experts say it’ll continue to be popular for years to come and project that 36.2 million Americans will be working remotely by 2025. To give you some perspective, that's a 417% increase compared to the pre-pandemic years when there were just 7 million remote workers. If...

Are you thinking about selling your house? If so, today’s mortgage rates may be making you wonder if that’s the right decision. Some homeowners are reluctant to sell and take on a higher mortgage rate on their next home. If you’re worried about this too, know that even though rates are high right now, so is home equity. Here’s what you need to...

An important factor shaping today’s market is the number of homes for sale. And, if you’re considering whether or not to list your house, that’s one of the biggest advantages you have right now. When housing inventory is this low, your house will stand out, especially if it’s priced right. But there are some early signs that more listings are coming. According to the...

Some Highlights Holding off on selling your house because you believe there aren’t any buyers out there? Data shows buyers are still active, even with higher mortgage rates. This goes to show, people still want to buy homes, and those who can are moving now. Don’t delay your plan to sell for fear no one is buying. The opposite is...

Click the images below to download your free...

One question that’s top of mind if you’re thinking about making a move today is: Why is it so hard to find a house to buy? And while it may be tempting to wait it out until you have more options, that’s probably not the best strategy. Here’s why. There aren’t enough homes available for sale, but that shortage isn’t just a today problem. It’s been a...

Are you a baby boomer who’s lived in your current house for a long time and you’re ready for a change? If you’re thinking about selling your house, you have a lot to consider. Will you move to a different state or stay nearby? Is it time to downsize or do you want more space to accommodate your loved ones? But maybe the biggest consideration boils down to this – will you buy...

If you're planning to buy a home, one thing to consider is what experts project home prices will do in the future and how that might affect your investment. While you may have seen negative news over the past year about home prices, they’re doing far better than expected and are rising across the country. And data shows, experts forecast home prices will keep...

Reaching retirement is a significant milestone in life, bringing with it a lot of change and new opportunities. As the door to this exciting chapter opens, one thing you may be considering is selling your house and finding a home better suited for your evolving needs. Fortunately, you may be in a better position to make a move than you realize. Here are a few reasons why. Consider...

Some Highlights Last year, some housing experts projected a decline in home prices by the end of 2023. But that didn’t happen – inventory was just too low. While it’s normal for experts to re-forecast throughout the year, the good news for 2023 is that prices are no longer projected to decrease....

Have you been trying to buy a home, but higher mortgage rates and home prices are limiting your options? If so, here’s some good news – based on what Ali Wolf, Chief Economist at Zonda, has to say – smaller, more affordable homes are on the way: “Buyers should expect that over the next 12 to 24 months there will be a notable increase in the number...

If you’re hoping to buy a home this year, you’re probably paying close attention to mortgage rates. Since mortgage rates impact what you can afford when you take out a home loan – and affordability is a challenge today – it’s a good time to look at the big picture of where mortgage rates have been historically compared to where they are now. Beyond that, it’s important to...

Toward the end of last year, there were a number of headlines saying home prices were going to fall substantially in 2023. That led to a lot of fear and questions about whether there was going to be a repeat of the housing crash that happened back in 2008. But the headlines got it wrong. While there was a slight home price correction after the sky-high price appreciation during...

Some Highlights Your equity grows as you pay down your home loan and as home prices increase. With home prices rising again, your equity is getting an extra boost. Almost half of homeowners are equity rich because they have at least 50% equity in their homes. If you’ve been in your home for a while, you might have gained a considerable amount of equity,...

Have you ever wondered how inflation impacts the housing market? Believe it or not, they’re connected. Whenever there are changes to one, both are affected. Here’s a high-level overview of the connection between the two. The Relationship Between Housing Inflation and Overall Inflation Shelter inflation is the measure of price growth specific to housing. It comes from...

Are you putting off selling your house because you’re worried no one’s buying because of where mortgage rates are? If so, know this: the latest data shows plenty of buyers are still out there, and they’re purchasing homes today. Here’s the data to prove it. The ShowingTime Showing Index is a measure of buyers touring homes. The graph below uses the latest...

Even though you may feel reluctant to sell your house because you don’t want to take on a mortgage rate that’s higher than the one you have now, there’s more to consider. While the financial side of things does matter, your personal needs may actually matter just as much. As an article from Bankrate says: “Deciding whether it’s the right time to sell your home...

Generation Z (Gen Z) is eager to put down their own roots and achieve financial independence. As a result, they’re turning to homeownership. According to the latest Home Buyers and Sellers Generational Trends Report from the National Association of Realtors (NAR), 30% of Gen Z buyers transitioned straight from living under their parents' roofs to owning their own...

There’s been talk about a recession for quite a while now. But the economy has been remarkably resilient. Why? One reason is employment and wages have stayed strong. Let’s look at the latest information on each one and why both are good news if you’re thinking about selling your house. More Jobs Are Being Created Instead of facing the job losses typical of any recession, the economy has been...

If you remember the housing crash back in 2008, you may recall just how popular adjustable-rate mortgages (ARMs) were back then. And after years of being virtually nonexistent, more people are once again using ARMs when buying a home. Let’s break down why that’s happening and why this isn’t cause for concern. Why ARMs Have Gained Popularity More Recently This graph uses data from...

The National Association of Realtors (NAR) is set to release its most recent Existing Home Sales (EHS) report tomorrow. This monthly release provides information on the volume of sales and price trends for homes that have previously been owned. In the upcoming release, it’ll likely say home prices are down. This may seem a bit confusing, especially if you’ve been...

Some Highlights With ongoing high inflation pushing up everyday costs, some people are worried that'll create a flood of foreclosures. Here's why that's unlikely. Fewer people are seriously behind on mortgage payments right now. If foreclosures were going to rise a lot, more people would need to be late on their payments. Since most are paying on...

In today’s housing market, there are two main affordability challenges impacting buyers: mortgage rates that are higher than they’ve been the past couple of years, and rising home prices caused by low inventory. To overcome those challenges, many people are working with their agents to find less expensive homes. And with newly built homes making up a historically...

The rising cost of just about everything from groceries to gas right now is leading to speculation that more people won’t be able to afford their mortgage payments. And that’s creating concern that a lot of foreclosures are on the horizon. While it’s true that foreclosure filings have gone up a bit compared to last year, experts say a flood of foreclosures isn’t coming. Take it...

If you’re a homeowner, you might be torn on whether or not to sell your house right now. Maybe that’s because you don’t want to take on a higher mortgage rate on your next home. If that’s your biggest hurdle, understanding your equity may be exactly what you need to help you feel more comfortable making your move. What Equity Is and How It Works Equity is the...

Plenty of people are still moving these days. And if you’re thinking of making a move yourself, you may be considering the inventory and affordability challenges in the housing market and wondering what you can do to help offset those. A new report from Gravy Analytics provides insight into where people are searching for homes and what they’re...

Some Highlights Looking at monthly home price data from six expert sources shows the worst home price declines are behind us, and they’re rising again nationally. If you’ve put your plans to move on pause because you were worried about home prices crashing, this rebound is good news. Let’s connect so you know...

Some homeowners have been waiting for months to put their house on the market because they don’t think people are buying homes right now. If that’s you, know that even though the housing market has slowed compared to the frenzy of a couple of years ago, it isn’t at a standstill. Contrary to what you may believe, buyers are still active and plenty of homes are...

Buying a new construction home can be an exciting experience. From being the very first owner, to customizing your home’s features, there are a lot of benefits. But navigating the complexities of buying a home that’s under construction can also be a bit overwhelming. This is where a skilled real estate agent can make all the difference. An article from The Mortgage...

Wondering if it still makes sense to sell your house right now? The short answer is, yes. Especially if you consider how few homes there are for sale today. You may have heard inventory is low right now, but you may not fully realize just how low or why that’s a perk when you go to sell your house. This graph from Calculated Risk can help put that into...

If you’re a homeowner, odds are your equity has grown significantly over the last few years. Equity builds over time as home values grow and as you pay down your home loan. And, since home prices skyrocketed during the ‘unicorn’ years, you’ve likely gained more than you think. According to the latest Equity Insights Report from CoreLogic,...

Some Highlights Want to know what experts say will happen in the rest of 2023? Home prices are already appreciating again in many areas. The average of the expert forecasts shows positive price growth. Where mortgage rates go for the rest of the year will depend on inflation. Based on historical trends, rates are likely to ease...

When you read about the housing market in the news, you might see something about a recent decision made by the Federal Reserve (the Fed). But how does this decision affect you and your plans to buy a home? Here's what you need to know. The Fed is trying hard to reduce inflation. And even though there’s been 12 straight months where inflation has cooled (see graph below), the...

https://youtu.be/zcmfPDjpGOs Have Buyer's Choices Peaked for 2023? Eastside Housing Market Update 8-2-2023 🏠 Have home buyers in the Eastside reached the zenith of their options for 2023? In this video, Tony Meier, a seasoned real estate expert with 34 years of experience at Windermere Real Estate, examines this query and provides an insightful update on the Eastside real estate...

If you’re trying to decide if you’re ready to buy a home, there’s probably a lot on your mind. You’re thinking about your finances, today’s mortgage rates and home prices, the limited supply of homes for sale, and more. And, you’re juggling how all of those things will impact the choice you’ll make. While housing market conditions are definitely a factor...

While this isn’t the frenzied market we saw during the ‘unicorn’ years, homes that are priced right are still selling quickly and seeing multiple offers right now. That’s because the number of homes for sale is still so low. Data from the National Association of Realtors (NAR) shows 76% of homes sold within a month and the average saw 3.5 offers in...

Even though the housing market is no longer experiencing the frenzy that was so characteristic of the last couple of years, it doesn’t mean today’s market is at a standstill. In actuality, buyer traffic is still strong today. The ShowingTime Showing Index is a measure of how much buyers are touring homes. The graph below uses that index to illustrate buyer activity trends over...

https://youtu.be/I6Uinywr6b8 Housing's Recession Already Happened! Eastside Real Estate Market Update 7-26-2023 🏠 In this eye-opening market update, Tony Meier, a real estate veteran with 34 years of experience at Windermere Real Estate, breaks down the recent events in the Eastside housing market and discusses why he believes the 'housing recession' has already happened. Link to...

While the wild ride that was the ‘unicorn’ years of housing is behind us, today’s market is still competitive in many areas because the supply of homes for sale is still low. If you’re looking to buy a home this season, know that the peak frenzy of bidding wars is in the rearview mirror, but you may still come up against some multiple-offer scenarios. Here are...

If you’re thinking of buying or selling a home, one of the biggest questions you have right now is probably: what’s happening with home prices? And it’s no surprise you don’t have the clarity you need on that topic. Part of the issue is how headlines are talking about prices. They’re basing their negative news by comparing current stats to the last...

You may have heard some people say it’s better to rent than buy a home right now. But, even today, there are lots of good reasons to become a homeowner. One of them is that owning a home is typically viewed as a good long-term investment that helps your net worth grow over time. Homeownership Builds Wealth Regardless of Income Level You may be...

If you’re following mortgage rates because you know they impact your borrowing costs, you may be wondering what the future holds for them. Unfortunately, there’s no easy way to answer that question because mortgage rates are notoriously hard to forecast. But, there’s one thing that’s historically a good indicator of what’ll happen with rates, and that’s...

Before you decide to sell your house, it’s important to know what you can expect in the current housing market. One positive trend right now is homebuyers are adapting to today’s mortgage rates and getting used to them as the new normal. To better understand what’s been happening with mortgage rates lately, the graph below shows the trend for the 30-year fixed mortgage rate...

If you’re following the news today, you may feel a bit unsure about what’s happening with home prices and fear whether or not the worst is yet to come. That’s because today’s headlines are painting an unnecessarily negative picture. If we take a year-over-year view, home prices did drop some, but that’s because we’re comparing to a ‘unicorn’...

Some Highlights Today’s housing inventory is still well below more normal years. This low inventory is why homes that are priced right are still selling quickly and seeing multiple offers. If you want to sell your house, now is a great time because inventory is still low. Let’s connect to start...

Even as some companies transition back into the office, remote work remains a popular choice for many professionals. So, if you currently enjoy working from home or hope to be able to soon, you’re not alone. According to a recent survey, most working professionals want to work either fully remote or hybrid (see below): This trend is good news if you’re looking to buy a home...

If you’re a homeowner ready to make a move, you may be thinking about using your current house as a short-term rental property instead of selling it. A short-term rental (STR) is typically offered as an alternative to a hotel, and they’re an investment that’s gained popularity in recent years. While a short-term rental can be a tempting idea, you may find the reality of being...

If you’re in the process of looking for a home today, you know the supply of homes for sale is low because you’re feeling the impact of having a limited pool of options. And, if your biggest hurdle right now is that you’re having trouble finding something you like, don’t forget that a newly built home is a great option. As a recent article from the National Association of...

When it comes to selling your house, you want three things: to sell it for the most money you can, to do it in a certain amount of time, and to do all of that with the fewest hassles. And, while the current housing market is generally favorable to sellers due to today’s limited housing supply, there are still factors that can cause delays or even prevent a house from selling. If you're...

Some Highlights Downsizing is a popular choice for homeowners when they retire or when their needs change, but with inflation still high, it’s also a way to reduce costs. Downsizing could help cut down on your expenses and your equity can fuel your move. If you’re thinking about moving to a smaller home,...

One of the biggest challenges in the housing market right now is how few homes there are for sale compared to the number of people who want to buy them. To help emphasize just how limited housing inventory still is, let’s take a look at the latest information on active listings, or homes for sale in a given month, as it compares to more normal levels. According to a recent report...

If you’re thinking of buying a home, chances are you’re paying attention to just about everything you hear about the housing market. And you’re getting your information from a variety of channels: the news, social media, your real estate agent, conversations with friends and loved ones, overhearing someone chatting at the local supermarket, the list goes on and on. Most likely, home prices...

Some Highlights An agent is a really important part of selling your home because they bring a lot of skill and expertise to the sales process. They’ll explain what’s happening today, what that means for you, and how to price and market your house. They’re also skilled negotiators and well versed in the contracts and disclosures involved. Let’s connect to ensure you have an...

Do you want to sell your house, but hesitate because you’re worried you won’t be able to find your next home in today’s market? You're not alone, but there’s some good news that may ease your worries. New home construction is up and is becoming an increasingly significant part of the housing inventory. That means when you go to put your house on the market...

You might be worried we’re heading for a housing crash, but there are many reasons why this housing market isn’t like the one we saw in 2008. One of which is how lending standards are different today. Here’s a look at the data to help prove it. Every month, the Mortgage Bankers Association (MBA) releases the Mortgage Credit Availability Index (MCAI)....

Today’s higher mortgage rates, inflationary pressures, and concerns about a potential recession have some people questioning: should I still buy a home this year? While it’s true this year has unique challenges for homebuyers, it’s important to think about the long-term benefits of homeownership when making your decision. Consider this: if you know...

Selling your house is no simple task. While some homeowners opt to sell their homes on their own, known as a FSBO (For Sale by Owner), they often encounter various challenges without the guidance of a real estate agent. If you’re currently considering selling your house on your own, here’s what you should know. The most recent Profile of Home Buyers and Sellers from...

Some Highlights Wondering if it makes sense to buy a home today even when inflation is high? When other costs go up due to inflation, buying a home helps you keep your monthly housing expense steady. Rents typically increase with inflation. Maybe that’s why, according to a recent survey, 65.1% of landlords say they plan to raise the rent of at...

If you’re thinking about buying a home, you should know your credit score’s a critical piece of the puzzle when it comes to qualifying for a home loan. Lenders review your credit to assess your ability to make payments on time, to pay back debts, and more. It’s also a factor that helps determine your mortgage rate. An article from Bankrate explains: “Your credit...

Are you planning to sell your house? If so, you may be surprised to hear just how much buyers value energy efficiency and eco-friendly features today. This is especially true as summer officially kicks off. In fact, the 2023 Realtors and Sustainability Report from the National Association of Realtors (NAR) shows 48% of agents or brokers have noticed...

The National Association of Realtors (NAR) will release its latest Existing Home Sales (EHS) report later this week. This monthly report provides information on the sales volume and price trend for previously owned homes. In the upcoming release, it’ll likely say home prices are down. This may feel a bit confusing, especially if you’ve been following along and seeing...

If you're planning to buy your first home, then you're probably focused on saving for all the costs involved in such a big purchase. One of the expenses that may be at the top of your mind is your down payment. If you’re intimidated by how much you need to save for that, it may be because you believe you must put 20% down. That doesn’t necessarily have to be the case. As the National...

Click the images below to download your free...

Some Highlights If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership. Over time, homeownership allows you to build equity. On average, nationwide home prices appreciated by 290.2% over the last 32 years. That means your net worth can grow significantly in the long...

If you're thinking about buying or selling a house, it's important to know that it doesn't just affect your life, but also your community. The National Association of Realtors (NAR) releases a report every year to show how much economic activity is generated by home sales. The chart below illustrates that impact: As the visual shows, when a house...

You may see media coverage talking about a drop in homeowner equity. What’s important to understand is that equity is tied closely to home values. So, when home prices appreciate, you can expect equity to grow. And when home prices decline, equity does too. Here’s how this has played out recently. Home prices rose rapidly during the ‘unicorn’ years. That gave homeowners a...

If you’re thinking about selling your house right now, chances are it’s because something in your life has changed. And, while things like mortgage rates are a key part of your decision on what you’ll buy next, it’s important to not lose sight of the reason you want to make a change in the first place. It’s true mortgage rates have climbed from the record...

Media coverage about what’s happening with home prices can be confusing. A large part of that is due to the type of data being used and what they’re choosing to draw attention to. For home prices, there are two different methods used to compare home prices over different time periods: year-over-year (Y-O-Y) and month-over-month (M-O-M). Here's an explanation of each. Year-over-Year...

Some Highlights Comparing housing market metrics from one year to another can be challenging in a normal housing market – and the last few years have been anything but normal. In a way, they were ‘unicorn’ years. Expect unsettling housing market headlines this year, mostly due to unfair comparisons with the ‘unicorn’ years. Let’s connect so I...

When you look at the numbers today, the one thing that stands out is the strength of this housing market. We can see this is one of the most foundationally strong housing markets of our lifetime – if not the strongest housing market of our lifetime. Here are two fundamentals that prove this point. 1. The Current Mortgage Rate on Existing Mortgages First, let’s look at the...

Today’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be asking yourself these two questions: Why Are Mortgage Rates So High? When Will Rates Go Back Down? Here’s context you need to help answer those...

With all the headlines circulating about home prices and rising mortgage rates, you may wonder if it still makes sense to invest in homeownership right now. A recent poll from Gallup shows the answer is yes. In fact, real estate was voted the best long-term investment for the 11th consecutive year, consistently beating other investment types like gold, stocks,...

During the fourth quarter of last year, many housing experts predicted home prices were going to crash this year. Here are a few of those forecasts: Jeremy Siegel, Russell E. Palmer Professor Emeritus of Finance at the Wharton School of Business: “I expect housing prices fall 10% to 15%, and the housing prices are accelerating on the downside.” Mark Zandi, Chief Economist...

Some Highlights June is National Homeownership Month, and it’s a perfect time to think about all the benefits that come with owning your home. Owning a home not only makes you feel proud and accomplished, but it’s also a big step toward having a secure and stable financial future. Are you ready to enjoy all the amazing advantages that come with owning a...

Buying and owning your home can make a big difference in your life by bringing you joy and a sense of belonging. And with June being National Homeownership Month, it’s the perfect time to think about all the benefits homeownership provides. Of course, there are financial reasons to buy a house, but it’s important to consider the non-financial benefits that make a home more than...

Buying your first home is an exciting decision and a major milestone that has the power to change your life for the better. As a first-time homebuyer, it’s a vision you can bring to life, but, as the National Association of Realtors (NAR) shares, you’ll have to overcome some factors that have made it more challenging in recent years: “Since 2011, the share of...

Comparing real estate metrics from one year to another can be challenging in a normal housing market. That’s due to possible variability in the market making the comparison less meaningful or accurate. Unpredictable events can have a significant impact on the circumstances and outcomes being compared. Comparing this year’s numbers to the two ‘unicorn’ years we just experienced is...

Some Highlights If you want to sell your house, consider doing it this summer. The days are longer, the weather is warmer, and it’s a great time for sellers. If your needs have changed, now’s the time to capitalize on the low inventory and multiple offers in today’s sellers’ market. Let’s connect today if you’re...

If you’re trying to decide if now’s the time to sell your house, here’s what you should know. The limited number of homes available right now gives you a big advantage. That’s because there are more buyers out there than there are homes for sale. And, with so few homes on the market, buyers will have fewer options, so you set yourself up to get the most eyes...

You’re probably feeling the impact of high inflation every day as prices have gone up on groceries, gas, and more. If you’re a renter, you’re likely experiencing it a lot as your rent continues to rise. Between all of those elevated costs and uncertainty about a potential recession, you may be wondering if it still makes sense to buy a home today. The short answer is – it does....

For many of us, visiting the same vacation spot every year is a summer tradition that’s fun, relaxing, and restful. If that sounds like you, now’s the time to think about your plans and determine if buying a vacation home this year makes more sense than renting one again. According to Forbes: “. . . if the idea of vacationing at the same place every year makes...

The process of buying a home can feel a bit intimidating, even under normal circumstances. But today's market is still anything but normal. There continues to be a very limited number of homes for sale, and that’s creating bidding wars and driving home prices back up as buyers compete over the available homes. Navigating all of this can be daunting if you’re trying to...

Some Highlights If you’re looking to buy a home, you should know even a small change in mortgage rates has an impact on your purchasing power. These charts show how rates generally affect your monthly payment. The best way to navigate changing mortgage rates and make an informed buying decision is to rely on the expertise of a...

The spring housing market has been surprisingly active this year. Even with affordability challenges and a limited number of homes for sale, buyer demand is strong, and getting stronger. One way we know there are interested buyers right now is because showing traffic is up. Data from the latest ShowingTime Showing Index, which is a measure of buyers actively...

The National Association of Realtors (NAR) will release its latest Existing Home Sales Report tomorrow. The information it contains on home prices may cause some confusion and could even generate some troubling headlines. This all stems from the fact that NAR will report the median sales price, while other home price indices report repeat sales prices. The vast...

If you’re following the news today, you may feel a bit unsure about what’s happening with home prices and fear whether or not the worst is yet to come. That’s because today’s headlines are painting an unnecessarily negative picture. Contrary to those headlines, home prices aren’t in a freefall. The latest data tells a very different and much more positive...

Even though home prices have moderated over the last year, many homeowners still have an incredible amount of equity. But what is equity? In the simplest terms, equity is the difference between the market value of your home and the amount you owe on your mortgage. The National Association of Realtors (NAR) explains how your equity grows over time: “Housing wealth...

Some Highlights While home prices vary by local area, they’ve already hit their low point nationally, and now they’re starting to rise again. Last July, prices started to decline, but around February, they began climbing back up. If you put your plans to move on hold waiting to see what would happen with home prices, let’s connect to discuss if...

As the housing market continues to change, you may be wondering where it’ll go from here. One factor you’re probably thinking about is home prices, which have come down a bit since they peaked last June. And you’ve likely heard something in the news or on social media about a price crash on the horizon. As a result, you may be holding off on buying a home until prices drop...

If you’re thinking about selling your house, you should know the number of homes for sale right now is low. That’s because, this season, there are fewer sellers listing their houses for sale than the norm. Looking back at every April since 2017, the only year when fewer sellers listed their homes was in April 2020, when the pandemic hit and stalled the housing market...

If you’re reading headlines about inflation or mortgage rates, you may see something about the recent decision from the Federal Reserve (the Fed). But what does it mean for you, the housing market, and your plans to buy a home? Here’s what you need to know. Inflation and the Housing Market While the Fed’s working hard to lower inflation, the...

There’s been some concern lately that the housing market is headed for a crash. And given some of the affordability challenges in the housing market, along with a lot of recession talk in the media, it’s easy enough to understand why that worry has come up. But the data clearly shows today’s market is very different than it was before the housing crash in 2008. Rest...

If you’re looking to buy a house, you may find today’s limited supply of homes available for sale challenging. When housing inventory is as low as it is right now, it can feel like a bit of an uphill battle to find the perfect home for you because there just isn’t that much to choose from. If you need to open up your pool of options, it may be time to consider a newly built...

Some Highlights Not sure if selling your house is the right move today? You should know there are a number of reasons it still makes sense to sell now. Your house will stand out because inventory is low. That’s why the number of offers on recently sold homes is on the rise. And most homeowners have a lot of equity that can fuel a move. If...

Downsizing has long been a popular option when homeowners reach retirement age. But there are plenty of other life changes that could make downsizing worthwhile. Homeowners who have experienced a change in their lives or no longer feel like their house fits their needs may benefit from downsizing too. U.S. News explains: “Downsizing is somewhat common among...